BOFIT Weekly Review 50/2015

Cheap oil hurts ruble

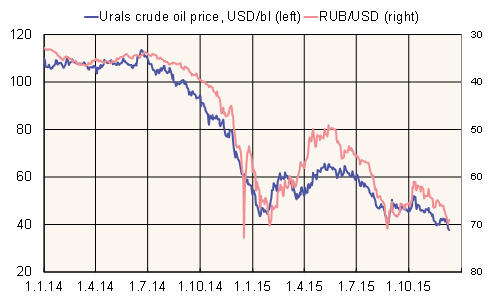

The recent slide in crude oil prices has again affected the Russian ruble’s external value. The price of Urals-grade crude oil has fallen by nearly 25 % since mid-October. Today (Dec. 11), the price of Urals crude went under $38 a barrel (Brent crude close to $39/bbl). In the same period, the ruble has lost over 10 % against the US dollar. One dollar currently buys 69.9 rubles and one euro 76.6 rubles. Since the start of this year, the price of Urals crude has slid nearly 30 % and the ruble-dollar rate about 35 %.

In recent months, the Central Bank of Russia has refrained entirely from intervening in forex markets to support the ruble’s value. The value of the CBR’s foreign currency reserves has fluctuated this year between $310 billion and $320 billion. The value of CBR currency reserves at the end of November was $317 billion. In addition, the value of its gold reserves was about $48 billion. In its monthly meeting today, the CBR kept its key rate at 11 %, where it has been since early August. The central bank cited inflation risks as the reason for maintaining the current level of the key rate.

Price of Urals crude oil and ruble’s exchange rate, 2014–2015

Source: Reuters