BOFIT Weekly Review 11/2017

No big changes at the start of the year in China's economic situation

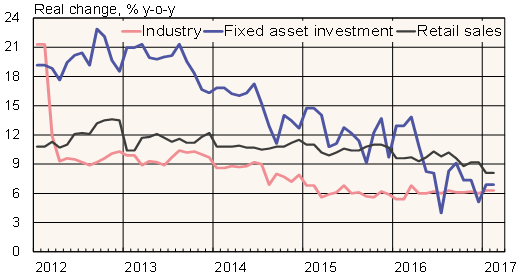

The basic economic data for January and February released this week offered no big surprises. Industrial output grew by 6 % y-o-y in real terms in the period. This was slightly higher than in the final months of 2016 and about a percentage point higher than in January-February 2016. Retail sales increased by just over 8 %, which was about a percentage point lower than at the end of last year and one and a half percentage point lower than in January-February 2016.

Fixed asset investment (FAI) in urban areas is an important indicator as capital formation still accounts for over 40 % of GDP. FAI in January-February was reported to be up nearly 9 % y-o-y in nominal terms. However, even a restrained rise in investment prices should reduce real investment growth to around 7 %. Although investment growth in January-February was higher than in December, the slowing trend in investment growth most probably remain unchanged. At the beginning of 2016, when investment growth was heavily boosted by public investment, FAI grew nearly double the rate of the first two months of this year. Also in January-February 2017, public investment grew significantly faster than private investment. Private investment, however, account for about 60 % of total fixed investment.

China's economic growth seems to remain strong, but the growth is if anything slowing down. However, several statistical issues make it hard to give a proper appraisal of the current conditions. Official figures show unusually steady GDP growth in recent years that seem to more reflect official growth target than actual trends. Numerous other indicators suggest that China's actual growth has occasionally been significantly lower than reported, especially since 2014. There is also reason to suspect that the statistical fraud recently revealed in the Liaoning province is not an isolated incident.

Industrial output, retail sales and fixed investment*

* January-February 2017 investment figure based on price estimates.

Sources: Macrobond and BOFIT.