BOFIT Weekly Review 12/2022

While China's industrial output growth accelerated in the first two months of this year, construction activity and apartment sales declined

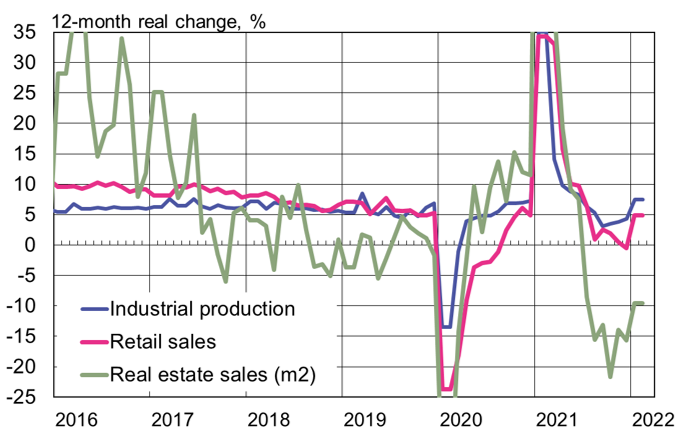

China’s National Bureau of Statistics (NBS) reports that industrial production grew by 7.5 % y-o-y in real terms during the first two months of this year. Growth picked up significantly from the second half of 2021. Real growth in retail sales also accelerated from the second half of last year, rising to nearly 5 % y-o-y in January-February. Nevertheless, retail sales growth was still a bit lower than in pre-pandemic 2019.

The troubles in the real estate sector persisted as large privately-held developers continue to struggle under mountains of debt and limited access to financing. New construction starts have fallen on-year since last spring. New construction starts, measured in floorspace, was down by 12 % y-o-y in January-February. In recent months, many regions have made it easier to purchase an apartment e.g. by reducing the required down-payment percentage and encouraging banks to make housing loans. Real estate sales nationally still fell by 10 % y-o-y in January-February.

Official figures can no longer be counted on in reliably tracking investment trends. The NBS said that nominal growth in fixed asset investment surpassed 12 % y-o-y in January-February, and despite reduced construction activity, investment in the real estate sector rose by 5 %. Assessing growth in real terms has become impossible as the officials no longer publish fixed investment price indices. The NBS also releases seasonally adjusted month-on-month (m-o-m) fixed investment growth figures, but they have little relation to year-on-year figures. For example, the m-o-m growth rates indicate that last year’s level of nominal investments was still about 15 % less than in 2019, but the y-o-y rates give a level that was 8 % higher.

Despite relatively brisk economic development in January-February, uncertainty has risen recently with the invasion of Ukraine and rapid spread of covid in China. Share prices on China’s stock exchanges plummeted in the first two weeks of March. Stocks recovered after vice premier Liu He gave assurances that economic policy would be geared to boosting the economy and supporting financial markets. Liu also called for a plan to reduce risks surrounding property developers.

China has reported an average of about 2,000 new covid cases daily over the last two weeks, a significant level of transmission in light of the country’s strict “zero-covid” suppression policies. Several major cities (e.g. Shenzhen) have imposed city-wide bans on movement, while many others (e.g. Shanghai) have ramped up regional restrictions. The restrictions have diminished demand for services and caused occasional production disruptions also for large multinational firms.

Growth of industrial output and retail sales was relatively strong in January and February, while apartment sales continued to fall

Sources: NBS, CEIC and BOFIT.