BOFIT Weekly Review 04/2023

Chinese economy struggled last year

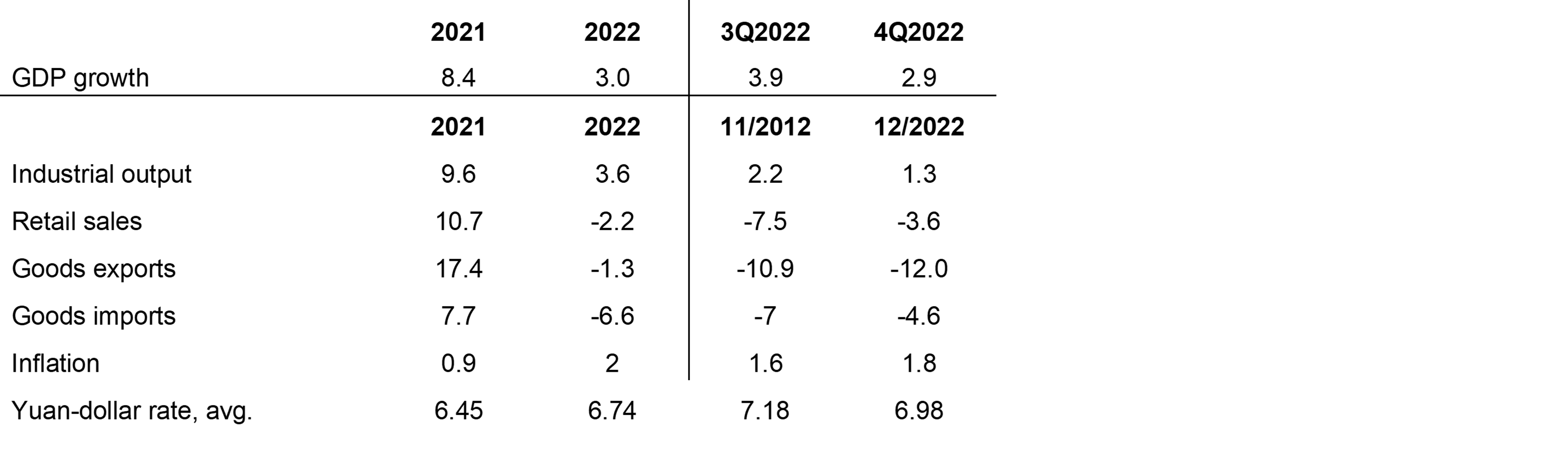

China’s National Bureau of Statistics reports that GDP grew in the fourth quarter by 2.9 % y-o-y. The 3.0 % GDP growth for all of 2022 was also well below the around 5.5 % growth target announced at the National People’s Congress in March last year. Economic development faltered twice last year, first in late spring and then in the final months of the year as the country experienced its large wave of covid infections and massive lockdown measures. Consumer demand, in particular, was subdued by covid waves. In 4Q22, retail sales contracted in real terms by 4–5 % y-o-y. With real growth in disposable income of around 3 %, households turned to building up their savings. Another factor dragging down growth was the demise of the construction sector, which continued to decline throughout the year. Real estate sales contracted by 30 % y-o-y in the fourth quarter of last year, while building volume saw a drop of 50 % in terms of floorspace under construction. The weak growth of the Chinese economy dragged the volume of goods imports to decline throughout the year. Robust exports, the bright spot in the first half of the year, plummeted at the end of last year on slowing global growth. The volume of exports contracted by over 10 % y-o-y in the fourth quarter. Exports contracted faster than imports, which caused net export growth to be negative depressing economic growth.

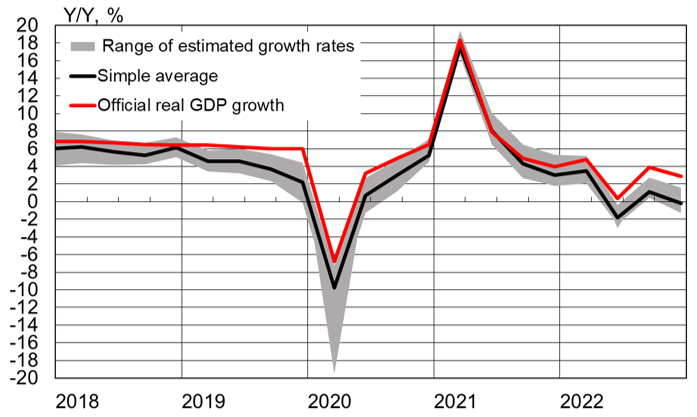

Official figures show that about half of last year’s growth came from fixed investment and rising inventories. It is difficult to make a more specific assessment of fixed investment trends, however, as China has either ceased to release certain critical economic indicators or continues to release inconsistent data. The strong contraction in real estate investment, however, points to other direction than GDP investment figures. It is likely that the overall trend in GDP growth last year was weaker than official NBS figures suggest. For example, BOFIT’s alternative estimations indicate that there was no GDP growth whatsoever last year, and that fourth quarter growth was essentially unchanged from 4Q21. Other alternative estimations even suggest economic contraction.

BOFIT’s alternative estimates of Chinese GDP growth suggest that growth stalled last year

Sources: NBS, Macrobond and BOFIT.

Population started to shrink last year

China’s population has passed its high-water mark. The Chinese population shrank last year by about a million people to around 1.412 billion and India likely surpassed China as the world’s most populous country. The contraction in the Chinese population was expected. The working-age cohort (15–64-year-olds) has contracted since 2013 and the number of economically active people has declined since 2015. China is ageing rapidly. The number of persons over 65 hit 210 million last year, an increase of 100 million from 2008. Despite these demographic eye-openers, shrinking population is seen as a minor concern compared to worries about China’s record-low birth rate. Only 6.8 births per 1,000 people last year, compared to a global average of about 17.5 per 1,000. Even if the government has effectively abandoned all family-size restrictions and in many provinces having children is encouraged through increased support for families with small children and some have offered longer maternity leave, child-rearing in China remains an extremely expensive proposition for most people. Moreover, many Chinese have come to terms with the single-child family model or are choosing not to have kids. China’s shrinking labour force creates by itself an impediment to economic growth. In addition, during the pandemic, the pace of urbanisation slowed sharply. Official figures show the registration of just 6 million new city residents in 2022. In comparison, the annual increase was still 20 million in 2018 and 2019. The contraction of the Chinese population and distinct slowdown in the move to cities should reduce urban investment needs.

Improved indicators raise optimism about growth this year

China’s zero-covid policies, which caused severe economic distortions, were lifted the first half of December (BOFIT Weekly 50/2022). The dropping of covid measures allowed the virus to spread rapidly with the peak in the latest wave of covid infections likely already passed. On the eve of the Lunar New Year holiday, officials estimated that as much as 80 % of the population has been infected and that the number of covid-related deaths as of January 19 was about 73,000. Other estimates, however, put the number of covid-related deaths at least an order of magnitude higher. The World Health Organization (WHO) has asked China to provide more comprehensive data on covid deaths and excess mortality. Further increase in deaths are feared, as after three years of lockdown, Chinese were finally able to travel to their home districts for the Lunar New Year holidays, spreading the virus to more remote areas with poor vaccination rates and health care. Although new waves of covid infection likely lie ahead, the worst is past as China no longer has a covid-naïve population.

With the lifting of covid restrictions in China, hope and excitement are in the air as the normalisation of the covid situation allows for improved economic conditions. Consumer demand is expected to strengthen significantly and many await a spending gusher from savings built up over recent years that further boosts consumer demand. The main focus of decisionmakers has also turned to supporting the economy and bolstering consumer confidence in line with the policies adopted at the economic work conference in December (BOFIT Weekly 52/2022). Even if concrete measures are still unclear in most cases, fiscal policy should remain very accommodative. Measures to support the real estate sector and developers are already underway. The government’s goal is to stabilise the real estate sector this year.

The rise in Chinese consumer prices remains modest (just 1.8 % y-o-y in December). There are expectations, that inflation kicks up this year with the economic recovery. However, inflation in China has remained exceptionally low and stable over the past decade compared other emerging economies. Pressure is on the central bank to provide economic support, especially to help the real estate sector and boost consumer demand. Expectations of a pick-up in inflation, however, can restrict the central bank’s room to manoeuvre in the monetary policy sphere. China’s quandary is how to ease monetary policy at a time when most advanced economies are raising rates. Such an environment can fuel capital flight from China and depress the yuan’s exchange rate.

The lifting of covid restrictions and targeted measures to support the real estate sector have led to a rapid brightening of the growth outlook for 2023. A month or so ago most forecasters expected 2023 growth to remain in the range of 4–5 % or even lower. Recent forecasts now typically expect GDP growth in the range of 5–6 %. In addition, China’s official growth target this year is expected to be “at least 5 %”. China traditionally announces its annual GDP growth target at the March session of the National People’s Congress.

Real 12-month change (%), consumer prices (%) and exchange rate

Sources: China National Bureau of Statistics, China Customs, WTO, CEIC and BOFIT.