BOFIT Weekly Review 23/2018

PBoC extends range of acceptable collateral from banks in medium-term borrowing

In reaction to increased uncertainty in China's bond markets, the People's Bank of China moved last week to allow corporate loans and bonds carrying lower credit scores to be used as collateral to banks using its medium-term lending facility (MLF). Many firms have recently found it difficult to find buyers for their debt. The MLF funding earlier required central government, local government, policy bank or domestically AAA –rated corporate bonds as collateral. The PBoC says it will now accept collateral such as corporate bonds rated AA or higher, green bonds and high-quality small- and micro-enterprise loans.

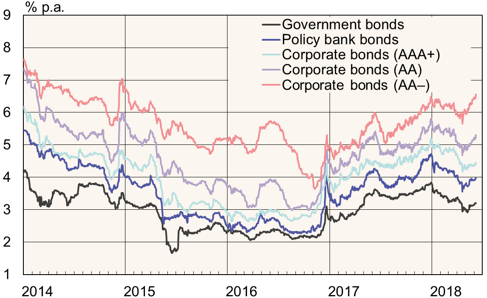

The move is intended specifically to improve small firms' access to finance and improve the access of smaller banks, which typically hold less high-grade collateral, to central bank lending. The interest rate spread between high-grade and lower-grade corporate bonds has widened since April. In China, bonds rated AA– are already treated as speculative grade in most cases.

On Wednesday (June 6), the PBoC lent commercial banks 463 billion yuan (USD 72 billion) in one-year MLF loans at a rate of 3.3 % p.a. The issuance compensated the 260 billion yuan of maturing MLF credits.

Interbank yields on one-year Chinese bonds

Source: CEIC.