BOFIT Weekly Review 11/2019

Recovery in Russian fixed investment continued in 2018

Fixed investment rose by 4.3 % last year (4.8 % in 2017, with Rosstat’s latest round of revision raising the figure a bit). The level of fixed investment was no longer more than about 3.5 % below its 2013 peak. Investment growth dropped below 3 % y-o-y in the fourth quarter of 2018, but the figure for the first nine months of the year was revised up. Together with the earlier upwardly revised growth figures for the construction sector this reaffirms the setup where the surprisingly strong GDP growth in 2018 figures rest partly on improved data for January-September (revised quarterly GDP data will be released in early April).

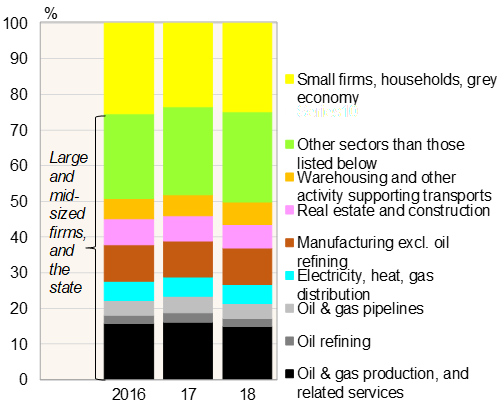

The pace of investment last year was typical of nearly all years in this decade, when investment of large and mid-sized firms, as well as the government, increased slower than total investments (just over 2 %). Instead, other investment such as small firms and households, Rosstat says, rose some 10 %.

Investment of large and mid-sized manufacturing firms (excluding oil refining) rose briskly. The increase was led by further growth in the chemical industry and a recovery of investment in the car industry after deep slump. The chemical industry makes the most investment in manufacturing industries by far. Investment in crude oil production declined last year, after increasing in 2017. Growth in investment in natural gas production soared due to the Yamal LNG project (the Yamalo-Nenets autonomous region accounted for about two-thirds of all Russian natural gas production investment in 2017 and 2018). Investment figures for large and mid-sized firms indicate a slight decline from previous years in the share of the energy sector (oil, oil products, natural gas and electricity) from about 30 % of total fixed investments, while manufacturing (excluding oil refining) rose to 12 %.

Main categories of fixed investments, 2016–2018

Source: Rosstat.