BOFIT Weekly Review 15/2015

Russian carmakers have it rough

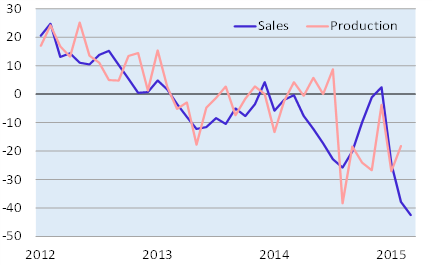

Car sales in Russia have been in trouble for a while. Even with a mini-shopping-spree at the end of last year based on expectations of further ruble devaluation and higher inflation, this year car sales have sunk again. On-year sales of new passenger cars in January-February shrank by a third, production fell 20 % and imports were down 45 %. Sales in March were off over 40 % y-o-y. Most forecasters now see new car sales falling at least 25 % for the whole year.

A number of car plants in Russia have already idled production temporarily, cut shifts or laid off workers – and further measures are planned. General Motors even announced it was shuttering its St. Petersburg plant indefinitely. The ruble’s collapse has caused additional problems for the assembly plant production of GM and other foreign carmakers. Most components must still be imported due to the lack of local production in Russia, even if Russia has long sought to raise the domestic content of its car production.

Import substitution has become the key issue for the policymakers also in car industry. The industry ministry recently announced specific goals for reducing dependence on imported car parts. The plan includes even shifting by 2020 to totally domestic supply of many car parts that are at the moment not produced in Russia, but sourced from one or two countries (e.g. Germany, Italy or the Netherlands). The goal, however, may be hard to reach given current economic situation and worsening business climate that are not encouraging new foreign investment in Russia.

Some 2.3 million new cars were sold last year in Russia. Over half were foreign makes assembled in Russia, just under 20 % domestic makes and the rest imports. Most major international car manufacturers have at least some assembly capacity in Russia. Even the largest Russian car manufacturers AvtoVAZ and Kamaz are partly foreign owned.

12-month change in car sales and production, %

Source: Macrobond