BOFIT Weekly Review 02/2025

Despite economic headwinds, China’s bond market continues to grow

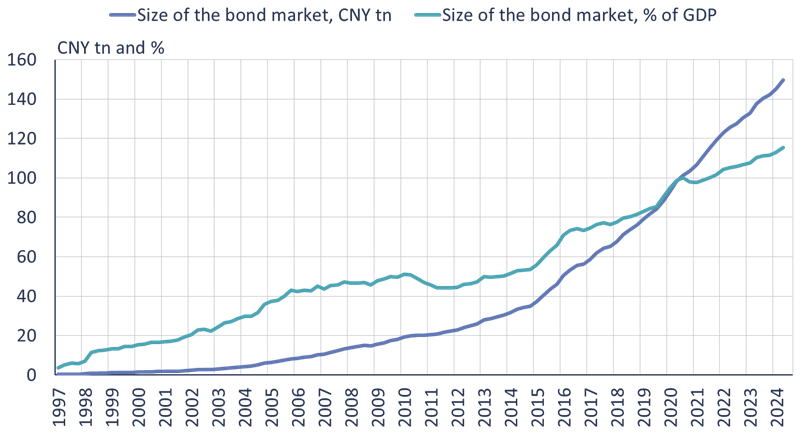

According to Asian Bonds Online, a site operated by the Asian Development Bank, the market for China’s yuan-denominated (RMB) bonds stood at 150 trillion yuan ($21.3 trillion) as of September 2024, an amount roughly equivalent to 115 % of China’s GDP. Markets grew by 13 % y-o-y. Although the pace of growth is higher than in the previous two years, it is still well below the pandemic era pace, when annual growth was nearly 30 %. China’s domestic bond markets are the world’s second largest after the United States. The roughly $1.4 trillion market for Chinese foreign-currency bond issues is tiny in comparison to market for RMB bonds.

Two-thirds of China’s RMB bonds have been issued by public-sector entities (central government, local governments and policy banks), with corporate bonds accounting for the remaining third. Chinese commercial banks hold about 70 % of government bonds on issue. Due to China’s capital controls, foreign investors only have minor participation in China’s bond market. Foreign investors have reduced their holdings since the pandemic despite the fact that Chinese government bonds have been incorporated into several global benchmark bond indices in recent years. As of September, foreign investors held 7 % of outstanding government bonds, down from 11 % at the end of 2021. China’s economic challenges, the real estate sector crisis, increased tensions with Western countries, and the interest rate spread between major advanced economies and China have driven foreign portfolio investment outflows.

The demand by Chinese investors for domestic bonds is a cornerstone of the Chinese bond market. As bonds are seen as providing a safe harbour for wealth amidst uncertain economic conditions, yields on government bonds have been falling notably. In addition, central bank’s shift to a more accommodative monetary stance (BOFIT Weekly 36/2024) has contributed to the lower interest rate environment. The yield on China’s 10-year bond has fallen by one percentage point since the beginning of 2024 to 1.6 %.

The past decade’s growth of Chinese bond markets has been quite remarkable

Sources: AsianBondsOnline and BOFIT.