BOFIT Weekly Review 13/2020

Oil prices, ruble and Moscow stock exchange all down; CBR holds key rate unchanged

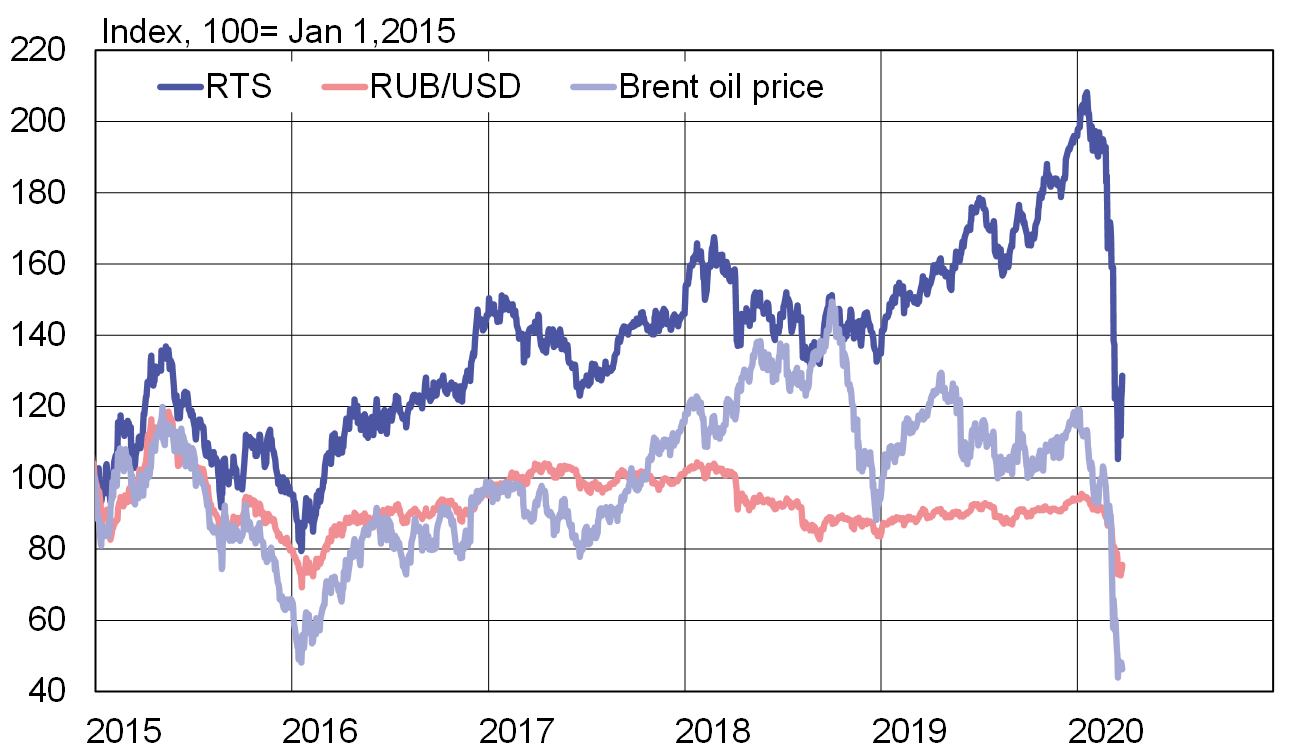

Global oil prices continued to slump in the wake of their March 9 collapse. The export price of Urals-grade crude averaged $21 a barrel this week, meaning that the Urals price is down 34 % after the March collapse and 67 % since the start of the year.

Oil prices face both demand and supply pressures. The coronavirus pandemic has depressed oil demand around the world, while excess supply issues have been triggered by an impasse among OPEC+ countries on renewing a voluntary agreement on production ceilings. If the coronavirus pandemic worsens or the large producer countries in OPEC+ fail to agree on production caps, oil prices can remain at their current levels or fall even further. In Russia’s case, this situation would show up as below-forecast economic growth.

The ruble’s exchange rate has mirrored the drop in oil prices. The Russian currency has weakened by 20 % against the dollar since the start of the year, and another 4 % after the March collapse. The ruble-dollar exchange rate averaged 79 rubles this week. The CBR has supported the ruble’s exchange rate by selling forex, so the ruble’s drop has not been as sharp as the fall in oil prices.

Russia was not spared in the global stock market crash. On Thursday (Mar. 26), the Moscow Stock Exchange’s dollar-denominated RTS index was down 34 % from the start of the year. Share prices of energy and financial firms were hit particularly hard: the oil & gas sector sub-index was down 41 % from the start of the year, while the financial sector sub-index was off by 39 %.

At its regular meeting on March 20, the CBR board decided to keep its key rate at 6 % as expected by market analysts. Among other things, the CBR noted the differing effects of the decline in oil prices and the depreciation in ruble with respect to inflationary pressures. In addition to holding the key rate unchanged, the CBR approved support measures to households, small and medium-sized firms and financial institutions. The CBR noted that inflation could temporarily exceed its 4 % inflation target this year, but expects inflation to return to the target level next year.

Oil prices, ruble exchange rate and Russian stock exchange hit major downdraft.

Sources: Macrobond and BOFIT.