BOFIT Weekly Review 07/2016

Russian government deficit soared in 2015

Revenues to the consolidated government budget (federal, regional and municipal budgets, plus state social funds) declined 1 % in nominal rubles, while expenditures increased by over 6 %. Using GDP data determined by Rosstat’s old methodology (i.e. before the recent adoption of broader definitions), revenues declined to 36 % of GDP, while expenditures climbed to nearly 40 % of GDP. The consolidated government deficit, which corresponded to 3.9 % of GDP in the old GDP system, was just under 3.6 % of GDP using the new system.

The large hole created by the drop in government revenues from oil & gas taxes was partly filled with considerably increased revenues from social taxes as part of the health insurance financial reform. Revenues from corporate profit taxes were up as company profits in the oil sector and among exporters involved in basic manufacturing saw significant gains from the ruble’s collapse at the beginning of the year. VAT revenues were also up in nominal ruble terms.

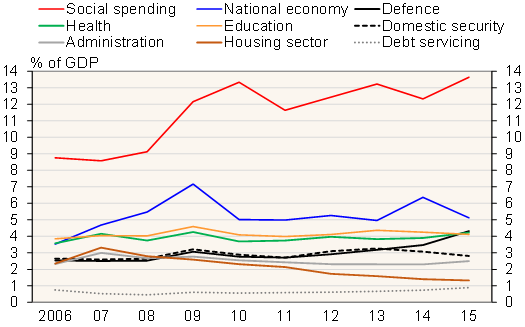

While defence spending continued to soar last year, increases in government spending otherwise averaged about 4–5 % in nominal ruble terms. Among major government spending categories, a notable spending increase was seen in public administration, although it is difficult to say where the increase went as it arose mainly from spending on unspecified international relations. In contrast, spending on domestic security and law & order contracted in 2014–2015.

Social spending is by far the government’s biggest spending category, and most social spending goes to pensions. Social spending increased rapidly last year. Financial reform of health insurance also lifted healthcare spending by well over 10 %. The low spending growth for education in 2014 dropped further last year, failing to increase even in nominal ruble terms. With the exception of day-care facilities, zero budget growth fell on education at all levels.

Largest government spending categories, 2006–2015

Source: Ministry of Finance.

Spending on the housing sector continued to decline. Budget spending on the economy fell, which was due to December 2014 recording of a very large one-time support sum granted later to banks. Budget spending was raised for the energy sector and, following a notable drop last year, also for agriculture. Spending on road network construction and maintenance showed virtually no increase in 2014–2015. Debt servicing costs (interest payments) rose last year by over 25 %.