BOFIT Weekly Review 01/2016

Chinese stock markets nosedive

On Monday (Jan. 4), the first trading day this year, share prices fell 7 % on mainland China stock markets. The new automated trading circuit-breaker mechanism kicked in on its first day in use, causing share trading to be suspended in the afternoon. The circuit breaker again shut down trading on Thursday (Jan. 7), just a half hour into morning trading. For the day, share prices were down 12 % in Shanghai and 15 % in Shenzhen from December 31. Share prices on the Hong Kong stock exchange were also down 7 % from the start of the year. Late Thursday evening, the China Securities Regulatory Commission (CSRC) suspended for now use of the circuit breaker.

The circuit breaker was introduced at the start of the year to halt share and derivatives trading in Shanghai and Shenzhen for 15 minutes whenever the CSI 300 index rises or falls more than 5 % during intraday trading. Trading is suspended for the rest of the day if the shift exceeds 7 %. The brake mechanism was introduced to promote healthy market development, but on Thursday the CSRC said it had not achieved the expected effect and rather amplified market volatility. Some observers have claimed that the threshold for the circuit breaker is just too low. Last summer alone, trading would have been suspended 20 times had the circuit breaker been in place. Indeed, the introduction of the circuit breaker may have added to market volatility; the threat of trading disruption forces investors to speed up their trades.

The market jitters this week were partly due to the expiration of a six-month ban on selling shares imposed on major shareholders after last summer’s market plunge. The CSRC announced yesterday that it would keep the sales ban partly in place and limit share sales of major shareholders to 1 % of a company’s shares. Media reports also claim that state financial firms have again been purchasing shares to prop up prices as they did last summer. Some observers have commented that December’s weak purchasing managers’ index (PMI) reading may have contributed to the collapse in share prices. On the other hand, nothing about the PMI reading was very surprising. Yet again, any real economy links to the share price meltdown are hard to identify.

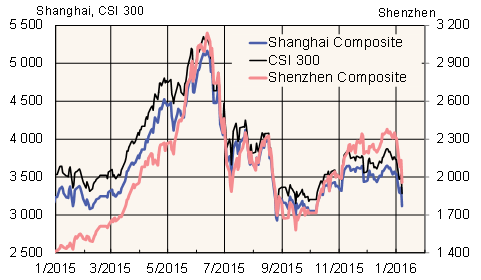

Trends in mainland China’s main stock market indices

Source: Macrobond.