BOFIT Weekly Review 03/2021

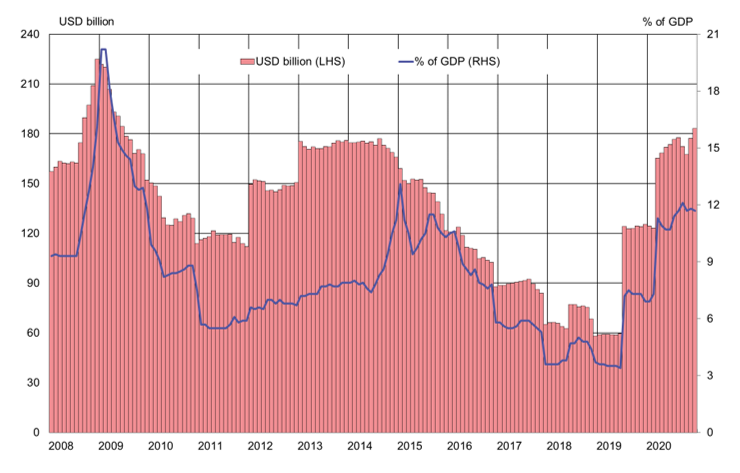

National Welfare Fund again close to 12 % of Russian GDP

At the end of 2020, Russia’s “excess” earnings on energy and higher share prices boosted the value of the National Welfare Fund to $183 billion. In accordance to the government’s fiscal rule, excess oil and gas earnings must be set aside in the Fund. In March 2020, for example, the government’s excess energy earnings for 2019 were transferred to the Fund (BOFIT Weekly 2020/37). Since then, much of the Fund’s further increase in value has come largely from the increase in the price of Sberbank shares and euro’s appreciation against the US dollar. In dollar terms, the Fund is now as large as it was in 2009.

The Fund includes about $115 billion in highly liquid public sector bonds and treasuries of large OECD countries. The central bank manages these assets as part of its foreign currency and gold reserves (BOFIT Policy Brief 2015/4). The Fund also holds the bulk of Sberbank shares ($41 billion). Some assets have also been deposited in the state-run VEB development bank.

The value of Russia’s National Welfare Fund has returned to levels not seen since 2009

Sources: Russian Ministry of Finance and BOFIT.