BOFIT Weekly Review 04/2024

China’s 2023 economic performance unsurprisingly hits the official target, but statistical data increasingly opaque

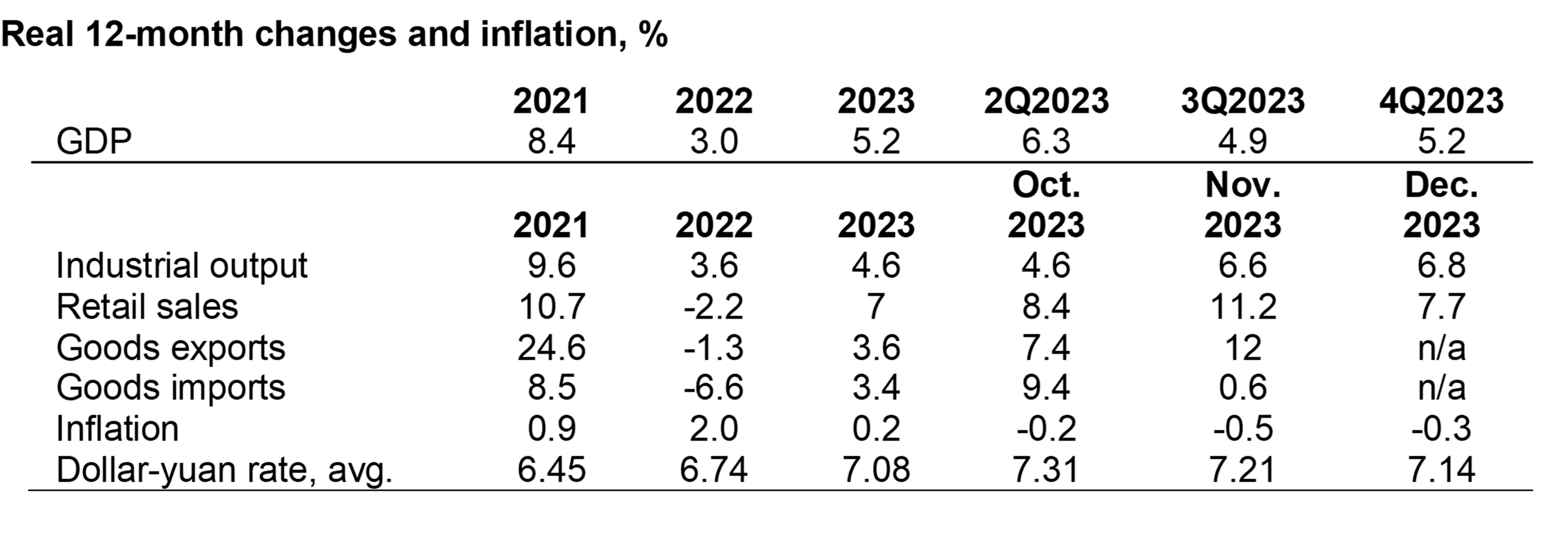

China’s National Bureau of Statistics (NBS) reports that GDP grew by 5.2 % last year, a performance in line with the official “about 5 %” 2023 growth target. Some of the relatively rapid growth reflects the low basis reference of 2022, when China was struggling with a wave of covid infections, lockdowns and other restrictive measures. Observers generally see a weaker economic outlook for China this year.

For the October-November period, GDP grew at a rate of 5.2 % y-o-y (July-September 4.9 %). Quarterly growth slowed to 1 % (1.5 % q-o-q in July-September). Many monthly indicators, however, pointed to a pick-up in growth late last year. Most of last year’s official GDP growth derived from increased consumer demand (4.3 percentage points). The contribution of fixed investment was considerably less (1.5 percentage points), and the contribution of net exports was negative (-0.6 percentage point). Growth in industrial output accelerated slightly from November to 6.8 % in December. Retail sales also experienced brisk growth at the end of last year. Real on-year growth in retail sales slowed somewhat in November, but was still estimated at nearly 8 % in December.

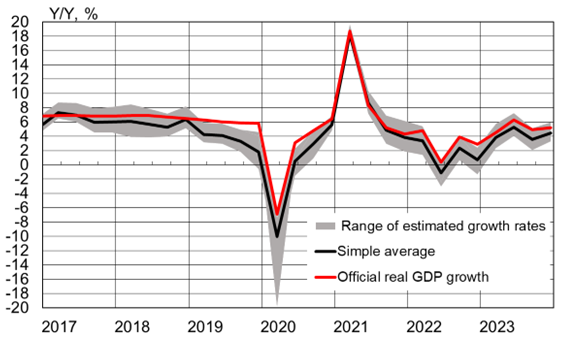

Nominal GDP growth last year was 4.6 %, suggesting a substantial drop in prices. BOFIT’s alternative GDP estimate, based on re-estimation of the GDP deflator, indicates last year’s economic growth could have been a bit more subdued than stated in official figures. According to our alternative calculations, average real GDP growth was 4.3 % last year and 4.5 % y-o-y in the fourth quarter.

Official figures for Chinese GDP growth and BOFIT’s alternative calculation, including growth range

Sources: China National Bureau of Statistics, Macrobond and BOFIT.

The availability and reliability of Chinese statistical data continues to worsen. Publication of some data series has ended altogether, while others have been revised to such an extent that recent figures have ceased to be comparable to the historical data. Monthly fixed asset investment (FAI) figures have long been quite opaque and exceptionally poor quality. The NBS presently only releases growth figures. It has ceased altogether the publication of investment values by branch and breakdowns of such investments. The NBS reports that real FAI grew last year by over 6 % (3 % in nominal terms). Nominal growth in construction investment was stunningly high (23 %), even as nominal growth in real estate investment reportedly contracted by 10 %.

Interpretation of available housing sales data has also become more challenging. The statistical method of recording the volume of real estate sales in the real estate investment category has been revised, so NBS figures no longer reflect growth from the calculated volumes. The NBS reports that the volume of real estate sales contracted last year by 8.5 % when measured in terms of floorspace. If the reported sales volume is compared directly to last year’s figures, however, the contraction was significantly larger (-18 %).

After halting the release of youth unemployment figures last summer, the NBS decided to release such figures in revised form. Under the new methodology, December youth unemployment (16–24 year-olds) was 15 % (21 % in June under the old method). The total unemployment rate in China remained, as it has for many years, at a level close to 5 % (5.1 % in December). The figure is does not reflect actual labour market conditions.

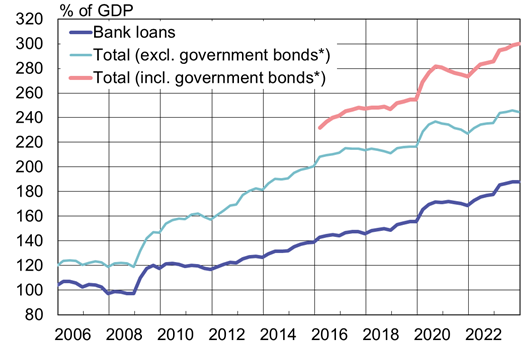

Indebtedness continued to climb last year

The People’s Bank of China’s broad measure of domestic debt – aggregate financing to the real economy (AFRE) – increased last year by 9.5 %. China’s total debt-to-GDP ratio at the end of last year hit 300 %, up from 286 % at the end of 2022. Among subcategories, the stock of bond issues by the central government and local governments displayed higher growth (up 16 %). Bank lending also grew briskly, with the bank lending stock expanding by 11 % to 188 % of GDP. Lending to corporations and state organisations was particularly strong, while the stock of household lending grew by just 3 %.

China’s domestic debt levels (excluding the financial sector) continued to rise rapidly last year

*) Bond issues of central government and local governments. IMF estimates suggest China’s total government debt corresponded to 110 % of GDP at the end of 2022.

Sources: PBoC, CEIC and BOFIT.

Inflation slowed late last year, with December consumer prices even falling by 0.3 % y-0-y. For all of 2023, consumer price inflation was slightly above zero (0.2 % y-o-y). Core inflation (energy and food prices excluded) remained below 1 % (0.6 % in December). Chinese producer prices China, which tend to track energy prices, declined a bit after summer. Producer price inflation fell by 2.7 % in December and were down by 3 % overall last year. The yuan last year lost 3 % of its value against the dollar and 6 % against the euro.

China eased its monetary policy stance only slightly last year, even if economic conditions and inflation pressures were sufficiently benign to allow more a accommodative stance. The central bank’s caution likely stems from devaluation pressure on the yuan and capital outflows. Major reference rates were cut slightly in June and August, but the PBoC balked at any further cuts at the end of last year. However, the central bank has employed a range of targeted instruments in allocating funds to e.g. the construction sector. In December, the PBoC offered targeted financing under its pledged supplementary lending (PSL) programme in the amount of 350 billion yuan (0.3 % of GDP). The inexpensive loans were offered via state policy banks for the purpose of funding various infrastructure and real estate projects.

The PBoC last year made small cuts in the reserve requirement in March and September. The PBoC announced this week that it would lower the reserve requirement by 50 basis points on February 5, with the average reserve requirement in the banking sector falling from 7.4 % to 7 %. The direct impacts on the economy generally and in easing the tribulations of financial markets are likely limited. Recent central bank easing measures are generally regarded as a sign that the Communist Party of China sees weaker-than-expected economic growth and wants to signal support to the economy.

Sources: China National Bureau of Statistics, China Customs, WTO, CEIC and BOFIT.