BOFIT Weekly Review 43/2015

Russia’s foreign debt fell in the third quarter

Preliminary Central Bank of Russia figures put Russia’s foreign debt at $522 billion as of end-September, down by just over $30 billion from end-June. Approximately half of the debt reduction apparently came from actual loan payments and about half from ruble depreciation. As of end-June, about a fifth of Russian foreign debt was held in rubles.

Nearly $40 billion in foreign debt came due in the third quarter. While banks largely stuck to their payment schedules, non-bank corporations apparently have rolled most of their debt. Nearly 40 % of non-bank corporate debt is “intragroup” debt resulting from arrangements between parent companies and their subsidiaries. The proportion of intragroup debt in the non-bank sector has risen slightly in recent months, which may indicate other foreign debt has been partly refinanced through increased intragroup loans.

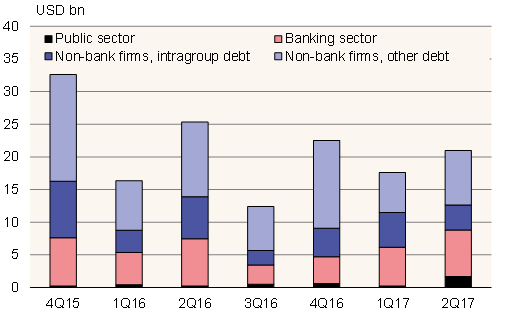

The scheduled debt payments coming due over the next three months exceed $30 billion. About half of that comes due in December. However, nearly a third of this maturing debt is intragroup debt, so extended payment schedules and rollovers are expected. Based on its company survey, the CBR expects that the actual amount of payments may be even smaller.

In the coming four quarters (4Q15-3Q16), a total of $87 billion in foreign debt principal comes due. Russia’s foreign currency reserves stood at $371 billion at end-September. A common rule-of-thumb suggests that a country’s reserves need to be sufficient to cover at least 100 % of its short-term foreign debt to avoid liquidity problems.

Scheduled Russian foreign debt principal payments

Source: CBR