BOFIT Weekly Review 38/2015

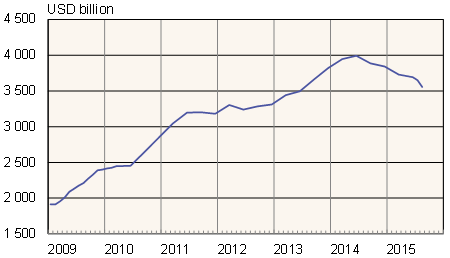

China’s foreign currency reserves declined by $94 billion in August

Following a record monthly drop, the value of China’s reserves held in foreign currencies at the end of August stood at $3.557 trillion. The decline in reserves reflects massive capital outflows and the central bank’s response in propping up the yuan’s exchange rate. Media reports note that the People’s Bank of China has supported the yuan’s exchange rate through currency interventions, even if the central bank does not publish information on this. Officials are trying to quell forex outflows e.g. by setting a 20 % reserve requirement ratio on forex forward contracts from October 15 onwards. Because interest is not paid on such deposits, hedging against currency fluctuations becomes more expensive.

Shifts in the value of China’s reserves depend on multiple factors, and the effect of one factor is hard to judge due to the lack of available information. Included here are capital outflows in the form of outbound foreign direct investment, money spent by Chinese tourists abroad and investment opportunities abroad – all of which are on the rise. Stock market uncertainty has caused foreign investors to pull their investments out of China. Thus, even if China’s goods trade surplus has increased, capital in net terms is currently flowing out of China and the outflow has picked up in recent months. The outflows are reflected in the drop in the country’s foreign currency reserves.

The value of foreign currency reserves is also affected by exchange rate changes. While China does not release an exact breakdown of the currencies in its reserves, they are held partly in currencies other than the US dollar. Moreover, China is drawing on its foreign currency reserves to finance various national projects. The Silk Road Fund and the Chinese-led development banks (AIIB and NDB) have received financing support from China’s foreign currency reserves.

China has embraced the IMF’s Special Data Dissemination Standard (SDDS), which improves reporting on its foreign currency reserves and foreign debt. China now reports all categories of its reserve assets on a monthly basis: forex, IMF reserves, special drawing rights (SDRs) and gold. In August, $62 billion was invested in gold. China’s total reserve assets stood at 3.634 trillion as of end-August.

Value of China’s foreign currency reserves

Source: Bloomberg.