BOFIT Weekly Review 28/2022

Slow growth for China’s household loan stock

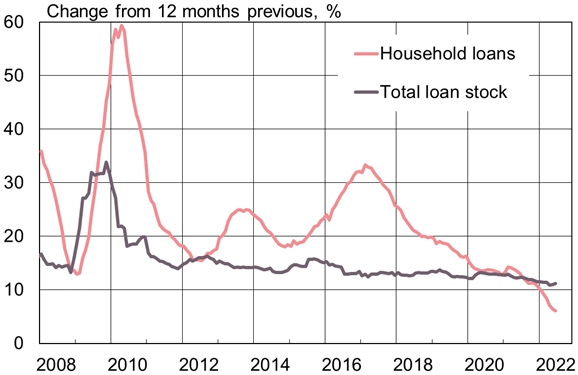

Loans to households represent nearly 30 % of the Chinese banking sector’s loan stock, with the lion’s share of household loans used for buying apartments. Apartment prices have fallen in many cities and apartment sales have declined since last summer. Already troubled real estate developers have seen their sales revenues continue to dwindle. New housing starts and sales of land-use rights have declined for nearly a year. Moreover, Chinese households themselves are increasingly uncertain about their future earning prospects and the degraded economic outlook caused by China’s zero covid policies this year. People now try to build up their savings and are reluctant to take on additional debt. On-year growth in the total volume of bank loans granted to households reached a record-slow pace last month.

Concern about China’s slowing economy has spurred officials to encourage banks to increase their lending. Although lower than in June 2021, 12-month growth in the total bank loan stock increased slightly to 11.2 % last month. With officials again embracing debt-fuelled stimulus, the banking sector finds itself at the forefront of lending. Banks offer financing to keep businesses afloat and finance public infrastructure projects. The acceleration in bank lending in June was mainly driven by growth in longer-maturity corporate loans, which is likely an indication of increased lending precisely in response to new stimulus policies. Companies also report an increased eagerness on the part of banks to offer them loans. The total bank lending stock corresponded to 176 % of GDP at the end of June.

Rising payment defaults resulting from the ongoing woes of China’s real estate sector and covid lockdowns have overshadowed banking sector profitability this year. Officially, the amount of declared non-performing loans (NPLs) on bank balance sheets remains small and has only fluctuated slightly in recent years. On the other hand, appraising the actual NPL situation is difficult, especially in light of the fact that during the first wave of the covid pandemic in 2020 and again this year, borrowers have been granted grace periods and banks are permitted to delay NPL recognition beyond the usual 90 days. Chinese banks also often grant new loans to borrowers for the purpose of extinguishing their old loans delaying recording the loans as non-performing. Observers have long considered China’s NPL situation to be less rosy than official figures suggest. The NPL ratios vary considerably from bank to bank. In this respect, China’s massive state-owned banks are better positioned than smaller banks. Smaller banks typically serve small and medium-sized enterprises (SMEs), i.e. those businesses that have borne the brunt of impacts from covid shutdowns and restrictions. The sectors to which the loans are granted also influence descriptions of their performance. For example, international credit rating agency Fitch and the Asian Pacific investment bank Natixis report that payment defaults on loans granted to China’s real estate sector have grown significantly over the past two years.

12-month growth in bank lending to households has slowed to a crawl.

Sources: PBoC, CEIC and BOFIT.