BOFIT Weekly Review 07/2024

Russia’s GDP growth last year higher than expected; lower growth ahead

Preliminary figures suggest surprisingly robust Russian GDP growth in 2023

Rosstat last week released its preliminary 2023 data, which showed that Russian GDP grew by 3.6 % in 2023. Growth was clearly higher than either international or Russian forecasters had expected. For example, the most recent forecast published by the Central Bank of Russia (CBR) last November estimated GDP would grow by about 2.5 % in 2023. The forecast update published by the International Monetary Fund (IMF) in late January said growth likely reached 3.0 % in 2023.

This year, Rosstat also released unusually rapidly a breakdown of GDP contributions on the demand and supply sides. Information on exports and imports, however, remained quite limited, making it more challenging to interpret the GDP data. While there are no clear indications of extensive and systematic statistical manipulation, the uncertainty surrounding the data and its inconsistencies have increased. We can be fairly sure that the Russian economy grew last year, but any specific growth figure should be taken with a high degree of caution.

Domestic demand drives growth and supports war industry

Increased domestic demand was the driver of GDP growth. Preliminary figures show that public consumption rose by 3.6 % last year, i.e. the biggest gain in the history of current GDP reporting starting in 1996. Household consumption bounced back strongly from its dip in 2022. Fixed investment growth reportedly climbed by 10.5 % last year and inventory growth turned substantially positive. The foreign trade components are published only in current prices, which makes it difficult to capture the impacts of price changes. Russia’s isolation from the global economy is, however, evident in the decline in the share of exports, which corresponded to just 23 % of GDP last year – the lowest level in the current GDP statistical series starting in 1996.

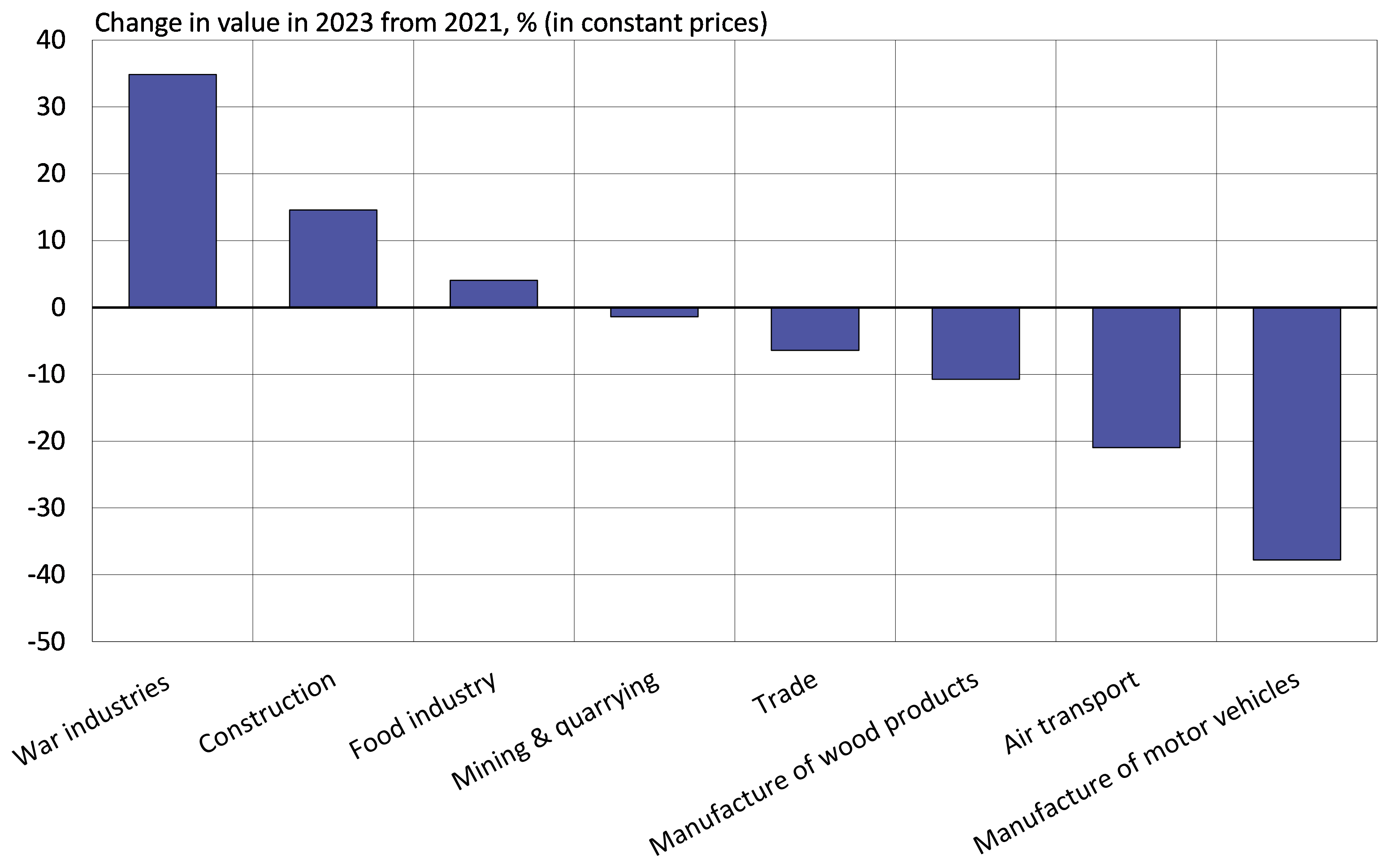

On the supply side, increasing domestic demand has fuelled growth in industries linked to the war effort, construction and retail sales. Industries serving the war effort and the construction industry have grown rapidly during the past two years and their 2023 output figures were much larger than in 2021. Manufacturing growth, in particular, has relied largely on war-related industries. Output of manufacturing branches contributing to the war effort last year were up by roughly 35 % from 2021, while other manufacturing branches as ana aggregate were down by 0.4 %. Even with economic recovery, many industries such as car manufacturing and air transport last year experienced output well below pre-war levels.

Russia’s GDP growth has been led by war-related manufacturing industries and construction sector

Note: War industries is a proxy measure consisting of manufacturing branches linked to the war effort (manufacturing of fabricated metal products, electronics and other transport equipment).

Sources: Rosstat, BOFIT.

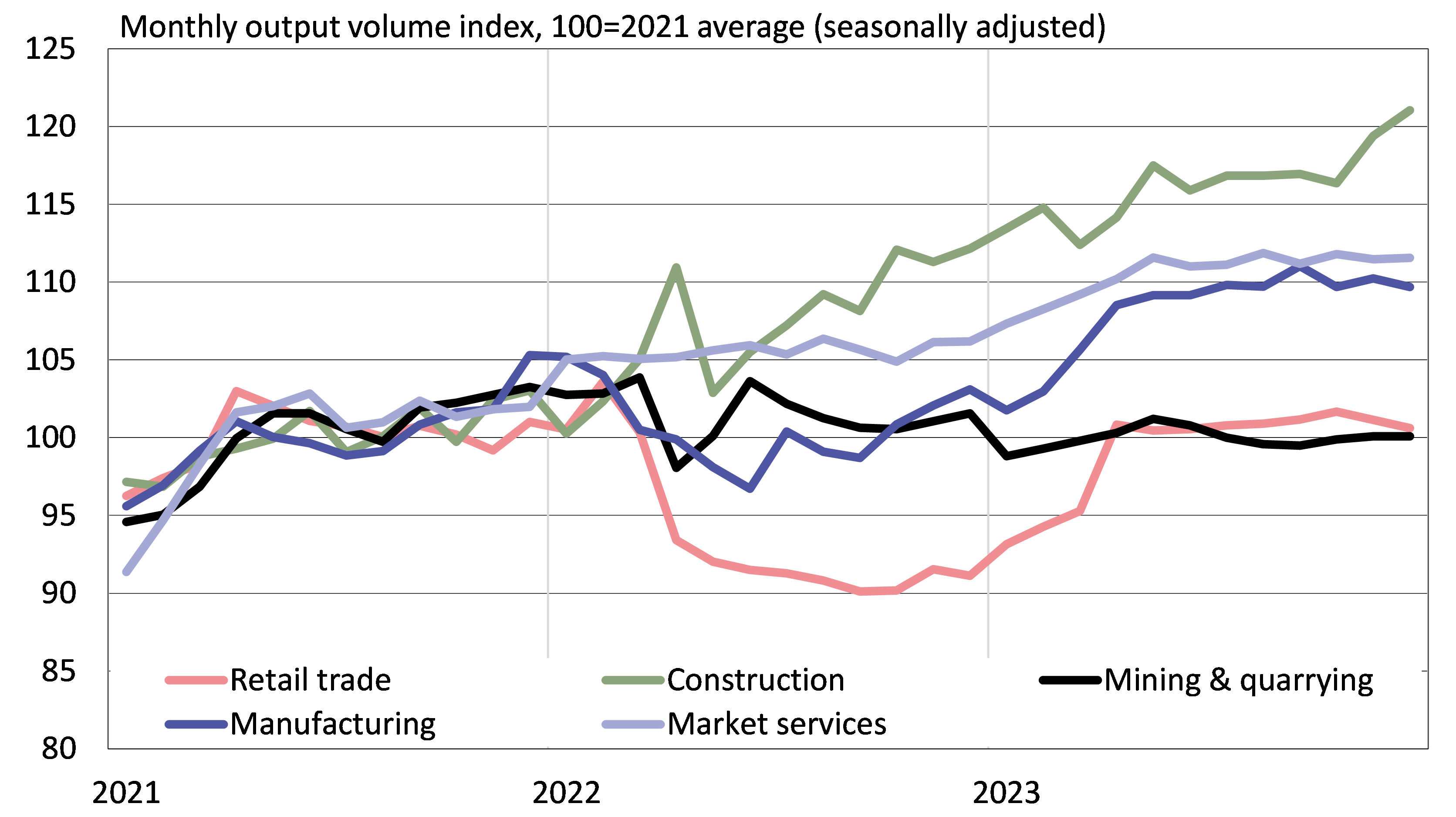

Output growth continues to slow

Monthly data suggest that output growth has slowed in recent months. Industrial output, retail sales and other services have remained flat for many months. Only construction appears to have showed sustained growth at the end of last year.

Labour shortages have become a key constraint on output growth. At approximately 3 %, Russia’s national unemployment rate is at its lowest level in the post-Soviet era. At the same time wages have risen rapidly boosting consumer demand. Preliminary Rosstat figures show the average real monthly wage (i.e. wage adjusted for inflation) rose by nearly 8 % y-o-y in the first eleven months of 2023.

Inflation accelerated sharply at the second half of last year. Consumer prices rose in December 2023 and January 2024 by 7.4 % y-o-y. Food prices have climbed even faster. Russians have been worried particularly by steep price increases for eggs, meat and poultry products. Egg prices were up by 59 % y-o-y in January, while meat and poultry products were up by 16 %. The CBR has substantially hiked its key rate in recent months in an effort to fight inflation. In its today’s meeting , the CBR kept the key rate unchanged at 16 %, as inflationary pressures remain high.

Recent forecasts see Russian GDP growth slowing this year. The CBR released its new forecast today and expects GDP to grow 1-2 %. The IMF forecasts GDP growth of 2.6 % and the OECD 1.8 %. The Consensus Economics average of forecasts released in January anticipated growth of 1.7 % this year. All international forecasts see Russian GDP growth slowing in 2025 to around 1 %. Russian economic growth is also expected to lag global economic growth, which is expected to remain around 3 % this year and next.

Several sectors of the Russian economy have slowed in recent months

Sources: Macrobond, Rosstat, BOFIT.