BOFIT Weekly Review 31/2015

Foreign investors reduce their stock investments in mainland China

PBoC figures show yuan assets held by foreign investors in June were worth 4.42 trillion yuan (€645 billion), or about 10 billion yuan less than in May. The decline reflected decrease in stock holdings, which slid nearly 10 % from May. Of all foreign yuan investments in June, 14 % were share investments. Foreign investments in assets other than shares increased.

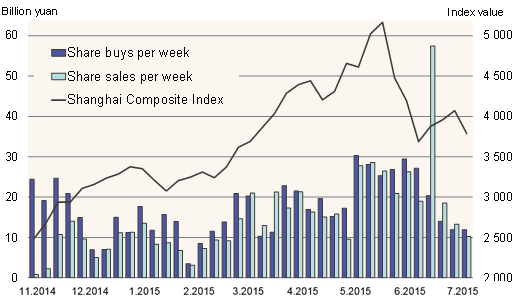

In recent weeks, the volume of share selling has outpaced buying under the Stock Connect arrangement (see chart below) that allows reciprocal access to trading on the Shanghai and Hong Kong stock exchanges. Share trades by foreign investors in the Stock Connect system in June-July accounted for roughly 1 % of the Shanghai exchange trading volume. Qualified and renminbi-qualified institutional investors can also invest in Chinese stock markets under the QFII and RQFII programmes.

Total foreign investments in the Shanghai exchange via Stock Connect amounted to 126 billion yuan at the end of July, or less than 0.5 % of the exchange’s market capitalisation. Similarly, mainland Chinese share investment flowing to the Hong Kong exchange via the program constituted less than 0.5 % of Hong Kong’s market cap.

Volume of foreign investor trades on Shanghai exchange under Stock Connect programme (17.11.2014–29.7.2015)

Source: CEIC