BOFIT Weekly Review 24/2019

China’s falling import figures signal weak domestic demand and shifts in global production chains

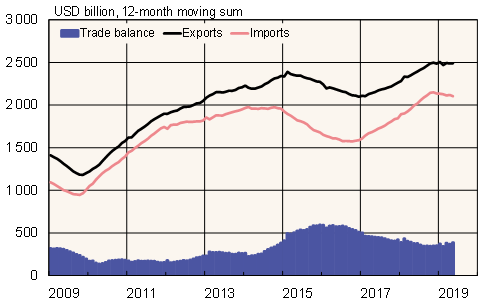

In dollar terms, the value of Chinese goods exports in May was up 1 % y-o-y. However, the value of imports was down by nearly 9 % y-o-y. For the January-May period, the level of exports remained roughly unchanged from the first five months of 2018, while imports contracted by nearly 4 %. China’s goods trade surplus in the period hit 130 billion dollars, up from 94 billion dollars a year earlier.

With China’s other major export markets showing declines or weakness in recent months, export growth is currently driven by gains in EU markets (up 6 % y-o-y). Exports to the US continued a string of down months, falling by 4 % y-o-y in May.

The weakening import trend suggests deeper problems with domestic demand. While the value of EU imports in May was still up by 2 % y-o-y, the value of imports from other major markets declined substantially. Imports from the US continued to slump as in previous months, dropping by about 25 % from a year ago. Imports from neighbouring Asian countries also continued to slide.

The complexity of the situation can be seen in the fact that exports and imports tied to international production chains have performed worse than the rest of China’s foreign trade.

Chinese foreign trade (goods) in 2009–2019

Source: CEIC.