BOFIT Weekly Review 27/2023

Despite signs of economic recovery, imbalances in the Russian economy continue to grow

Ruble depreciation

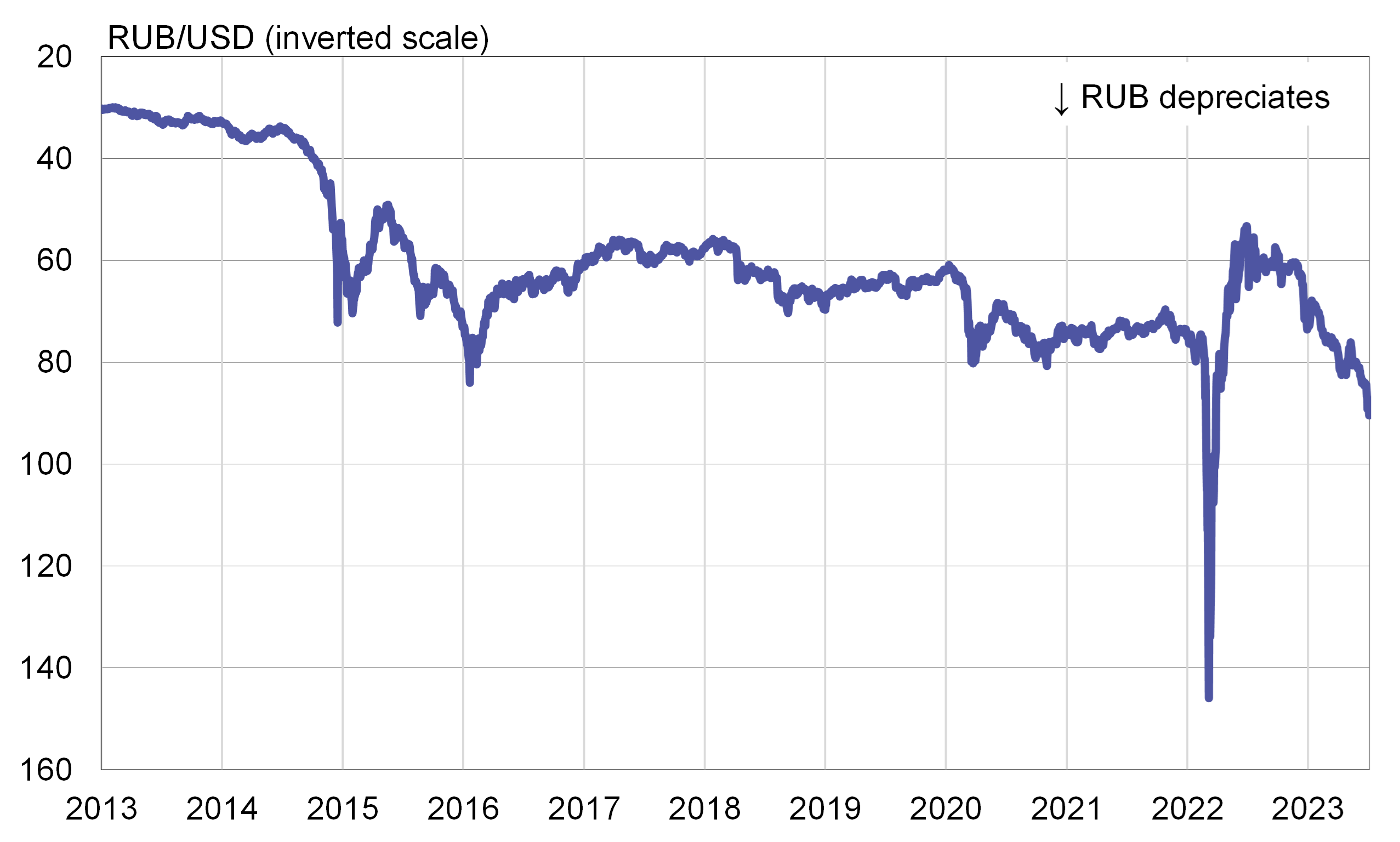

While Yevgeny Prigozhin’s short-lived insurrection had little immediate economic consequence, it has increased uncertainty about the Russian economy. The events on June 23 and 24 are reflected in a drop in the ruble’s exchange rate to levels not seen in over a year. In early July, the ruble-dollar exchange rate went above 90 for the first time since March 2022.

The ruble has been on a downward trajectory already for months, reflecting mainly Russia’s shrinking current account surplus. Preliminary estimates from the Central Bank of Russia (CBR) show that the current account surplus for the first five months of this year fell to 23 billion dollars, an 82 % drop from the record-high level in the same period in 2022. The declining current account surplus manifests a sharp drop in Russia’s export earnings and a recovery in imports as Russia pivots to other import routes and suppliers.

The CBR says that the value of goods exports in January-April was down by about a third from the same period a year earlier. While lower oil prices were the biggest factor in reduced export revenues, Russia has also ceased transmission of pipeline natural gas to most EU countries. The value of goods imports in January-April rose by 12 % y-o-y, mainly due to the weak reference basis of 2022. The value of goods imports in April hovered near pre-invasion levels.

The ruble has faced strong depreciation pressure in recent months

Sources: Macrobond, BOFIT.

Sources: Macrobond, BOFIT.

Inflation picks up

Ruble depreciation can further fuel inflationary pressures in Russia. The CBR noted at its June policy meeting that inflation appears to be accelerating, putting the annualised rate at that time around 4 %. Although the CBR decided at the same meeting to keep its key rate unchanged at 7.5 %, it also signalled that rate hikes are possible at upcoming meetings. In addition to the ruble’s slide, the CBR mentioned several other factors that increase inflation risks, including increased public-sector spending, tight labour markets and potential extensions of sanctions against Russia.

Russia’s federal budget spending rose by 27 % y-o-y in the first five months of 2023. Revenues contracted by 19 % y-o-y as oil & gas revenues fell by half. At the same time, the budget deficit ballooned. Thus, the realised January-May budget deficit already well exceeded the government’s budget deficit target for all of 2023. The running 12-month deficit for May corresponded to 5.5 % of GDP. Russia last saw such a large budget gap in 2009 during the global financial crisis.

Russia’s labour markets continue to tighten. The unemployment rate hit again a post-Soviet low of just over 3 % in May. The Russian labour force was already shrinking before the Ukraine invasion. With the war and last October’s partial mobilisation of reserves, as well as large-scale emigration, the size of the Russian labour force has contracted by at least several hundred thousand people. The CBR noted that the labour market conditions are increasingly limiting Russia’s capacity to expand production. The lack of workers has also caused wages to rise rapidly and added to inflationary pressure.

Sanctions aimed at Russia continue to widen as the EU approved its 11th sanctions package on June 26. The latest package includes a number of measures to prevent circumvention of sanctions. For example, the ban on goods transiting Russia has been expanded and a new mechanism has been introduced making it possible to target firms in third countries that abet sanction evasion, particularly with regard to sensitive dual-use goods and technology. The new sanctions package includes further export bans on e.g. electronic components and semiconductor materials, as well as import bans on such goods as coal and peat products. According to the European Commission, trade restrictions currently cover 54 % of EU exports to Russia and 58 % of EU imports from Russia based on 2021 trade valuations. Sanctions reduce Russia’s export earnings and limit the availability of many goods in Russia.

The CBR expects consumer prices to rise by 4.5–6.5 % this year and that inflation will subside to the central bank’s 4 % target next year. The inflation estimates of major international institutional forecasters currently run in the range of 5–6.5 % for this year and 4–5 % for 2024.

Output generally recovered in May, but varied considerably from industry to industry

Retail sales, a proxy for private consumption trends, continued to recover in May. The volume of retail sales, however, was still down by about 4 % from pre-invasion levels in seasonally adjusted terms. Sales of durable goods have been hit particularly hard. For example, sales of new passenger cars were still in May down by about half from pre-invasion levels. Car sales have been further restrained by supply issues due to Western sanctions.

The development of extractive industry output remains tepid. Natural gas production in May was down by 15 % y-o-y. The International Energy Agency (IEA) reports that Russian oil production has fallen in recent months, but not enough to satisfy Russia’s commitments under the current OPEC+ agreement. Russia this week announced that it would further reduce its oil exports to 500,000 barrels a day in August.

Construction and manufacturing have provided the strongest support to the Russian economy. Construction has grown rapidly despite the war, with growth in construction activity further accelerating in May. Most manufacturing growth is related to construction and branches involved in supplying the war-time economy. Branches dependent on foreign trade continue to experience economic headwinds.

The forecasts of the European Commission, EBRD and OECD released in May and June anticipate drops of 0.9–1.5 % in Russian GDP this year. The Consensus Economics forecast for June found an average expectation of 0.4 % growth for the Russian economy this year and 1.3 % growth next year.

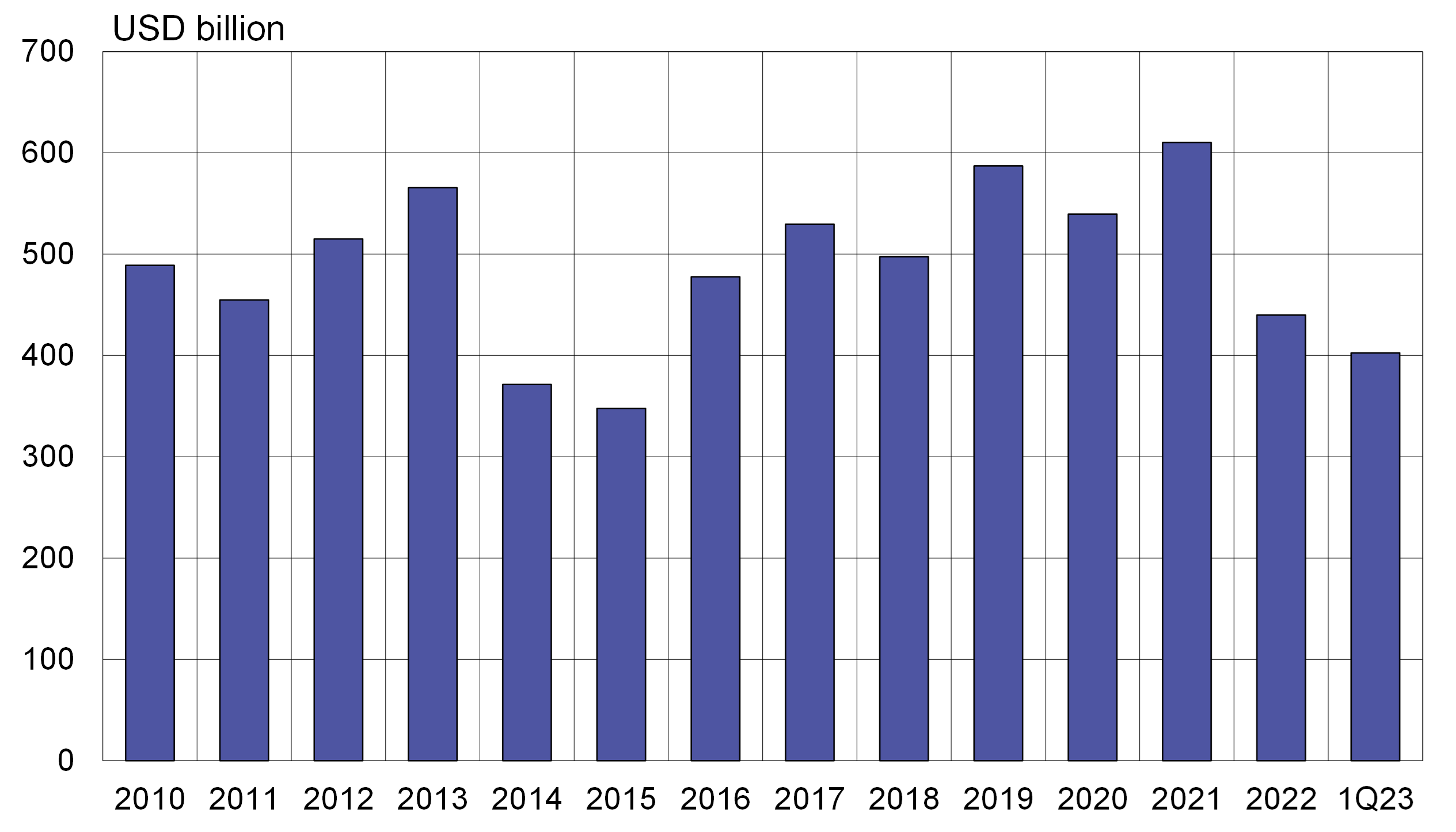

Outlook for Russian economy further clouded by sharp drop in direct foreign investment

CBR figures indicate that the stock of foreign direct investment (FDI) has shrunk considerably since Russia’s unprovoked invasion of Ukraine. The value of the stock of FDI in Russia amounted to 610 billion dollars at the end of 2021, but stood at just 402 billion dollars at end of March 2023. Russia has not released detailed FDI information specifying country of origin or branch of activity since 2021. Observers note that a large portion of FDI inflows to Russia before the war was likely just Russian capital round-tripping via third countries for purposes such as evading taxation.

The stock of FDI has decreased by about a third since the start of the war despite Russia’s efforts to block the exit of foreign firms from the Russian market. For example, the possibilities for foreign firms to repatriate their capital investments have been severely restricted. Divestment sales of foreign-owned firms require official approval, which is typically a long drawn-out process. Current legislation also allows the government to seize assets of foreign-owned firms.

The stock of foreign directed investment in Russia has contracted significantly since Russia’s invasion of Ukraine

Sources: Central Bank of Russia, BOFIT.

Sources: Central Bank of Russia, BOFIT.