BOFIT Weekly Review 24/2021

Pace of industrial growth in China stabilises; retail sales continue to gain steam

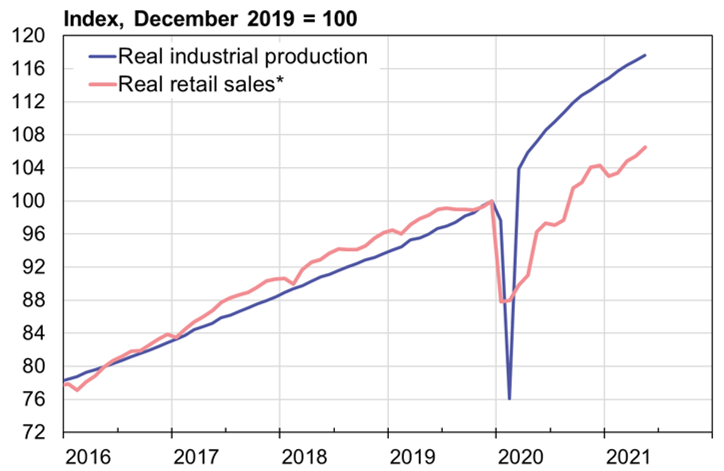

May on-year industrial output growth reached nearly 9 % with the strongest performances coming from high-tech products such as electric cars (up 166 % y-o-y), robots (50 %) and microchips (38 %). Industrial activity picked up rapidly after the first wave of the covid pandemic, and production growth has returned to pre-covid levels. The growth is stabilising as for both April and May, real seasonally-adjusted output grew by 0.5 % m-o-m, roughly the same pace as in 2019.

The recovery of domestic consumer demand has been slower. Real growth in retail sales in May exceeded 10 % y-o-y and were up by about 1 % from the previous month. On-month growth during March-May was clearly more robust on average than before the covid crisis, indicating rising domestic consumer demand. Exceptionally strong growth was seen in online commerce, the value of which jumped by nearly 25 % y-o-y in January-May. While restaurant sales have rebounded since last year, their nominal value barely exceeds the 2019 level.

Growth in foreign trade remained strong in May. The value of goods exports rose by 28 % y-o-y in dollar terms, while goods import growth was up by 50 %. In yuan terms, the growth figures were about 10 percentage points lower. Growth in exports of mechanical and electrotechnical products was exceptionally strong, climbing by about 30 % y-o-y. Despite strong import growth, China’s trade surplus was still $46 billion.

Real industrial output and retail sales growth have returned to their long-term trends

*) Nominal retail sales deflated with consumer prices.

Sources: China National Bureau of Statistics, CEIC and BOFIT.