BOFIT Weekly Review 21/2015

CBR returns to the forex market

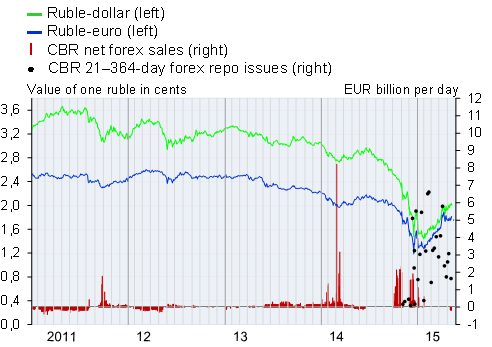

Last week (May 14), the CBR announced it started regular forex purchases to increase its forex reserves. The central bank emphasised that the purpose of the forex buying was not to support the ruble’s exchange rate at any determined level. The CBR will purchase $100–200 million in forex daily on the market, but that amount can change with market conditions.

Since it announced the floating of the ruble last November, the CBR has made ruble support purchases only in exceptional situations. Also from November, the CBR has weekly provided banks with 6–364-day forex repo credits to help them repay foreign debt (which at the same time has supported the ruble). The ruble has also been supported by the government guideline issued in December to large state-owned exporters to limit the size of their forex assets, accompanied by signals from the state leadership that particular private companies should also limit their forex holdings.

Ruble exchange rate, CBR forex interventions and forex repo credits

Source: CBR.