BOFIT Weekly Review 15/2024

Russia’s overall economic performance steady in February; construction investment has supported wartime growth

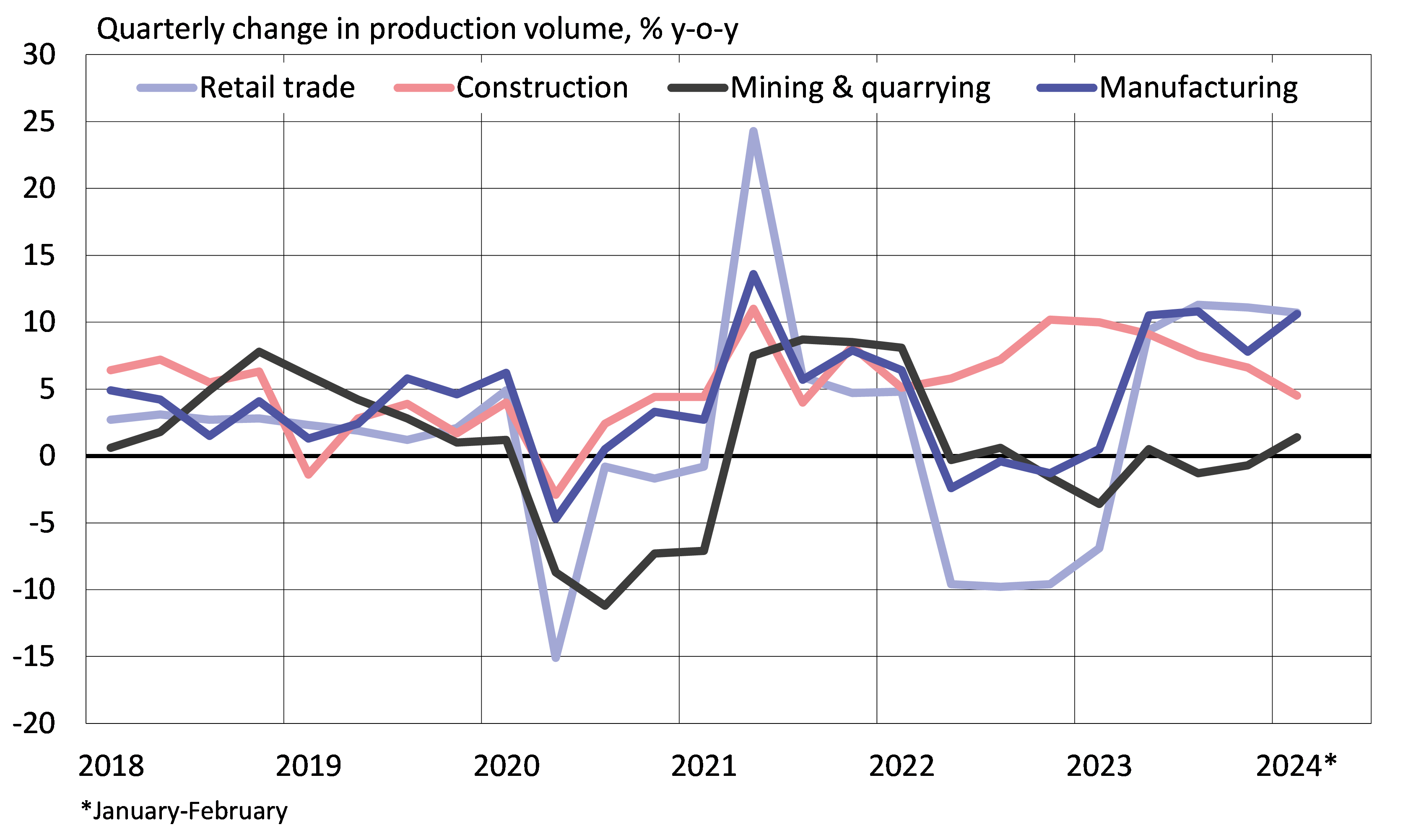

February’s numbers suggest little change in Russia’s economic trends. 12-month growth was still strong, but production levels in many branches have been stagnant for months. Forming a comprehensive picture of February’s performance is further complicated by the fact that leap year 2024 added an extra workday. Russian analyst assessments of February’s economic performance range between modest growth to slight contraction from the previous month.

Rosstat only releases workday-adjusted and seasonally-adjusted figures for industrial output. The Russian statistics agency reports that the volume of industrial output, after remaining unchanged in previous months, increased slightly in February. On-year industrial output also accelerated slightly in January-February in both the mining & quarrying sector and manufacturing. In contrast, 12-month growth in retail sales and construction slowed slightly in January-February compared to the end of last year even with the extra workday in February.

Several institutional forecasts see the Russian economy slowing this year. The March report from Consensus Economics, which presents an average of forecasts of Russian GDP growth, puts growth this year at 2 %. The forecast released by the Central Bank of Russia in February predicted GDP growth of 1–2 % this year. The January IMF forecast, its most recent, anticipates growth of 2.6 % in 2024.

Russia’s 12-month growth numbers were still strong in the first two months of this year, but some sectors showed signs of slowing

Sources: Rosstat, BOFIT.

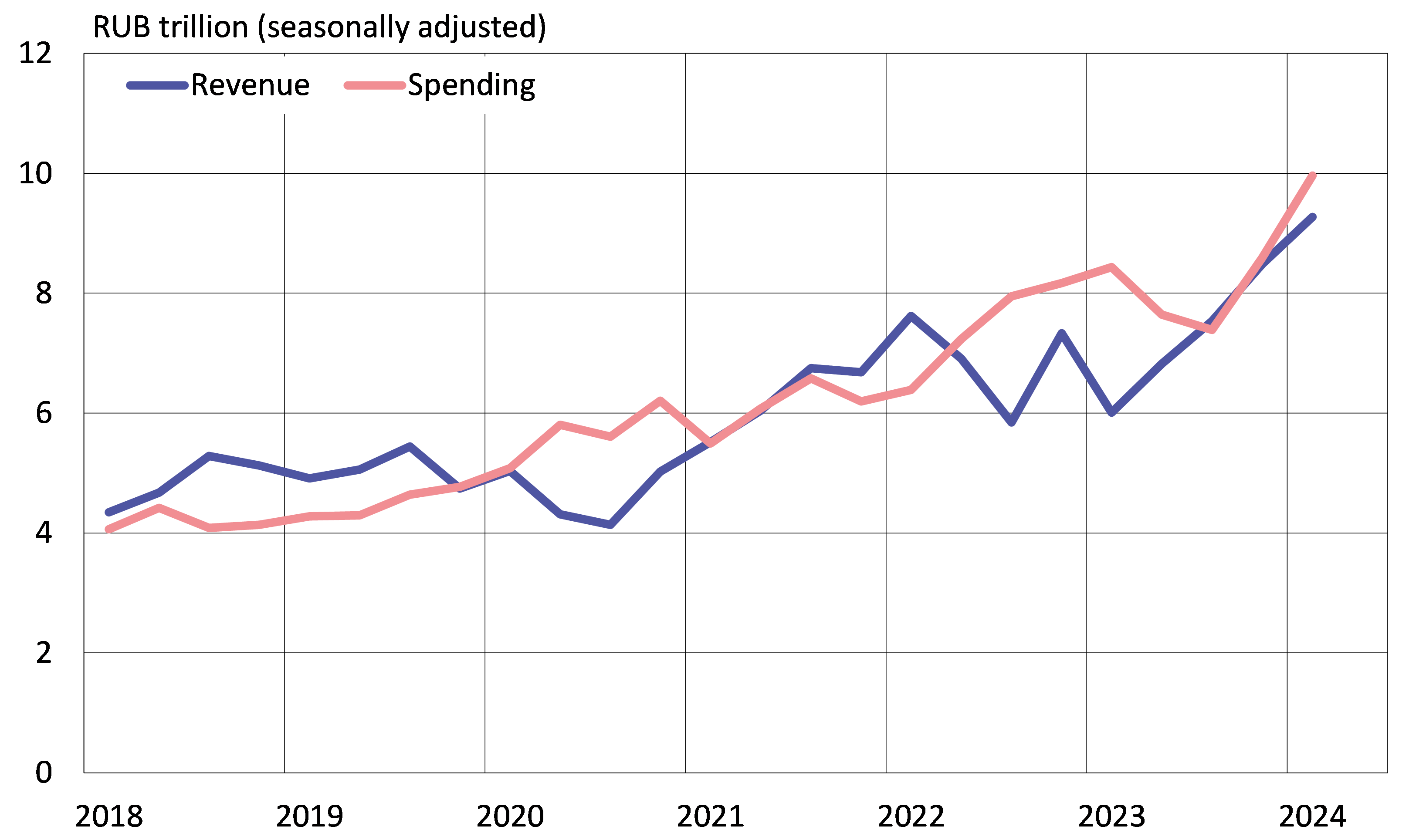

Substantial budget spending increases in the first quarter

Preliminary figures from Russia’s finance ministry show that federal budget revenues and spending increased sharply in January-March. Federal budget spending rose by 20 % y-o-y in the first quarter. The finance ministry also reports that spending this year has been slightly front-weighted due to certain prepayments. Russia no longer releases detailed information on realised federal budget spending.

Revenue growth partly reflected exceptional factors such as timing of certain oil taxes, as well as non-recurring payments. The growth in oil revenues was also supported by higher oil prices. Oil & gas revenues accounted in the first quarter for a third of federal budget revenues. Value-added tax revenues were also up by 25 % y-o-y. For January-March, revenues were quite on track, corresponding to a quarter of the budgeted revenues for the entire year.

The federal budget deficit in the first three months of this year was 600 billion rubles. The budget projection for all of 2024 sees a deficit of 1.5 trillion rubles, which corresponds to 0.9 % of GDP according to the finance ministry.

Russia’s federal budget revenues and expenditures grew sharply in the first quarter of 2024

Sources: CEIC, BOFIT.

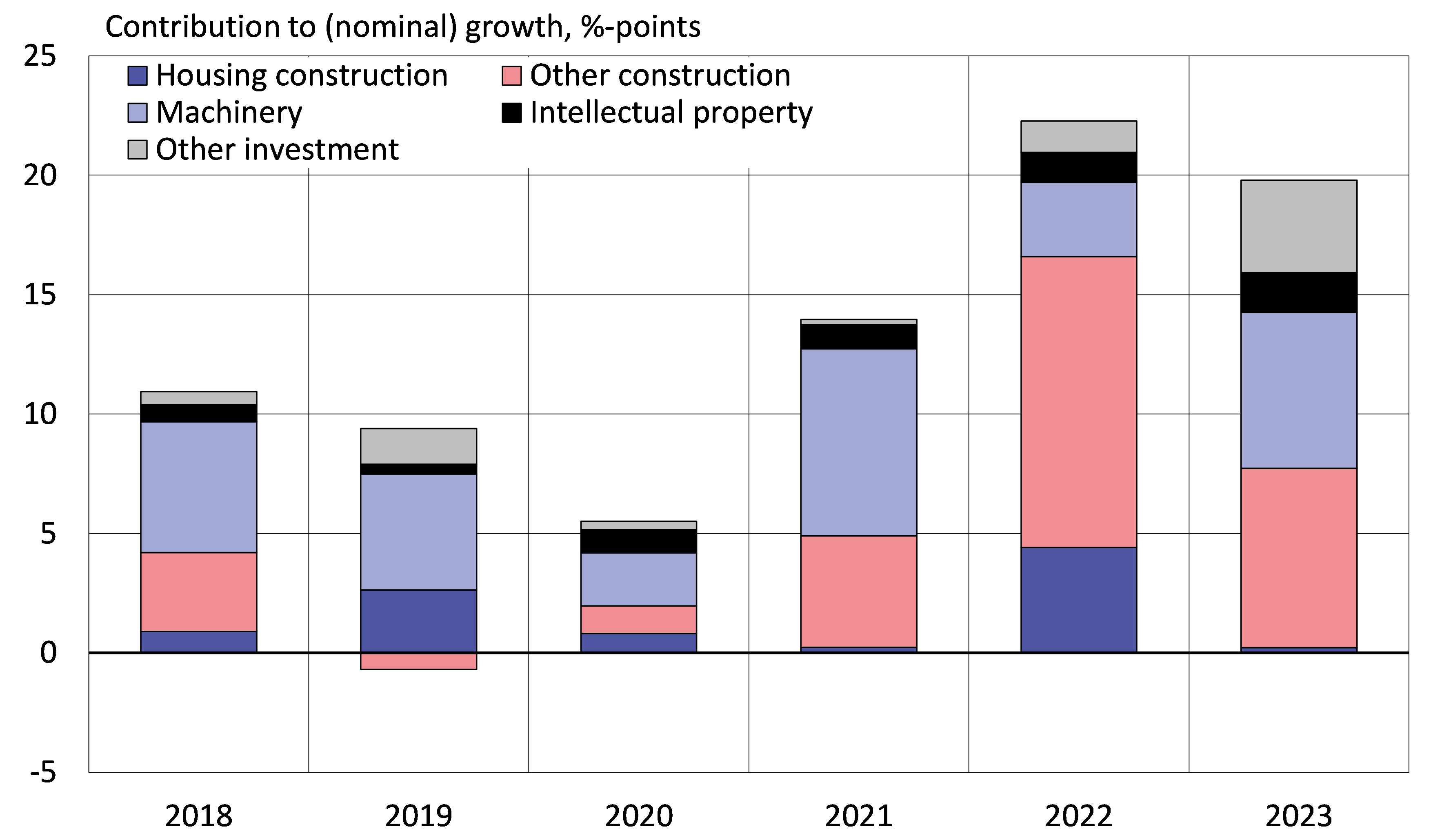

Construction investment has driven fixed investment growth in recent years

The central factor supporting Russian economic growth last year was the sharp increase in fixed capital investment. Increased budget spending was also used to finance investments. The share of budget funding now accounts for about 20 % of fixed investment financing.

Most companies still finance their fixed investment out of pocket (56 % of fixed investment financing last year). Investment funding through bank loans fell last year to just 9 %, which is partly a reflection of the challenges in obtaining foreign financing. Foreign bank lending accounted for just 0.5 % of fixed investment financing last year, its lowest level since the year 2000. The participation of foreign investors in investment financing plunged to a negligible 0.1 % last year.

Construction has led investment growth in wartime. Investment in housing construction increased briskly in 2022, but last year growth evaporated. Other construction investment continued rapid growth also last year. The fastest growth during the wartime, and particularly last year, was recorded for intellectual property (IP) investment and the “other investment” category. Although the share of IP investment has doubled since 2017, it still accounted for just 5 % of total investments last year. IP includes software development, patents, copyrights and proprietary R&D.

Wartime investment has seen its highest growth in branches providing services for the information technology sector, machine repair and air traffic. In contrast, investments have fallen in such areas as car manufacture and sales, headquarter services, legal and bookkeeping services, as well as forestry and the forest industry.

From the regional standpoint, investment growth has been highest in recent years in regions of southern Siberia such as the Altai and Buryat republics and Amur region, but also Chechnya. Investments have contracted in many regions in the Northwest Russia Federal District (including Vologda, Pskov and Murmansk regions), as well as regions in the Central Federal District (including. Kaluga, Orlov and Lipetsk regions).

The lion’s share of budget-financed investment has gone to the City of Moscow in recent years. Moscow’s share of budget-financed investments was also proportionally much higher than total investments in 2022–2023. Other regions with relatively higher share in budget-financed investment include the Rostov region bordering Ukraine, the military industry heartland of Nizhniy Novgorod, the Dagestan republic and illegally annexed Crimea.

Most of Russia’s investment growth in recent years has been driven by construction investment

Sources: Rosstat and BOFIT.