BOFIT Weekly Review 49/2024

Ruble exchange rate plunges

New round of sanctions slams ruble’s external value

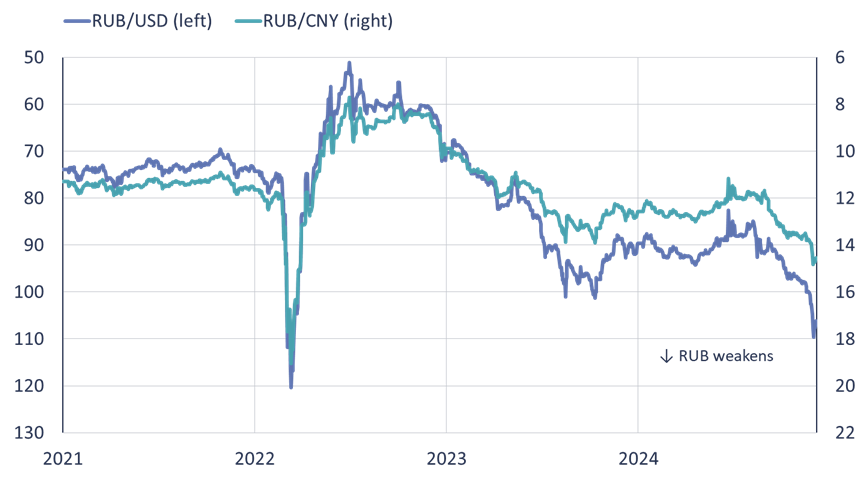

The ruble’s exchange rate, which had weakened gradually since late summer, declined dramatically in late November. The Russian currency last week hit its lowest point since the spring 2022 collapse following the invasion of Ukraine. The official Central Bank of Russia (CBR) rate has this week hovered around 107 rubles to the US dollar.

The list of factors in the ruble’s recent depreciation is topped by problems facing exports. Export earnings have developed weaker in the face of falling oil prices and reduced oil export volumes. Sanctions have made repatriation of export earnings more complicated and slower. Export firms are also converting less of their foreign currency earnings to rubles thanks to relaxation of currency repatriation rules in October (companies are now only required to convert 25 %, rather than 50 %, of their export earnings to rubles). Sanctions imposed on the Moscow Exchange this summer effectively ended trading in Western currencies on the exchange. The official USD-RUB exchange rate is now referenced to trading prices on the OTC market (BOFIT Weekly 2024/35).

An ever-increasing share of Russian export earnings is denominated in rubles, so the supply of forex in Russia continues to decline. CBR figures show that the share of currencies of the sanctioning countries as an invoicing currency has declined faster in Russian exports than imports. For the trade invoiced in these currencies, Russia’s trade balance already turned negative in the third quarter of this year.

The ruble’s latest slide mainly reflects the newest round of sanctions imposed by the United States. On November 21, the US Treasury Department added to its list of sanctioned entities over 50 Russian banks, 40 securities clearing centres and specific financial sector workers such as CBR employees. The US emphasised that the CBR’s own System for Transfer of Financial Messages (SPSF) is now also subject to sanctions, implying that foreign financial institutions interacting with that system could also be subject to US sanctions. The new listings also include one of Russia’s biggest banks, Gazprombank. Among other things, Russia’s invoicing for natural gas exports largely goes through Gazprombank. Therefore the latest round of sanctions is expected to further complicate Russian exports, thereby reducing Russia’s forex earnings from exports at least temporarily.

After plunging against the yuan and dollar in November, the ruble has recovered slightly

Sources: Central Bank of Russia, BOFIT.

Ruble rates have stabilised in recent days

According to the CBR statistics it has not moved to support the ruble by additional selling of its foreign currency reserves. Sanctions deny the central bank access to a large part of its foreign currency reserves as they are invested abroad. The CBR, however, did announce that it was suspending until the end of this year its purchases of forex on behalf of the finance ministry under the government’s long-standing fiscal rule. If oil prices diverge from the average price assumed in the budget, the fiscal rule requires the central bank to purchase or sell foreign currency to cover the imbalance in realized oil revenues. The CBR also announced it continues with daily forex sales to compensate for the government’s 2023 draining of the National Wealth Fund. As announced last summer, forex sales in the second half of this year average 8.4 billion rubles a day.

While the ruble’s exchange rate appears to have stabilised for the moment, pressures that could drive some further devaluation persist even if new work-arounds for foreign trade payment traffic are found. Futures markets anticipate a slight drop in oil prices in coming months. Russian budget spending is traditionally back-weighted to the last part of the year. The consolidated budget figures for the first nine months of this year, for example, show that only about two-thirds of this year’s budget spending had been disbursed. Thus, the usual flood of budget spending in the final two months of this year should be under way. Such spending is likely to add to depreciation pressure on the ruble.

Weak ruble adds to inflationary pressures

Ruble depreciation has two-fold effects in the short term. A weak ruble increases the ruble earnings of export companies paid in foreign currencies. By the same token, it boosts the Russian government’s oil earnings, which are priced in dollars, after they are converted to rubles. This situation gives the government more money for ruble budget expenditures. The share of oil and gas revenues in federal budget is about 30 %.

On the other hand, a weak ruble also raises the prices for import goods, adding to the already severe inflationary pressures facing Russia’s war economy. Russian consumers must pay more for consumer goods imported from abroad. The price of imported inputs to Russian producers also increases. Russia is dependent on imports particularly in precision-manufactured goods and high-tech products. The CBR signalled already earlier it was considering a new rate hike in December and the recent ruble weakening could increase pressures to further hike the interest rate.

In general, the weakening and increased volatility of the ruble exchange rate reflect gradual increase in the imbalances in the Russian economy as a consequence of the war and sanctions. At the same time, output growth is slowing down. Despite slowdown in growth, Russia is still able to maintain and finance the output it needs to continue waging the war. An economic crisis is not in sight at least in the short-term, but risks are mounting.