BOFIT Weekly Review 30/2017

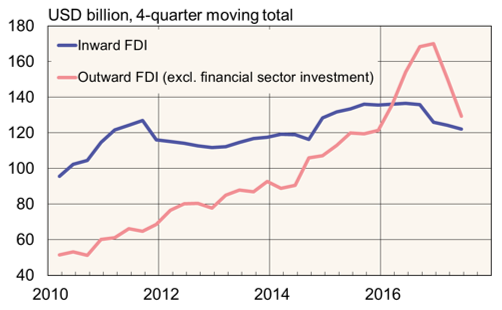

Foreign direct investment from China and to China contract

Measures introduced by the central government to stifle capital outflows from China have effected investment flows in the first half of 2017. Since last December, officials have paid special attention to outbound direct investment (ODI). Last week, the government announced that the intensified scrutiny would continue. In particular, real estate, hotels, the film industry and sports investment have received closest scrutiny. China's Ministry of Commerce notes that ODI (excl. financial sector) fell to around 48 billion dollars in the first half, down by 46 % from 1H16.

Inward foreign direct investment (FDI) also fell to 66 billion dollars in the first half, a decline of 5 % from 1H16. In yuan terms, the value of inbound FDI remained at the 2016 level as the yuan has weakened against the dollar. As usual, Hong Kong's dominance as an FDI source continued with the share of investment (including investment routed via tax havens) rising to 74 %. The EU accounted of the 8 % of FDI inflows to China.

China's inward and outward FDI flows

Source: China Ministry of Commerce.