BOFIT Weekly Review 35/2015

Large shifts in structure of government revenues and spending

In the first half of 2015, revenues to the consolidated budget (federal, regional and local governments, plus state social funds) remained unchanged in nominal ruble terms as 9 % y-o-y growth in other budget revenues offset a 20 % drop in tax and fee revenues from oil & gas. The non-oil share of revenues rose to 77 % and equalled over 28 % of GDP.

Nominal ruble revenues from income and excise taxes increased just a few percent and VAT revenues were up 6 %. Revenues from mandated social contributions, however, rose 9 % and revenues from corporate profit taxes were up even 30 %. The unusually large increase mostly came from higher profits of exporters in the oil and metal branches. These firms have seen their ruble denominated profits rise sharply due to ruble depreciation. Nominal budget revenues from property taxes were up 10 %. Revenues from state property rose 60 % as income from investment of government assets quadrupled (again, partly due to the ruble’s collapse) and the transfers to the state from CBR surplus increased by 2.5 times.

A nearly 20 % rise in first-half consolidated budget spending (in nominal ruble terms) was driven largely by higher social and defence spending (both up by over a third). As defence spending increase was more front-loaded than usually (i.e. allocated early in the year), its share of budget spending rose to 14 % and exceeded 5.5 % of GDP. Social spending rose by 36 % to 14 % of GDP. Debt-servicing costs, due in part to ruble weakness, also increased over 30 %.

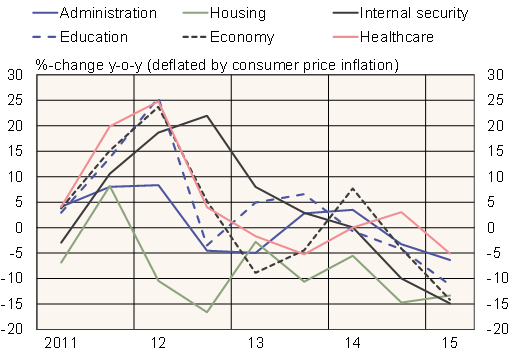

The government increased healthcare spending by 10 % in the first half of this year. Other main spending categories rose slowly in nominal ruble terms or were unchanged from a year earlier. Inflation picked up dramatically last winter, so all spending not related to defence or social spending fell sharply in real terms relative to the first half of 2014.

Real changes in select government spending categories

Source: Ministry of Finance