BOFIT Weekly Review 02/2015

2014 exposed major weaknesses in the Russian economy

Former finance minister Alexei Kudrin notes that the basic reason for the slowdown of the Russian economy since 2011 is the peculiar economic model Russia has created over the past ten years that often provides inappropriate signals for business activity.

According to Mr. Kudrin, market mechanisms function poorly in Russia. In recent years, state participation in the economy has increased so that large state-owned or quasi-state-owned enterprises now dominate the economy. These firms have little incentive to modernise or seek out operational efficiencies. They seek instead to maximise their various forms of state support and get supply contracts with the government. These perverse business incentives are disseminated throughout the economy via distribution chains. All this together with uncertain business environment caused by stunted institutions encourage to short sighted business activity. Firms seek opportunities for quick profits rather than invest long term.

The Ukraine crisis last year increased uncertainty in the business environment. The annexation of Crimea and the on-going Donbass conflict, as well as the economic sanctions and countersanctions that followed, are likely to depress economic growth for years to come. The final nail in the coffin has been the sharp decline in world oil prices.

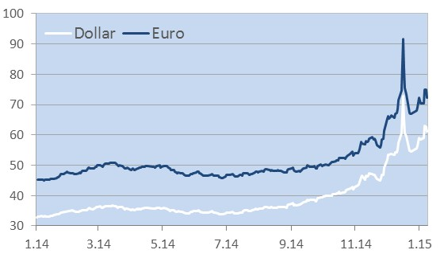

All these problems are reflected in the ruble’s exchange rate. Over the course of the year, the Central Bank of Russia’s official ruble rates showed a 34 % drop against the euro and a 42 % loss against the dollar.

The ruble’s slide on currency markets continued this month with the exchange rate remaining above 70 rubles to the euro and the dollar rate holding close to or above 60.

Ruble-dollar, ruble-euro rates, 1 Jan. 2014 – 8 Jan. 2015 (falling trend indicates ruble appreciation)

Source: Thomson Reuters

The weakening of the ruble also reflects the international collapse in oil prices. The price of Urals crude, Russia’s key export oil grade, lost 52 % last year, a bit more than North Sea Brent oil (down 48 %). The price of Urals crude tracks the Brent price and typically is a couple dollars cheaper per barrel.