BOFIT Weekly Review 50/2024

Yuan declines against the dollar; nominal interest rates in China continue to fall

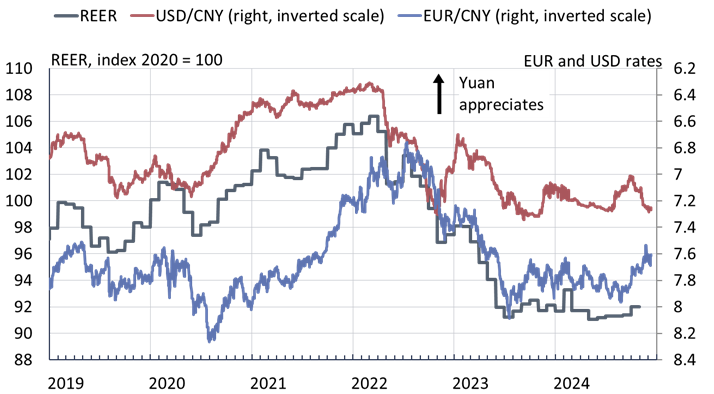

The US dollar, which had already been appreciating against other currencies since October, strengthened further on the November election of Donald Trump to a second presidential term. The dollar’s trade-weighted exchange rate (DXY) is up 6 % from end-September. Most major currencies have lost ground against the dollar. This includes the yuan, which is currently down about 4 % against the dollar since end-September and close to its lowest rate against the dollar since 2007. On Friday (Dec. 13), one dollar bought 7.28 yuan. In recent days, the People’s Bank of China (PBoC) has moved to brake the yuan’s slide by letting the daily fixing rate appreciate only minimally. The exchange rate in mainland forex trading can fluctuate within a 2 % band around the fixing rate, which currently has a set ceiling of 7.33 yuan to the dollar.

Other major currencies have lost value against the yuan and China’s real effective (trade-weighted) exchange rate, or REER, has slightly increased. For example, the yuan has strengthened by 3 % against the euro since end-September. One euro currently buys 7.61 yuan.

The yuan has lost value against the US dollar since October

Sources: Macrobond, BIS and BOFIT.

The PBoC, which has eased monetary policy this year, says further cuts are coming. The politburo, China’s highest decision-making body (and which does not include a single member of the central bank’s monetary policy committee), this week announced that the characterisation of monetary policy stance had been changed from “prudent” (used since the end of 2010) to “moderately loose.” China’s leadership has sought to bolster market and consumer confidence since early autumn by signalling that wide-ranging support measures are under consideration, even if the actions taken have yet remained modest (see BOFIT Weekly 40/2024 and 46/2024). More specific information is expected in the follow-up to the Central Economic Work Conference held this week (Dec. 11-12) in Beijing.

Although the central bank has yet to announce further easing measures since the politburo’s announcement, the change in the monetary stance is unsurprising. Monetary policy has been in accommodating mode for years to bolster economic growth. The PBoC has refrained from broader and more aggressive interventions, however, due to the risk of excessive yuan depreciation and worries about accelerating capital flight from the country.

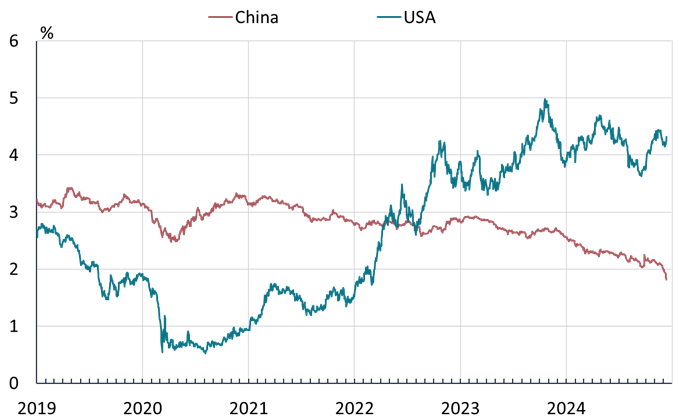

Monetary easing has translated into lower interest rates in China. Yields on government bonds have also fallen due to high demand from investors seeking safe investment opportunities. The PBoC became involved in selling and buying government bonds on the secondary market since August. At the end of November, the net purchases under this scheme amounted to 700 billion yuan. Yields on government bonds have continued to fall in recent weeks, with the yield on the 10-year bond falling below 2 %. The nominal rate is considerably lower in China than in the US, that is increasing capital outflow pressures. In November, the Chinese government issued dollar-denominated bonds on the international markets priced the same as US bonds.

Inflation remains close to zero, which usually indicates to policymakers that there is room for more accommodative monetary policies. November consumer prices overall were up by just 0.2 % y-o-y, while core inflation (excludes food and energy prices) was up by 0.3 %. Producer prices fell by 2.5 % y-o-y. Real interest rates in China are still clearly positive. Measured using consumer prices, real government bond yields in the US and China are on par. US 12-month inflation in November was 2.7 %.

The yield on 10-year government bonds (in yuan) in China has continued fall, while the yield on the US 10-year treasuries (in dollars) has remained stable

Sources: Macrobond and BOFIT.