BOFIT Weekly Review 02/2023

Yuan lost ground against the dollar and euro last year; swings in the CNY-USD rate widened

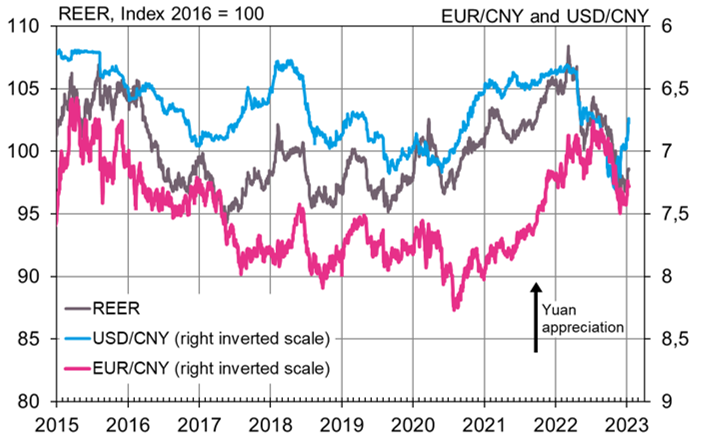

The yuan’s real effective (trade-weighted) exchange rate, or REER, declined by 8 % last year. At the end of 2022, the yuan was down by 9 % against the dollar and 2 % against the euro from the start of the year. On December 31, one dollar bought 6.9 yuan, and one euro 7.4 yuan.

After weakening by 15 % between April and November last year, the yuan has recovered against the dollar. Much of the yuan’s depreciation last year was a reflection of dollar strength. The US dollar spot index (DXY) gained about 8 % last year, and 14 % between April and early November. The dollar has weakened in recent months, however. The People’s Bank of China once carefully managed the yuan-dollar rate, but recently the central bank has tolerated larger fluctuations. The PBoC regulates the exchange rate by publishing a daily “fixing” rate, around which the yuan-dollar rate can diverge by up to 2 % in either direction in Chinese markets. In addition, PBoC officials can order the country’s commercial banks to purchase or sell foreign currency to stabilise the yuan’s exchange rate. Direct central bank currency interventions have been less common in recent years.

The yuan’s international use increased slightly last year. The yuan remained the fifth-most-used currency in international payments made via the SWIFT system, accounting 2.4 % of total international payment traffic in November (2.1 % in November 2021). The allocation of central bank reserves as reported to the IMF show that the yuan accounted for 2.8 % of central bank allocated currency reserves globally in September (2.7 % in September 2021).

The yuan depreciated against both the dollar and euro last year

Sources: Macrobond and BOFIT.