BOFIT Weekly Review 05/2015

Foreign debt of Russian banks and companies shrank last year, repayments ahead

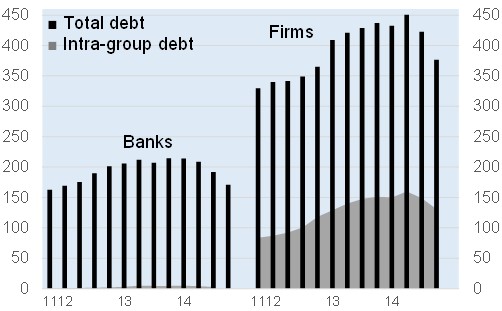

The largest drop in foreign debt occurred in the second half of the year, and at year’s end the debt stood at $548 billion, or slightly less than 30 % of GDP.

Bank foreign debt was reduced over the course of the year by $43 billion and stood at $171 billion at the end of the year. Most of the reduction came from paying down existing debt mainly in the second half of the year, due to the limited access of banks to foreign credit (caused e.g. by financial sanctions). The ruble’s slide also notably reduced the size of bank debt as reported in dollars because about 15 % of the debt was actually denominated in rubles.

Corporate foreign debt declined last year by $60 billion to $376 billion. Most of the contraction came from the drop of the ruble, since about a quarter of corporate foreign debt was denominated in rubles. Moreover, unlike banks, about a third of corporate debt consists of debt within corporate groups, i.e. loans from foreign parent corporations or subsidiaries to Russian subsidiaries and parent companies. Many corporate groups have postponed payments on such debt. Other debt was repaid by Russian firms in rather moderate amounts last year, but there was an uptick in debt repayment in the second half.

According to the latest published information on payment maturities of debt owed by Russian banks and firms (situation at the beginning of October 2014), they face foreign debt repayment obligations in 2015 on principal totalling $108 billion and interest payments of $20 billion. Banks must pay down debt of $37 billion and firms $71 billion, of which payments not related to intra-group debt amount to $48 billion.

Given the scarcity of refinancing opportunities of banks and firms, certain firms burdened with foreign debt last year sought and were granted financing from government funds and the CBR. It looks for now that repayment of debt under these circumstances also this year will not have to be financed fully out of state coffers, as banks and firms have assets abroad that act as a source. For example, the short-term deposits of banks and firms abroad were about $120 billion at the beginning of last October.

Foreign debt of Russian banks and firms, end of quarter (31 Dec. 2011 – 31 Dec. 2014), USD billion

Source: Central Bank of Russia