BOFIT Weekly Review 31/2024

Russian unemployment falls to record post-Soviet low

Russian unemployment was already low, with nearly all skilled workers having jobs prior to the invasion of Ukraine. Labour demand started to increase in the second half of 2022 with the recovery in the economy and growth in public consumption. At the same time, the first wave of mobilisation of reserves resulted in roughly a million working-aged persons (mostly men) leaving the workforce. As a result, competition for competent workers has increased in many branches. The tightness of the Russian labour market is clearly reflected in both the low numbers of unemployed people and changes in the unemployment rate.

Russia’s unemployment rate, which stood at 4.3 % in January 2022, had fallen to 2.9 % in January 2024. By June, the unemployment rate had declined to 2.4 %, its lowest level recorded since the current ILO-based statistical methodology was adopted. The total number of people officially employed is about 74 million, while the number of unemployed actively seeking jobs is less than 2 million. The number of unemployed has declined by about 1.4 million since the start of 2022. The number of persons officially reported by unemployment offices numbered just 400,000 for the entire country. At the same time, unemployment offices showed 2.1 million job openings, of which 481,000 were in regions of the Central Federal District and 438,000 in regions of the Volga Federal District.

Both workforce participation (the total of employed and unemployed in the working-age cohort from 15 to 65 years) and the average per capita number of hours worked have risen slightly since the start of the war. Despite increased demand, the growth in the workforce is likely to remain small. The participation rate is already exceptionally high, Russia’s population is ageing rapidly, immigration to Russia is challenging, and many pensioners already remain in the workforce (a common practice in Russia). According to Rosstat figures, the workforce participation rate was 61.2 % in April. The difference between the participation rates of men (69 %) and women (55 %) is fairly small by international standards. For example, ILO-standard participation rates are 71 % for men and 35 % for women in Turkey, 71 % and 52 % in Chile and 64 % and 52 % in EU countries.

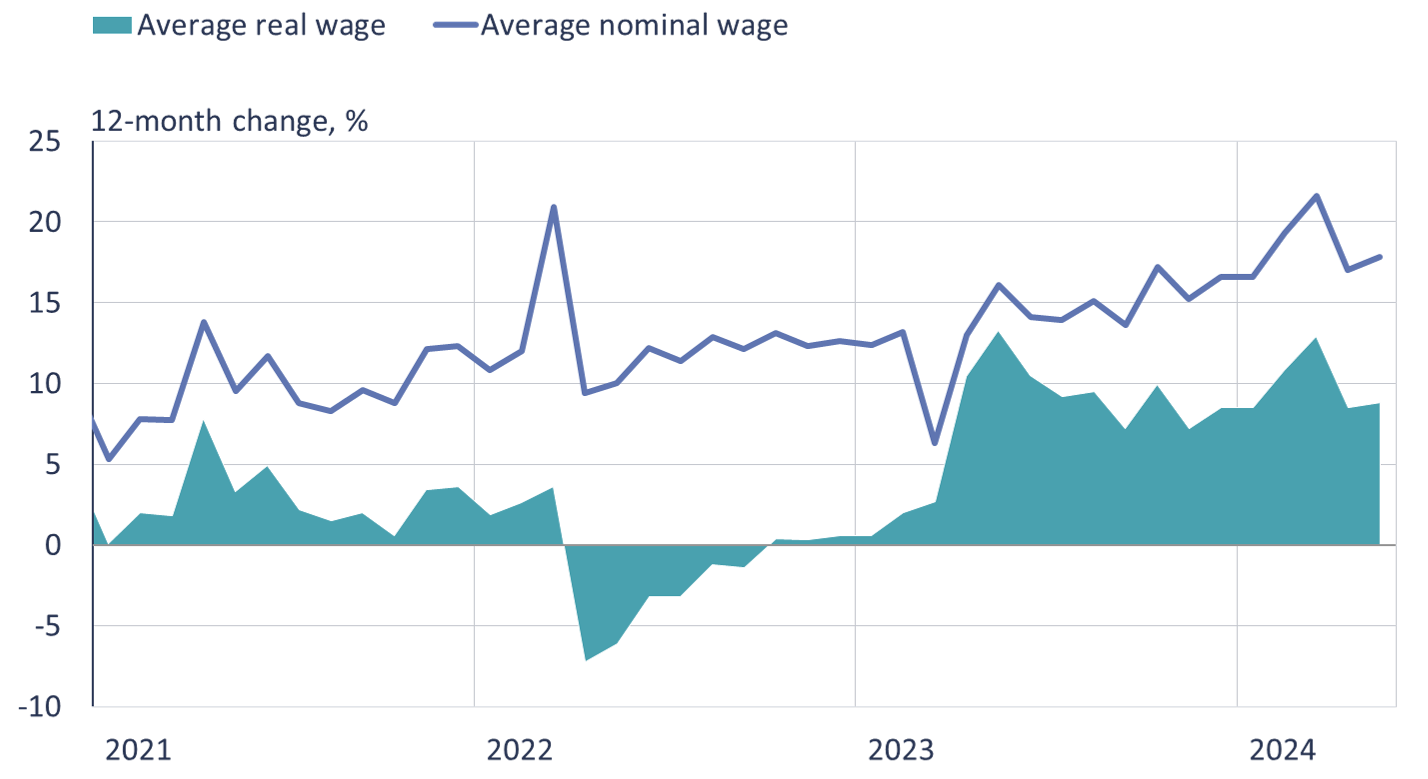

RISE IN WAGES ACCELERATES

Wage trends clearly reflect Russia’s lack of skilled workers. Nominal wages rose an average of 15 % last year, and this year the rise in average wages has accelerated. In May 2024, the average monthly wage was 86,384 rubles (about 920 euros), an increase of 18 % from May 2023. The average real monthly wage (i.e. taking consumer price inflation into account) was up by nearly 9 % y-o-y in May. Wage increases were fastest in the Central and Volga Federal Districts, which also boast the most job openings.

Russian wages have surged this year

Sources: Rosstat, CEIC and BOFIT.

The size of wage packages naturally varies greatly across and within branches. Russia’s traditionally highest paying sectors have been oil & gas, finance and IT, and indeed, these sectors have continued to show the fastest rise in average wages. Wage growth in fields related to the defence industry has also soared over the past two years. For example, in metal product fabrication and manufacturing of vehicles other than automobiles, the average wage was up by about 70–80 % from the start of 2022. Demand for workers is especially high in manufacturing related to the war effort. In these branches, the working day is statistically slightly longer than the average Russian workday. The rise in wages has also been rapid in such service branches as transport, particularly road transport.

Rosstat does not release wage structure data (e.g. educational background of workers or specific job descriptions). Based on corporate surveys, however, Russia suffers from a large deficit of workers with technical training. The wage offers on job-posting sites often well exceed the average wage in the branch, with monthly wage offers in excess of 200,000 rubles (2,222 euros) not unusual. For example, heavy vehicle operators, mechanics and engineers are especially sought after in manufacturing and construction in Russia’s major production centres and near the front. Wage competition can be intense. Contract-service soldiers, for example, earn a starting monthly wage of around 200,000 rubles (2,130 euros) and can get sign-up bonuses of close to 2 million rubles.

When wages in the formal economy are rising and there are lots of available jobs, the prospect of taking earnings under the table becomes less enticing. For example, over half of the respondents to a recent survey on the Superjob recruiting portal said they would refuse to work off-the-books.

HIGH UNEMPLOYMENT LIMITED TO A FEW REGIONS

The regional variance in employment and wage levels is considerable. The April average unemployment rate in regions of the Central Federal District was below 2 %, while the average for regions of the North Caucasus Federal District averaged 9 %. Unemployment remains highest in the North Caucasus Federal District, as well as the poorer regions in the Siberia and Far East Federal Districts. Notably, the unemployment rates in some of these regions has fallen rapidly. In North Ossetia, Tuva, Kalmykia, Karachay-Cherkessia, Volgograd and Buryatia, unemployment rates have fallen by over four percentage points in two years from levels around 10 % to near 6 %. The unemployment rate in April 2024 only exceeded 10 % in three North Caucasus republics (Ingushetia, Dagestan and Chechnya). The average wage in these regions is about half the national average.

Regions with high unemployment typically have fairly small populations. The total combined populations of North Caucasus, Siberia and Far East Federal Districts is only about 3.4 million people (roughly 2.3 % of Russia’s population). In April 2024, more than 800,000 officially unemployed persons lived in these three Federal Districts, or about 40 % of the entire pool of unemployed workers actively seeking jobs. Labour mobility between regions is problematic, and unemployed persons from periphery regions often lack the skillsets need by the manufacturing or service sectors of the Central Federal District. In the absence of rapid productivity gains, the dearth of skilled workers threatens to increase wage and inflation pressures on the economy as a whole.