BOFIT Weekly Review 45/2018

China posts current account deficit for January-September; currency reserves decline

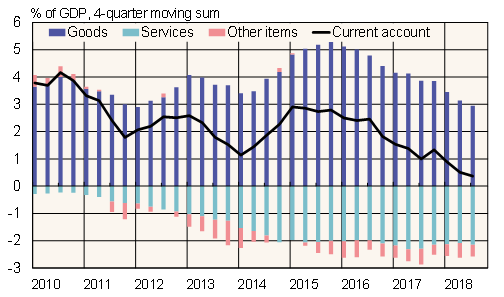

Just-released balance-of-payments figures show China with a current account deficit of 13 billion dollars for the first nine months of this year. During the same period last year, the country produced a 103-billion-dollar surplus. Small surpluses in the second and third quarters were inadequate to erase the first-quarter deficit.

Higher prices for commodities helped reduce the goods trade surplus from the same period last year. About 80 % of the services trade deficit this year came from tourism. On an annual basis, the current account is still in surplus though just below 0.4 % of GDP.

The financial account shows that considerably more capital this year flowed into China in the form of direct investment than last year. The direct investment balance in January-September showed an 81-billion-dollar surplus. Other balance-of-payments figures will be published later. Other measures, however, suggest a slight increase in capital outflows this year.

The value of China’s foreign currency reserves has fallen by 87 billion dollars this year. Balance-of-payments figures show that China’s currency reserves increased in the first half, indicating that the decline in separately published reserves was due to exchange rate shifts and other valuation changes. In the third quarter of this year, the contraction in reserves also appears in the balance of payments, indicating that the central bank was using the forex reserves to make up for the capital outflows or support the yuan’s exchange rate. The People’s Bank of China does not release information about its foreign currency interventions. In October, the value of the foreign currency reserves fell by 34 billion dollars to 3.053 trillion dollars.

Ratio of Chinese current account components to GDP

Sources: Macrobond and SAFE.