BOFIT Weekly Review 09/2016

Inflation in Russia moderates

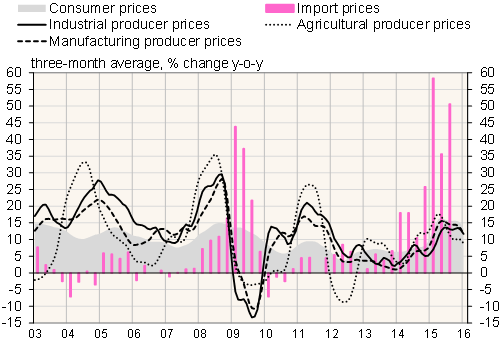

Consumer and producer price inflation have slowed recently. Industrial producer prices were in fact down clearly on-month in December-January. In on-year terms industrial producer prices and consumer prices were still up 8–10 % in January. A similar 12-month rise in industrial producer prices was last seen in 2012 (not counting the 2015 spike).

Inflation picked up when the ruble’s slide steepened in spring 2014 with the Ukraine conflict and the following summer on foreign sanctions and Russia’s retaliatory import bans on food and agricultural products. Inflation picked up sharply last winter as the ruble crashed and import prices soared in ruble terms (up 75 % in just six months), more than even in the 2008–2009 ruble crisis. Imports have had a large share in the economy, e.g. spending on imported consumer goods and spending by Russian travellers on goods and services abroad equalled about 15 % of private consumption, while imported investment goods represented a fifth of total investment.

This winter, the ruble’s slide has been much milder compared to last winter. Central Bank of Russia governor Elvira Nabiullina noted that the effect of the ruble’s slide on prices has also been weaker than a year ago. The CBR reports this is due to weak demand and the fact that there has been no rush to buy goods, unlike last winter. The CBR expects consumer price inflation to slow to 7–8 % y-o-y by the end of this year.

Changes in consumer, producer and import prices, 2003–2016

Source: Rosstat.