BOFIT Weekly Review 15/2021

Russian GDP contracted by 3 % last year; domestic demand revived in second half

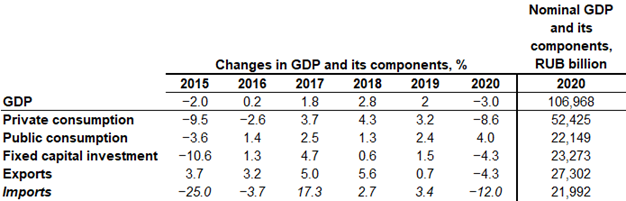

Rosstat released revisions of Russia’s national accounts at the beginning of this month. While its earlier reporting showed Russian GDP contracting by 3.1 % in 2020 (BOFIT Weekly 5/2021), the new adjusted figures have GDP contracting by just 3.0 %. As the numbers harden, it is increasingly evident that Russia has faced milder economic impacts from the covid-19 pandemic than most G20 countries. The least economically impacted G20 members in 2020 now appear to be China (positive GDP growth of 2.0 %) and Turkey (+1.8 %). Other G20 countries experiencing smaller GDP contractions than Russia’s include South Korea (negative GDP growth of 1.0 %), Indonesia (−2.1 %) and Australia (−2.4 %). Russia has been more reticent since last summer than most countries about using lockdowns. Moreover, the structure of the Russian economy, e.g. low reliance on service industries such as tourism, seem to have helped it escape some of the harsher economic effects of the pandemic.

On the economy’s supply side, output of extractive industries notably contracted by 9.5 % y-o-y. Much of this was due to Russia’s participation in the OPEC+ agreement on crude oil production ceilings. As in many countries, Russia’s service branches faced severe distress due to covid lockdowns and travel restrictions. For example, hotel and restaurant services declined by 25 %, while transport services were off by 11 %. Financial services, in contrast, grew by 7.3 % last year. Some of this strength reflects the growth of digital services in Russia, particularly in online securities trading.

On the demand side, private consumption was particularly hard-hit last year, falling by 8.6 % y-o-y. Growth in public consumption (up 4.0 %) reflected government efforts to preserve domestic demand. Russia’s use of stimulus was similar to that of many other countries in their response to the covid shock in 2020. Heightened risk and uncertainty, along with reduced overall demand, led to a 4.3 % contraction in fixed investment. The volume of fixed investment in 2020 was lower than in 2013. The OPEC+ agreement drove the drop in export volumes last year.

Rosstat has updated all its quarterly national accounts data back to 2018, putting understanding of the Russian economy in a new light with these adjusted figures for GDP and its core components. For example, the drop in fixed investment in the second quarter of 2020 was considerably smaller than previously thought. In the fourth quarter of 2020, GDP contracted by 1.8 % y-o-y. On a seasonally adjusted basis, GDP contracted by 0.2 % q-o-q. Components of domestic demand recovered at the end of the year.

Russia’s national accounts show a rise in public consumption, but big drops last year in private consumption and fixed investment

Sources: Rosstat and BOFIT.