BOFIT Weekly Review 26/2022

Mainland China’s stock markets have been on a rise for the past two months

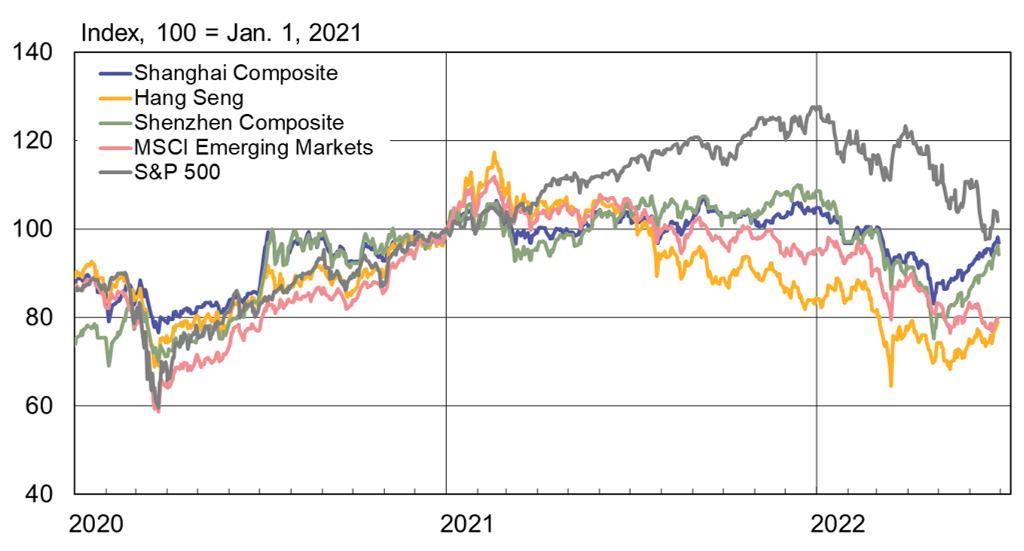

Dragged down by uncertainty, share prices of companies listed on Chinese stock exchanges took a beating in the first four months of this year. By the end of April, the Shenzhen Composite Index was down by 26 % from the start of the year, the Shanghai Composite Index down by 16 % and Hong Kong’s Hang Seng Index off by 12 %. The drop in share prices reflected, among other things, covid lockdowns, ongoing problems in the real estate sector and uncertainty over government regulation especially in regard to the technology sector. Russia’s war in Ukraine and drop in US stocks were also visible in the performance of Chinese share prices. Foreign investors increasingly sold their Chinese shares in the early months of this year via the Hong Kong Stock Exchange’s Stock Connect programme with mainland China stock exchanges.

Following the drops at the start of this year, share prices on Chinese stock exchanges rebounded sharply in recent months. From the start of May to end of July, the Shenzhen Composite Index was up by 19 %, the Shanghai Composite Index up by 12 % and Hong Kong’s Hang Seng Index by 6 %. The return of market confidence has been supported by government commitments to support the economy, stabilize the housing market and slow down with the regulation on technology firms. The highly disruptive covid lockdowns of Shanghai and other big cities have also ended during the period. In addition, the China Securities and Regulatory Commission (CRSC) announced at the end of April that it would seek to stabilise markets by encouraging institutional investors to buy more shares. In June, share purchases by foreign investors through the Stock Connect programme in Mainland China have also increased again.

Mainland China’s stock exchanges will become more accessible to foreign investors as the July 4 expansion of the Stock Connect programme will allow foreign investors to invest in exchange-traded funds (ETFs) listed in Mainland China’s exchanges. The expanded Stock Connect programme gives foreign investors access to 53 ETFs on the Shanghai bourse and 30 ETFs on the Shenzhen exchange. In addition, four Hong Kong ETFs will be opened to mainland Chinese investors. Hong Kong officials have described the expansion of the Stock Connect programme as a “gift” from Beijing to Hong Kong in commemoration of the 25th anniversary of the UK’s handover of Hong Kong to China and to further facilitate the integration of Hong Kong financial markets with the mainland. The Stock Connect programme began in 2014 with the possibility of limited trading in shares between the Shanghai and Hong Kong exchanges. The Shenzhen Stock Exchange joined Stock Connect in 2016. The Beijing Stock Exchange is not part of the programme.

Trading on mainland China’s newest stock exchange, the Beijing Stock Exchange (BOFIT Weekly 48/2021), has gotten off to a bumpy start. Since the launch in November 2021 trading volumes and market capitalisation of the Beijing bourse have fallen significantly. The Beijing Stock Exchange is mainly for smaller companies with high growth prospects, with trading limited to “professional” and institutional investors. The biggest drop in the market caps of listed firms occurred in April this year as the Shanghai covid lockdowns persisted. Nevertheless, the number of listed firms continues to grow. This year has seen the addition of another 17 firms, bringing the total to 99. The biggest jump in the number of listings took place between May and June with the addition of ten firms.

China’s stock markets experienced large drops in the first four months of this year but began to recover in May.

Sources: Macrobond, BOFIT.