BOFIT Weekly Review 44/2023

BOFIT expects Chinese economic growth to slow in coming years

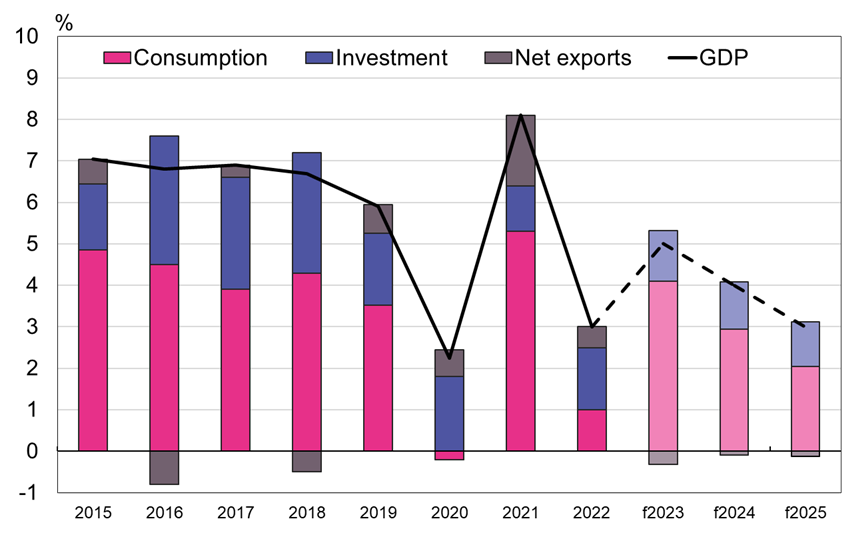

On Monday (Oct. 30), BOFIT released its latest Forecast for China 2023–2025 and held a briefing in Finnish on the Chinese economy (here). We expect the Chinese economy to slow gradually over the forecast period. While GDP growth should still reach about 5 % this year, it slows to around 4 % next year and 3 % in 2025. The biggest hindrances to growth are structural factors, including China’s shrinking working-age demographic, an ageing population, modest productivity gains and stalled political efforts to move from an economic paradigm based on fixed investment to a growth model driven by consumption. China is unlikely to make much progress in the extensive structural reforms needed to correct the situation during the forecast period. The country’s leadership instead is likely to remain fixated on increasing self-sufficiency and strengthening national security, objectives broadly reflected in economic policymaking.

Chinese GDP growth, factors contributing to growth and BOFIT Forecast for China 2023–2025

Sources: China National Bureau of Statistics and BOFIT.

The possibility for the government to support economic growth are more limited than earlier. Public-sector deficits have been very large in recent years, creating a mountain of debt. Local governments, which typically are responsible for implementing stimulus measures, are struggling, especially those outside China’s richest provinces. Large pressures to export capital from the country and the yuan’s weak exchange rate are expected to keep the central bank cautious on its monetary policy stimulus measures. The future outlook also carries considerable risks. For example, how the leadership will try solve problem areas it recognises? How much more tense already-strained relations between China and the west will become? Risks in China’s complex and opaque financial sector continue to mount as the county piles on debt. Could we see major a disturbance that shocks the financial system?

ADDITIONAL SUPPORT MEASURES

Since the release of our latest forecast, the October readings of the official purchasing manager indices have been released. They indicate a weak economy in October. The manufacturing PMI fell below the 50, indicating that the conditions of manufacturing firms were worse than in September. The latest services PMI index slightly exceeds the neutral reading of 50, implying that the situation of service-providers only improved slightly in October. Officials have announced numerous minor measures to support the economy in recent months (BOFIT Weekly 38/2023), and further measures in recent weeks. Although the measures will boost economic growth slightly, their overall impacts will likely be limited.

In late October, the central government announced it was increasing its borrowing this year by 1 trillion yuan (roughly 0.8 % of GDP). The measure is exceptional; the last time the central government decided on a supplemental budgetary increase during a fiscal year was in 2000. According to some reports, the additional funds would be spent on infrastructure projects such as repairing flood damage from last summer and building resilience for future flooding. Moreover, local governments have been given permission to to begin issuing their bond 2024 allocations as the special debt quota granted to local governments this year is nearly exhausted already. The purpose of the decision is to smooth the transition of local finances going into the coming year. Local governments have also been granted the possibility its issue bonds to pay off typically high-interest debt hidden in their off-budget local government financial vehicles. Some provinces have already done this. The measures ease the financial position of local governments and mitigate debt-servicing costs.

The government has even become involved in propping up traded share prices. Central Huijin, which manages government stakes in China’s giant state-controlled banks, has announced it has bought more shares of state banks from the market. Several state-owned firms have also announced share buy-back programmes in recent weeks. Moreover, officials reportedly changed rules for insurance companies this week to make longer-term investment in company shares easier.