BOFIT Weekly Review 31/2016

Russia has yet to see clear upturn in business cycle

Key economic indicators for June and July failed to show a distinct uptick in the Russian economy, even if positive growth is clearly taking hold in certain branches. The economy ministry’s figures show total output fell in May by 0.6 % y-o-y and was down another 0.5 % in June. The seasonally-adjusted total economic output indicator was the same in June as in May.

Broken down by core production sectors, in June industrial output rose 1.7 % y-o-y, agriculture 2.1 % and transportation 1.8 %, while the volume of retail sales declined 5.9 % and construction activity fell 9.7 %.

The economy ministry estimates that GDP contracted 0.6 % y-o-y in the second quarter. The CBR offered a slightly smaller figure for GDP shrinkage in the same period. Somewhat disconcerting for the prospects for Russian growth was the CBR’s finding that fixed investment continued to contract in the second quarter, falling by over 3 % y-o-y. The CBR’s estimate noted ongoing declines in construction activity and production of investment goods. Fixed investment in Russia has fallen since 2013.

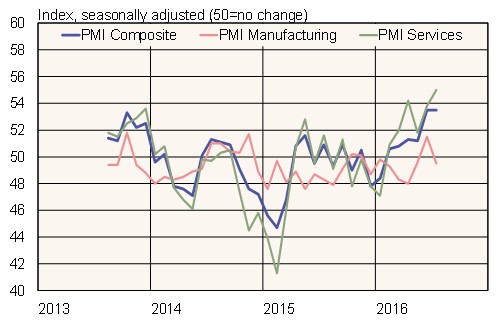

Various confidence indices also give conflicting perspectives for Russia’s near-term economic trends. The July PMI index reading for manufacturing activity, for example, was 49.5, suggesting a contraction. The June reading was 51.5. While July manufacturing output increased overall slightly, the volume of new orders fell. On the other hand, the services PMI index reading rose to 55, its highest level in over three years. The volume of new orders for services increased substantially.

Rosstat also makes a quarterly survey of consumer confidence. Its consumer confidence reading for the second quarter was −26, a slight improvement from −30 in the first quarter. Consumer confidence, however, was weaker than in Q2 last year and well below the long-term average.

Russia’s Purchasing Managers’ Indices (PMIs)

Sources: Markit, Macrobond