BOFIT Weekly Review 32/2016

China’s central bank tightens the control of capital flows

The yuan’s slide this year has provided Chinese investors with motivation to take advantage of existing possibilities as well as invent new ways to sneak capital out of the country. In response, the People’s Bank of China has tightened enforcement of capital controls and imposed new rules on commercial banks that limit large transfers of capital out of the country. The PBoC has considerable say in the operational aspects of commercial banking in China and lately “window guidance” policy has been used to control outbound capital flows. Media reports assert that commercial banks are now required to provide much more details of their clients’ forex trading. Certain banks apparently are now also required to alert officials in advance of large forex purchases and some banks have had to limit repayment of forex loans ahead of payment schedule.

Private individuals are allowed under current law to purchase up to $50,000 in foreign currency each year, so many schemes have been devised to circumvent this rule. For example, Chinese customers have shown recent appetite for pricey Hong Kong insurance policies that pay out claims in dollars and are accepted as collateral for dollar loans. In February, China’s State Administration of Foreign Exchange (SAFE) imposed a $5,000 ceiling on single UnionPay credit card purchases of financial products. UnionPay is China’s national credit card company. The planned QDII2 programme to expand foreign investment opportunities for private Chinese investors has been put on ice and SAFE has not granted domestic institutional investors new foreign investment quotas since March 2015.

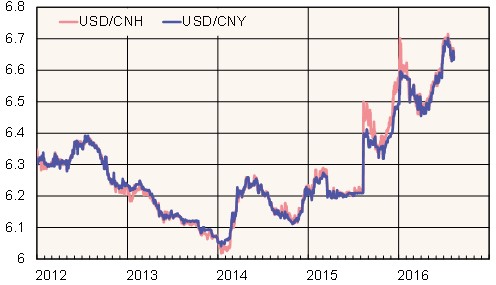

Yuan-dollar exchange rate onshore (mainland China, CNY) and offshore (Hong Kong, CNH)

Source: Macrobond

The capital outflow pressure also effects China’s monetary policy. In its June quarterly report released last week, the PBoC warned that any lowering of the general reserve requirement would increase liquidity in the market, which might lead to increased depreciation pressure on the exchange rate and fuel speculative trading. These policy goals partly explain the PBoC’s reliance on targeted lending programmes (e.g. MLF, PSL) at the moment. These have become key instruments of implementing monetary policy.

Capital outflows appear to have slowed this year compared to the second half of 2015 and China’s foreign currency reserves have remained at around $3.2 trillion since January. This week the yuan gained slightly against the dollar. On Friday (Aug. 12), one dollar bought 6.64 yuan. The yuan has lost about 5 % against the dollar after last August’s implementation of a revised exchange rate mechanism and a surprise 2 % devaluation.