BOFIT Weekly Review 14/2024

2023 current account surplus reduced by surprising recovery in Chinese travel spending abroad

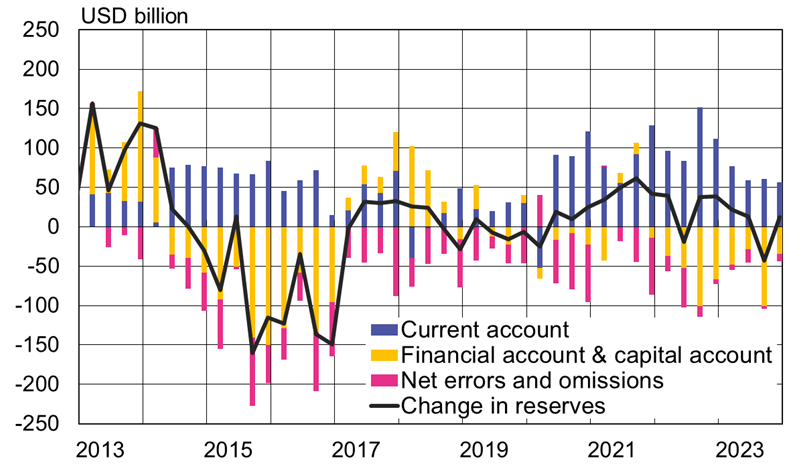

The State Administration of Foreign Exchange (SAFE), which operates under the auspices of the People’s Bank of China, released its 2023 balance-of-payments figures last week. The balance-of-payments figures showed a current account surplus (includes goods & services trade) of 253 billion dollars (1.4 % of GDP) for all of last year, down sharply from the 2022 surplus of 443 billion dollars. The financial account (foreign direct investment, portfolio investment and other investment flows) showed as deficit of 210 billion yuan. Central bank reserves dropped slightly (down 5 billion yuan), indicating that the PBoC largely refrained from intervening to prop up the external value of the yuan. At the same time, however, state-owned commercial banks appear to have been active in the forex markets. The “net errors and omissions” item in the balance-of-payments figures showed a 38 billion dollar deficit, which is small by Chinese terms and suggests that the officials have been rather successful in identifying capital flows.

In the current account, the surplus in the goods trade fell below 600 billion dollars, down from a record high of 670 billion dollars in 2022. The services trade deficit rose from 87 billion dollars in 2022 to nearly 210 billion dollars last year. The latest balance-of-payments figures indicate that most of the widening in the services trade gap came from increased tourism. The spending of Chinese tourists and other persons living temporarily abroad last year amounted to almost 200 billion dollars, which begins to approach the 2019 level of 250 billion dollars. Other figures paint a different picture of Chinese tourism, however. China’s ministry of culture and tourism reports that last year the number of people travelling abroad reached about 60 % of the 2019 level, while China’s civil aviation administration estimates that the number of passengers in international flights last year was only about 40 % of the 2019 level. While it is difficult to measure exports and imports of tourism, it is possible that some of last year’s high tourism imports actually reflect capital outflows circumventing China’s capital controls rather than actual tourism or travel spending.

China’s financial account figures reflect both its own economic struggles and geopolitical uncertainty. Inbound FDI flows to China last year amounted to just 43 billion dollars, which is the lowest inward FDI flow in over two decades. On the other hand, outward FDI flows from China were roughly the same as in recent years (185 billion dollars in 2023), meaning that net FDI outflows from China climbed to a record 142 billion dollars. Portfolio investment inflows were also a modest 14 billion dollars, suggesting that the massive pull-out of portfolio assets from the Chinese market by foreign investors in 2022 was a short-lived phenomenon. Chinese portfolio investment flows abroad fell to 77 billion dollars, over 100 billion dollars less than in previous years.

Quarterly change in main categories of China’s balance-of-payments (USD billion)

Sources: SAFE, Macrobond and BOFIT.