BOFIT Weekly Review 39/2022

Russian central bank further eases monetary policy

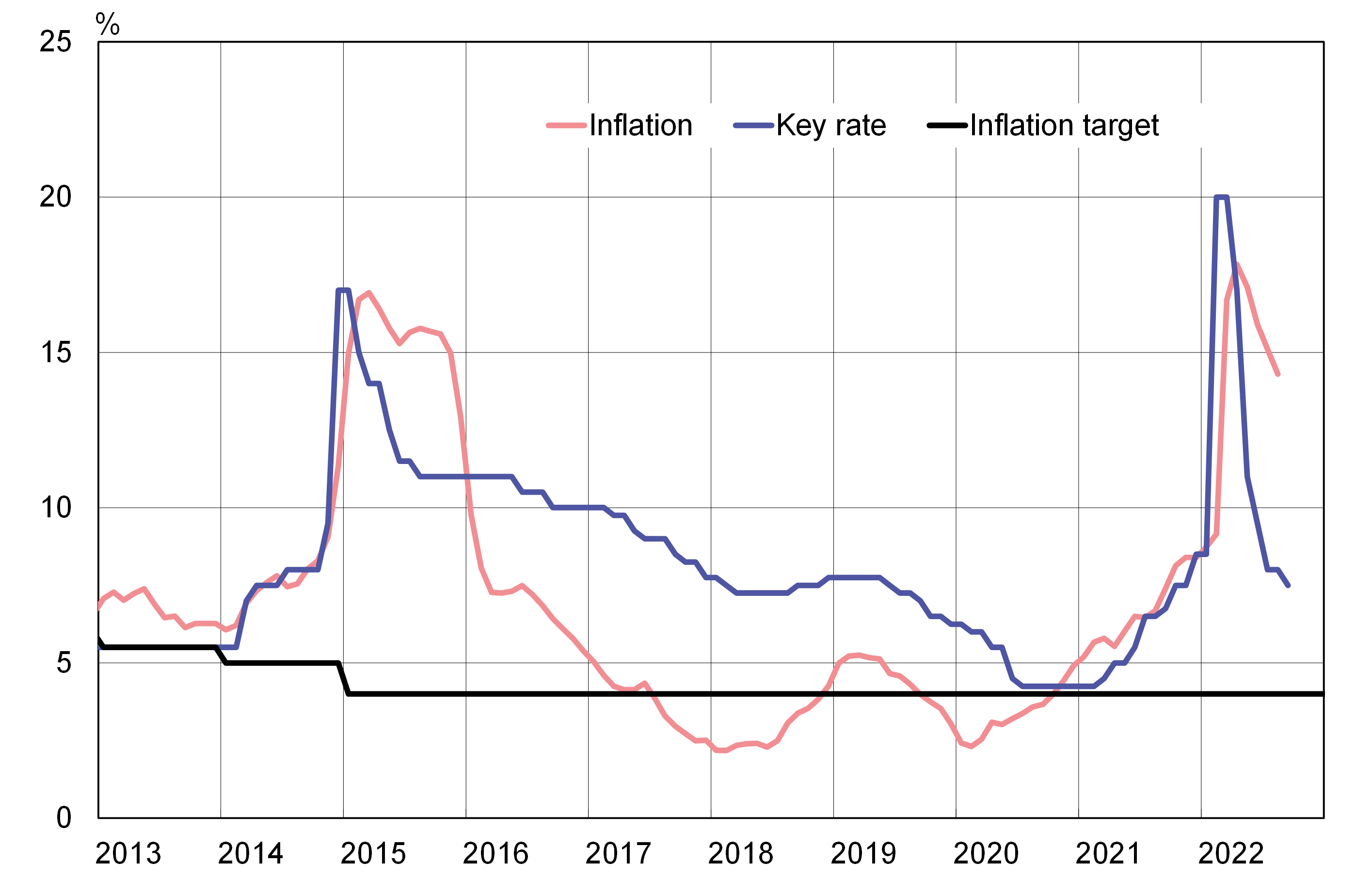

On September 16, the Central Bank of Russia lowered its key rate by 50 basis points to 7.5 %. It was the fifth consecutive rate cut since the early April peak, and overall represents a drop of 12.5 percentage points. The CBR said that it now sees less space for further rate cuts, which analysts interpreted as a signal that the rate-cutting cycle is coming to its end.

On-year inflation remains high in Russia. August consumer prices were up by 14 % y-o-y despite a slowdown in the month-to-month rise in prices. Prices for food and non-food goods climbed by 16 % y-o-y, while prices for services were up by 10 %. In individual product categories, the biggest price rises were seen for sugar (45 %), detergents and cleaning agents (33 %), grain products (30 %), pasta (25 %) and butter (24 %).

The CBR also provided an updated inflation forecast for this year in conjunction with the rate cut announcement. Central bank expects 12-month inflation to be in the range of 11–13 % this year (12—15 % in the previous forecast), 5—7 % in 2023 and return to the CBR’s inflation target of 4 % p.a. in 2024. The central bank left its GDP forecast for this year unchanged (i.e. a contraction of 4–6 %), but indicated that the forecast will likely improve in its October forecast update.

The Central Bank of Russia further lowered its key rate this month

Sources: Macrobond, Central Bank of Russia, Rosstat and BOFIT.