BOFIT Weekly Review 36/2024

China’s central bank overhauls monetary policy operating framework and starts trading in government bonds

Chinese monetary policy relies on a broad range of policy tools for its implementation. The People’s Bank of China (PBoC) regulates both the cost and amount of money through a range of lending programmes and open market operations, as well as setting reserve requirement ratios for banks and interest-rates for its lending. A variety of programmes are also used to target cheap credit to favoured sectors, with bank lending influenced directly as needed through “window guidance” meetings. In his June speech at the Lujiazui Forum, PBoC governor Pan Gongsheng talked at length on reform of Chinese monetary policy and its operating targets. He argued that the monetary policy framework should be based more on interest rates and that the PBoC should focus on a single main policy rate rather than multiple rates of different tenors as at present. He expressed hope that such changes would improve the transmission of monetary policy to markets and the real economy.

Central bank considers single Short-term policy rate and narrows Interest-rate band

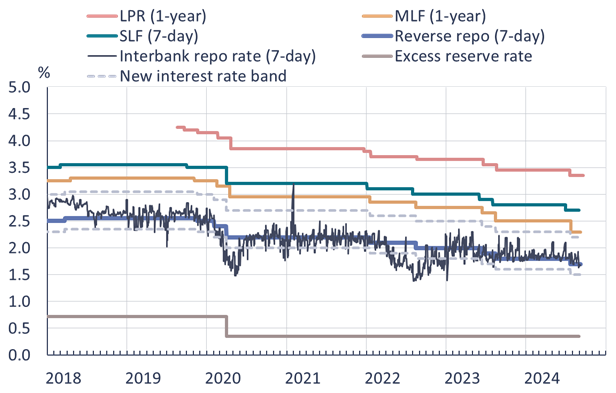

Governor Pan proposed the 7-day reverse repo rate as the main short-term policy rate. The PBoC implements its daily open market operations, where it offers commercial banks money at a fixed price, using reverse repurchase contracts (repos) – usually at the 7-day tenor. In conjunction with the PBoC’s July rate cuts, the 7-day reverse repo rate was reduced by 10 basis points to 1.7 %.

In addition to its usual daily open market operations, the central bank announced in July that it would begin to implement additional afternoon sessions as needed. In these late sessions, the PBoC would provide temporary overnight lending (reverse repo) at a fixed price of 50 basis points above the 7-day reverse repo rate or take in overnight deposits (repo) at a rate 20 basis points below the reverse repo rate. This fine-tuning, in practice, confines the money market rate to a 70-basis-point range around the 7-day reverse repo rate. China’s most-watched money market rate is the 7-day repo rate (DR007) that represents the weighted average of rates between banks with government-backed bonds as the collateral on the interbank market. China in theory had an interest-rate band also previously, but it was so wide that it had little practical significance. The lower bound was the rate paid for banks’ excess reserves (0.35 % in September) and the upper bound was the standing lending facility (SLF) rate (2.7 % on a 7-day loan). Under the SLF programme, PBoC provides banks short-term funding against collateral as needed.

Pan noted that the setting of the loan prime rate (LPR), the reference rate for bank lending, needs to be reformed to better reflect market rates. Currently biggest commercial banks submit their quotes to the central bank based on the PBoC’s medium-term lending facility (MLF) rate. Under its MLF lending programme, the central bank offers commercial banks loans typically with a maturity of one year. In July and August, the central bank conducted its MLF operations later than usual and instead provided liquidity into the market using open market operations. The PBoC wants to reduce the role of the MLF rate as a key policy rate, which might also affect the way the LPR rates are set.

Money market rate has already remained within the PBoC’s new proposed corridor

Sources: CEIC, PBoC, National Interbank Funding Center and BOFIT.

More clear implementation of monetary policy and moves towards market-based direction are welcome. Hopefully, this will also make it easier to trace the PBoC’s monetary stance. The reform, however, neither alters the central bank’s operating environment nor monetary policy objectives. More, it does not necessarily assure improved transmission of policy to the real economy. The PBoC lacks independence, functioning instead under the State Council. As a result, monetary policy in China serves as one tool in implementing broader economic policy. China’s official monetary policy objective is to “maintain the stability of the currency value and thereby promote economic growth.” The value of the currency is interpreted to mean both its external value and domestic price stability. Other policy goals include the pursuit of financial market stability, balance-of-payments balance, optimal employment and supporting branches of the economy or regions seen as vital to government interests. It is hard to see how a single-rate instrument might be used to achieve multiple, often conflicting, goals. Thus, some targeted policy instruments must necessarily be retained in the central bank’s policy toolbox. The transmission of monetary policy is currently hindered by low demand for financing due to problems in the real estate sector and low consumer confidence – problems that cannot be fixed through reforming the monetary policy framework.

In his speech, governor Pan stressed his desire for increased monetary policy transparency and communication. The central bank, however, cannot decide on the preferred policy goals (and sometimes not even the timing of policy actions) making effective forward guidance unfeasible. Orders to adjust the monetary policy stance often come from the government. Given the opacity of China’s current monetary policies, more clear communication of the policy measures and their intended goals would, nonetheless, be widely appreciated.

CENtral Bank starts buying and selling government bonds ON SECONDARY MARKETS

Markets have been expecting the PBoC to start trading government bonds in the secondary markets after the central bank confirmed in June that it was planning to do so and in July announced that it has access to a vast pool of government bonds through borrowing them from primary dealers, which also makes selling the bonds possible. The central bank’s concern has been this year’s incessant decline in government bond rates especially at the long end of the yield curve as investors continued to pile into government bonds in the absence of other attractive investment possibilities. The PBoC has repeatedly expressed concern about the risks from a sudden increase in interest rates to the financial sector. According to official comments, the PBoC’s entry into government bond trading does not signal the launch of a quantitative easing programme, as the central bank will be both selling and buying bonds, and it is instead aimed at regulating market liquidity (BOFIT Weekly 22/2024).

Last week (Aug. 30), the PBoC announced that it sold long-term government bonds and bought short-term bonds on the open market. The net purchase was 100 billion yuan, although the tenors were not specified. PBoC trading seemed to have little impact on market rates. The central bank’s balance sheet contains only a small amount of government bonds. In August, some of these bonds matured and the central bank replaced them with new issues. The markets expect the PBoC to continue selling of long-term government bonds to restrain the fall in interest rates and affect the yield curve.

Implementing appropriate monetary policy remains challenging for China. The current purpose of selling government bonds is to prop up long-term rates. The domestic economy, on the other hand, would need accommodative policies and rate cuts to boost activity. The depreciation of the dollar in recent months has allowed the yuan to strengthen. A drop in interest rates, however, could renew depreciation pressure on the yuan. Most of the year the central bank has been restraining yuan depreciation. As long as China is unwilling to relinquish control of the yuan’s exchange rate, interest-rate policy cannot be shaped to fully account for conditions in the domestic economy.

Rates for government bonds have declined this year.

Sources: China Central Depository & Clearing Co, CEIC and BOFIT.