BOFIT Weekly Review 25/2019

Central Bank of Russia lowers key rate

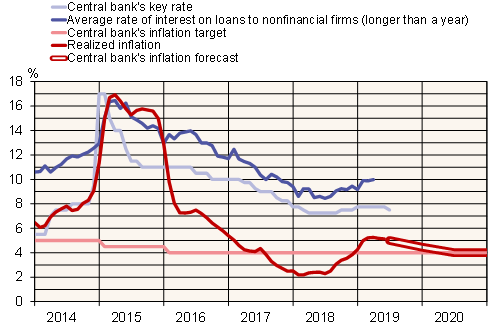

On June 14, the Central Bank of Russia, as markets anticipated, lowered the key rate by 25 basis points. The key rate is now 7.5 %. The CBR said their decision reflected slowing annual inflation and tepid economic growth in the first half of the year.

Annual inflation peaked in March at a rate of 5.3 %, and annual consumer price growth reached an estimated 5 % at the beginning of June. Ruble appreciation (up 8 % against the dollar since the start of the year) and slowing growth in retail sales contributed to slowing inflation. The CBR also noted that the pass-through of the VAT hike at the start of the year has been transferred to consumer prices. The central bank now forecasts 12-month inflation slowing further to a range of 4.2–4.7 % (reduced from the earlier forecast of 4.7–5.2 %) at the end of 2019. In 2020 and 2021, annual inflation is expected to remain close to 4 %.

The weaker-than-expected economic data early in the year (BOFIT Weekly 21/2019) also have caused the CBR to slightly cut its GDP growth forecast for this year. The updated forecast reduces the growth outlook from a range of 1.2–1.7 % to 1–1.5 %. Government investment projects, however, might return growth to a level of 2–3 % in 2021. The CBR did not rule out the possibility of a further rate cut at one of the upcoming board of directors’ meetings.

Interest rates and inflation

Source: Macrobond.