BOFIT Weekly Review 09/2025

Ukraine’s economy grew last year despite massive damage to its energy sector

Preliminary figures show Ukraine’s GDP grew by an impressive 3.4 % last year, even if growth slowed somewhat from 5.3 % in 2023. Last year’s performance exceeded expectations with economic recovery occurring amidst continuous bombing campaigns and severe labour shortages. It also happened without a boost from the earlier low reference basis caused by the post-invasion drop in GDP. Economic growth was especially driven by stronger consumer demand and higher government defence spending. Moreover, export growth accelerated, and manufacturing sector posted stronger gains led by metallurgy.

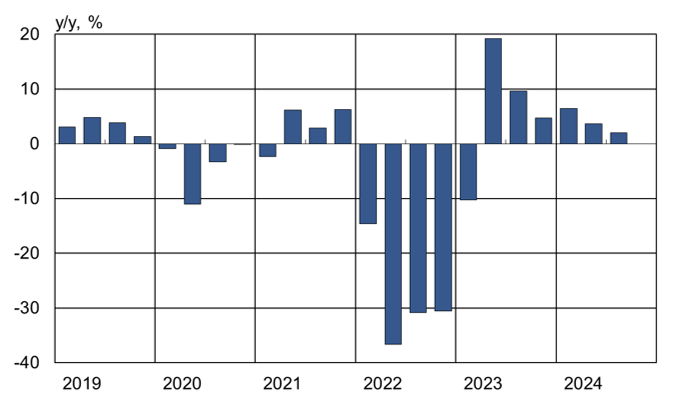

Ukraine’s economy grew every quarter despite a receding reference basis

Sources: Ukrstat, BOFIT.

The growth in Ukrainian goods exports (up 15 % y-o-y) was a bright spot for economic performance last year. Half of the value of Ukraine’s goods exports consisted of agricultural products ($21 billion) and 17 % ores and metals ($7 billion). Export routes via Black Sea ports under Ukrainian control played a decisive role. Last year, 79 % of exports of agricultural products were shipped via Black Sea ports. Shipment travelling via the Danube river accounted for 11 % of agricultural exports, followed by rail shipping (8 %) and road freight (2 %).

Exports of services grew by 4 % y-o-y in January-November 2024, even if exports contracted in IT, Ukraine’s largest services exports industry. Exports increased in the transportation & logistics branch. With the end of pipeline gas transmission via Ukraine, exports in the transportation & logistics branch are expected to contract this year. Gas is no longer transmitted to Europe via the Druzhba gas pipeline running through Ukraine. In the first eleven months of 2024, Ukraine’s export earnings from pipeline transit fees and operations amounted to $1.2 billion.

Ukraine’s 2025 government budget largely secured by foreign financing

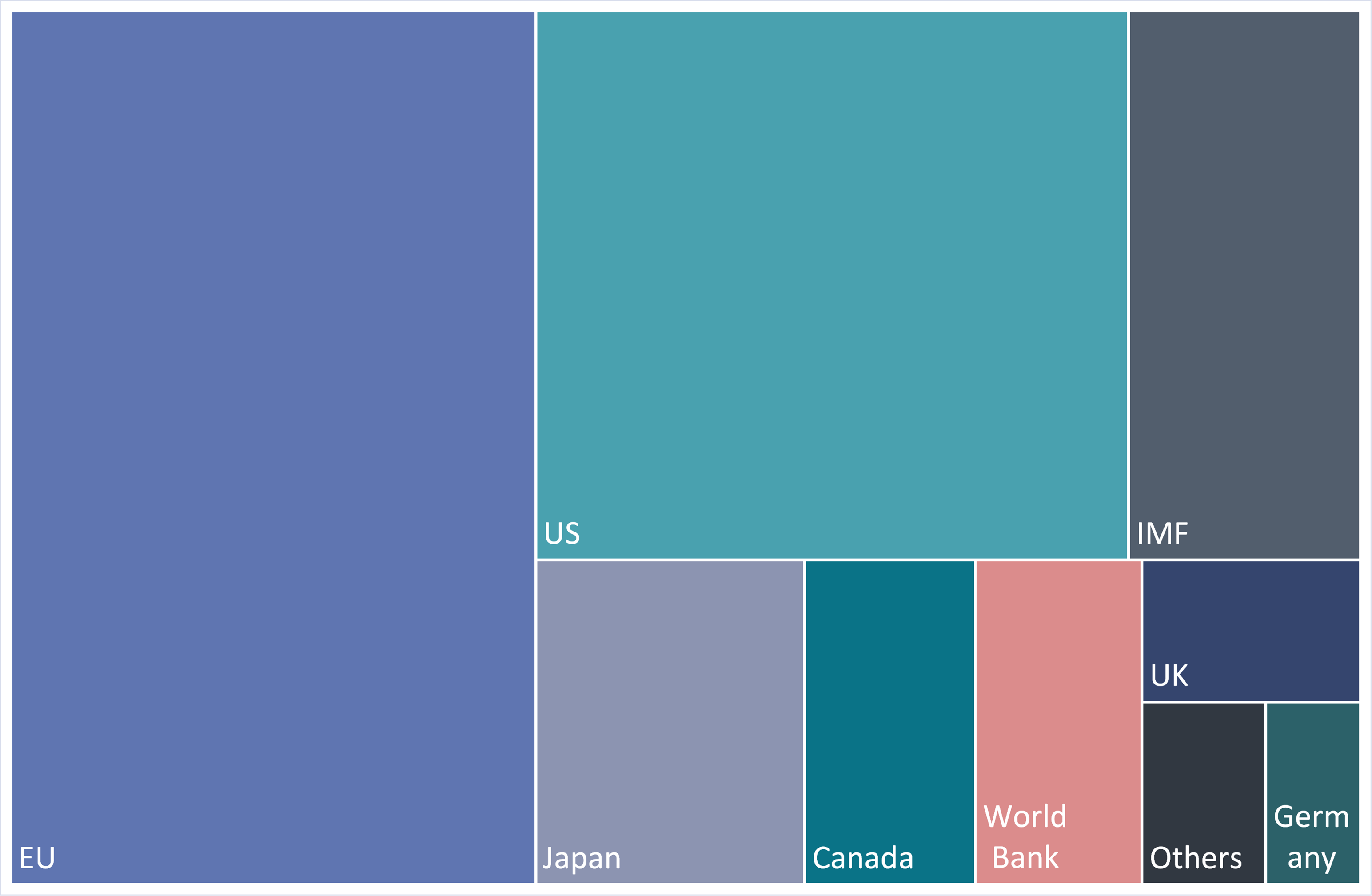

Last year, Ukraine received $42 billion in direct budget support from its international partners in order to cover its public sector deficit. The amount corresponds to about two-thirds of Ukraine’s government financing needs (deficit and debt-servicing costs). The remaining financing needs are covered by issuance of government bonds. Ukraine’s largest single source of foreign financing in 2024 consisted of just over $17 billion from the EU’s Ukraine Facility. Ukraine has received a total of more than $115 billion in direct support between February 2022 and end-2024. Of that, the EU has provided about $45 billion, followed by the US with about $31 billion. Ukraine had withdrawn slightly over $12 billion from its IMF loan facility as of end-2024.

At the end of last year, Ukraine had received about $115 billion in direct budget support

Sources: Ukraine’s Ministry of Finance, BOFIT.

The largest external financing source this year is the G7’s $50-billion loan programme, which is paid for out of the profits of Russia’s assets frozen in the West. Specifically, the Extraordinary Revenue Acceleration (ERA) arrangement allows G7 countries to take loans with the payments on principal and costs paid out of the revenues of Russian state and central bank assets frozen in the EU area. Ukraine’s estimated external financing for 2025 is $38 billion, of which nearly $22 billion in direct budget support will come from the ERA programme. Ukraine is also set to receive $13.7 billion from the EU Ukraine Facility once it meets the programme’s conditions. ERA payments are donations to Ukraine, a change from the previous two years when Ukraine had received the lion’s share of its international funding in the form of low-interest loans. The US has committed to cover the ERA programme’s largest tranche of $20 billion.

Costs of Ukraine’s recovery and reconstruction exceed $500 billion

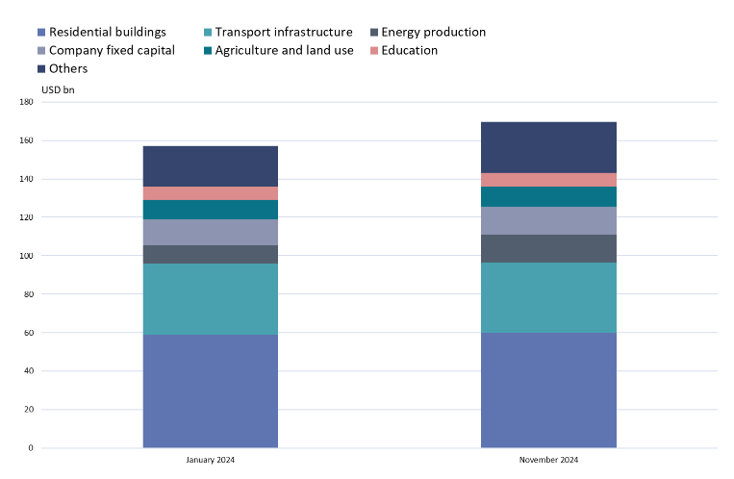

The updated joint assessment of the World Bank, Ukrainian government, EU Commission and the UN estimates the costs of Ukraine’s recovery and reconstruction as of end-2024 had risen to $524 billion, or 2.9 times Ukraine’s nominal GDP in 2023. The assessment assumes the recovery costs to be distributed over a decade. Recovery costs increased by $38 billion from the previous assessment last year.

The cost of repairing the direct war damage to Ukraine’s existing infrastructure has already reached $170 billion according to the Kyiv School of Economics (KSE). The sum corresponds to 95 % of Ukraine’s 2023 nominal GDP. The most significant damage has been to residential housing ($60 billion), transportation infrastructure ($38.5 billion) and the energy sector ($14.6 billion). Damage to the country’s energy sector was particularly significant in January-November 2024 (up 46 % from the same period a year earlier), indicating how Russian bombing has focused strongly on energy infrastructure. Nearly 90 % of damage is located in 10 of Ukraine’s 24 regions (Crimean peninsula was unavailable). The regions that have suffered the most include Donetsk, Kharkiv, Luhansk, Kyiv, Chernihiv and Kherson. All are situated near the frontlines or were occupied by Russia.

Damage to Ukraine’s infrastructure between January and November 2024 amounted to nearly $13 billion

Source: Kyiv School of Economics.

Ukraine’s mineral endowments extensive, but underexploited

Ukraine’s government estimates that the country’s reserves of critical raw materials represent roughly 5 % of global reserves. Based on the EU’s current list of 34 critical raw materials, Ukraine has identified commercially viable deposits containing over 20 of these critical raw materials. Despite vast reserves, Ukraine’s mineral riches are largely underexploited. Prior to Russia’s full-on invasion, only 15 % of Ukraine’s estimated 20,000+ deposits of critical raw materials were exploited. According to a report from the Ukrainian thinktank WeBuildUkraine, investments in Ukraine’s mining sector have been impeded by Ukraine’s institutional inadequacies such as scattered and unsystematic collection of geological data, confidentiality rules and complex land acquisition procedures.

Ukraine’s president Volodymyr Zelensky says that less than 20 % of Ukraine’s mineral deposits are in Russian-occupied areas, but over half of deposits of rare earth metals are under Russian control. A precise assessment of Ukraine’s mineral and natural resources are difficult the define precisely and many estimates are based on Soviet-era exploration data.

Among the rare earth metals (REEs) found in commercially viable quantities in Ukraine are neodymium, which is used in electrical vehicle batteries and permanent magnets in e.g. speakers and wind turbines, as well as erbium and yttrium, which are used in e.g. lasers, radar and structural ceramics. China dominates the rare earths market, which is partly the reason the US and EU are interested in Ukraine’s REE reserves. Beyond an enduring peace, exploitation of Ukrainian REEs demands large-scale investment and research.

Ukraine also has substantial reserves of metals important to the green transition and defence industries, including lithium and titanium. Ukraine already supplies about 7 % of the world’s titanium. Europe remains highly dependent on Russian titanium. Thus, Ukraine’s titanium market has significant growth potential despite the on-going war.

According to Ukrainian Geological Survey, Ukraine is estimated to have 20 % of the world’s graphite reserves. Graphite is an important raw material in electrical vehicle batteries and nuclear reactors. According to the US Geological Survey, Ukraine produces less than 1 % of the natural graphite on the global market. Graphite deposits are located in the country’s central and western areas. Ukraine is also estimated to control about 3 % of the world’s lithium reserves.