BOFIT Weekly Review 01/2018

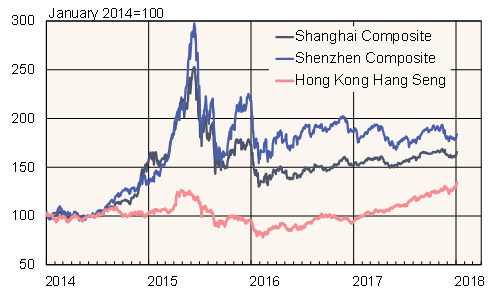

Weakness in mainland China stock markets last year relative to stock markets globally

In 2017, the FTSE All-World Index climbed 25 %, the MSCI Asia Index (excluding Japan) soared 39 % and the MSCI Emerging Market Index rose 34 %. In contrast, stock exchanges in mainland China lagged the global development, with the Shanghai Composite Index ending the year up 7 % and the Shenzhen Composite Index down 4 %.

Share prices of large Chinese firms significantly outperformed prices of small firms last year. The CSI300 Index of the stock exchanges' 300 largest firms rose 22 %, while Shenzhen's index of small high-growth firms, the ChiNext Index, fell by 11 %. This partly reflected the convergence in prices after the bursting of the stock price bubble. Shares of Chinese companies listed outside mainland China generally fared better than shares traded on domestic exchanges. For example, the share index of mainland Chinese firms listed in Hong Kong rose by 25 % last year. The shares of firms listed on both mainland China and Hong Kong exchanges, however, are still on average 30 % cheaper in Hong Kong than in China. The Hang Seng, Hong Kong's main share index was up 38 % last year.

With well over 400 IPOs in mainland China last year, the pace of IPOs nearly doubled from 2016, and hundreds of firms still await listing dates.

Recent trends in China's main stock indices: Shanghai Composite, Shenzhen Composite and Hong Kong Hang Seng

Sources: Macrobond, BOFIT.