BOFIT Weekly Review 23/2023

Output in most branches of the Russian economy still below pre-invasion levels

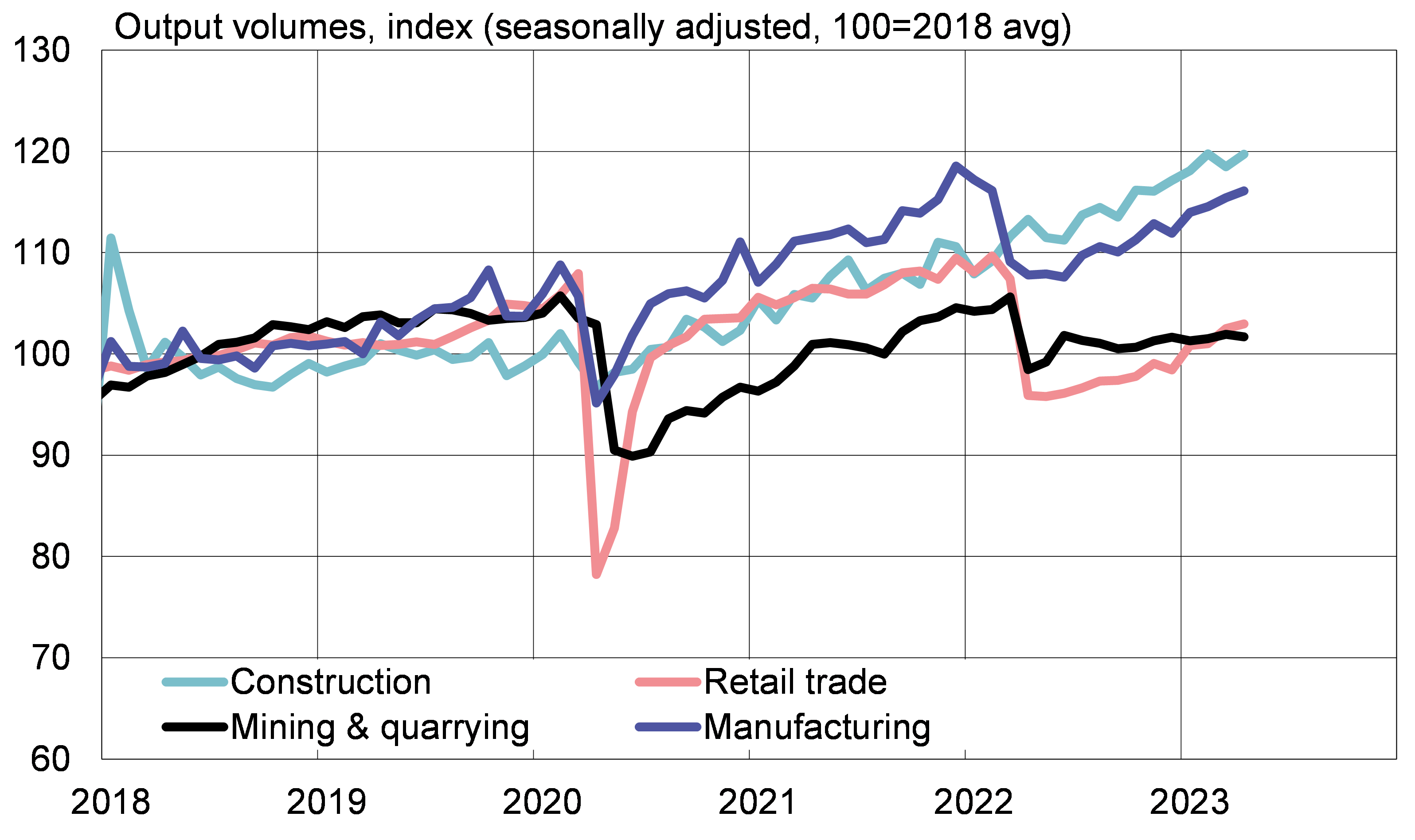

Many branches of the Russian economy recorded growth in annual terms in April. The growth mainly reflects the weak reference basis of a year earlier. Many branches experienced sharp declines in April 2022 in the wake of Russia’s unprovoked aggression against Ukraine in February and the negative repercussions from stepped up sanctions. The level of Russia’s seasonally adjusted output in April 2023 was still below pre-invasion levels in most branches. There were also signs of emerging changes in some sectoral trends.

Consumer demand seems to be coming back, but fixed investment demand has plateaued

After months of weak performance, consumer demand appears to be reviving. Long-depressed retail sales has shown some signs of recovery. The volume of retail sales in April, however, was still about 6 % below pre-invasion levels. Real wages have continued to rise. The employment rate has risen while the unemployment rate has continued to fall. Russia’s unemployment rate hit again a post-Soviet low of 3.3 % in April.

The latest figures suggest growth in investment demand has slowed this year. Fixed investments in January-March grew by just 0.7 % y-o-y, while growth for 2022 overall was 4.6 %. Rapid growth in the construction sector also appeared to plateau. The volume of construction output in April, however, was about 9 % higher than pre-invasion levels.

The differences in performance of various industrial branches continue. The output of the mining & quarrying sector, which includes oil & gas, has remained nearly unchanged over recent months. Output volumes in April were down by about 3 % from pre-invasion levels. Natural gas production has decreased sharply compared to a year earlier due to reduced exports. Mining of certain non-ferrous ores (e.g. ores containing lead and gold) grew briskly in January-April in comparison to a year earlier.

Rosstat no longer publishes crude oil production data. The International Energy Agency (IEA) estimates that the level of Russian crude output in April was unchanged from March, and only slightly less than at the start of the year. According to the IEA, Russia has not yet cut output as much as it has declared and committed to under the OPEC+ agreement.

Manufacturing continued to show signs of recovery in April. Manufacturing volumes in April were only about 1 % below levels in the months preceding the February 2022 invasion.

Output of most of Russia’s core sectors were still below pre-invasion levels in April

Sources: CEIC, Rosstat, BOFIT.

Sources: CEIC, Rosstat, BOFIT.

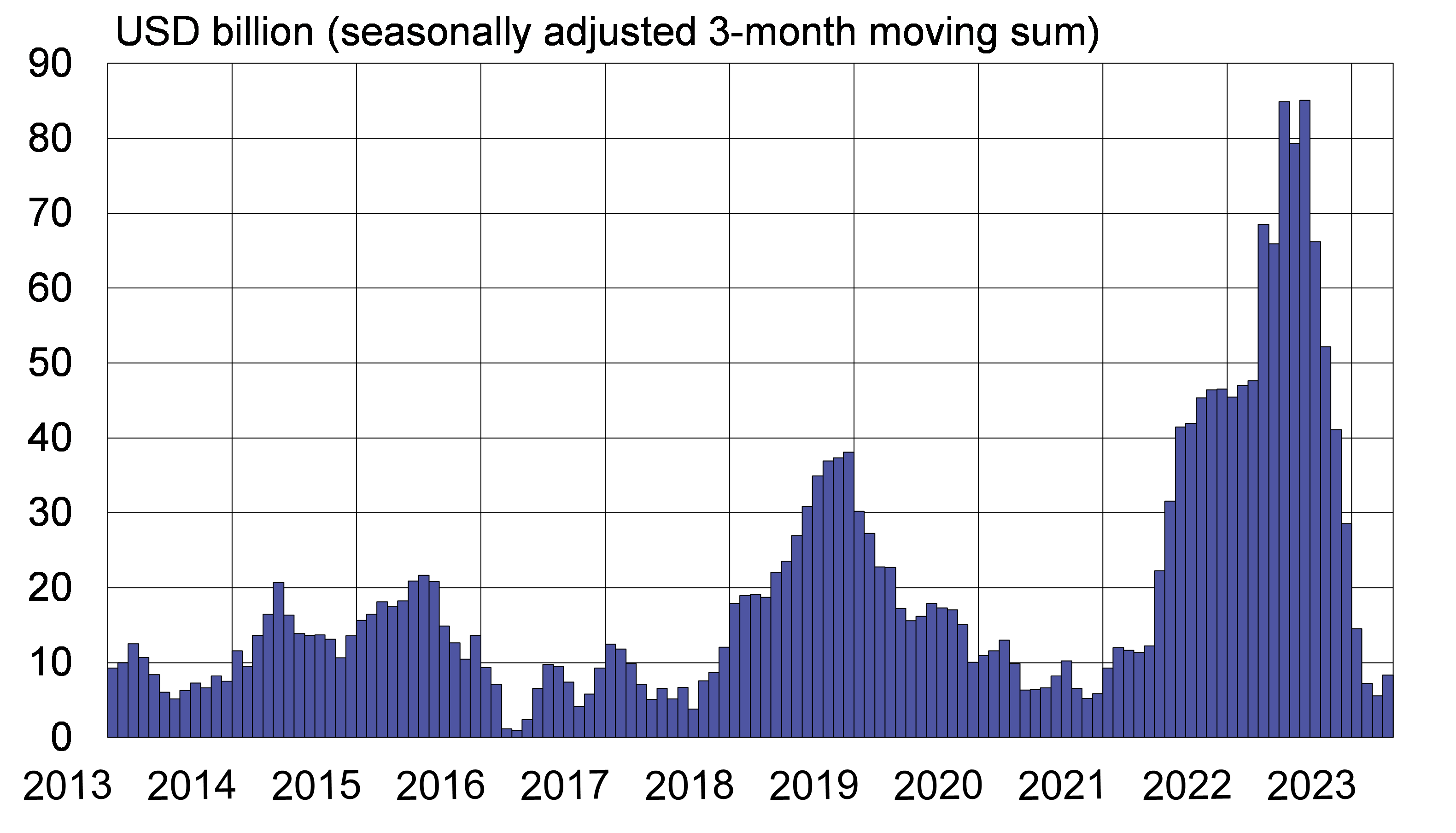

Serious shrinkage in Russia’s current account surplus and federal budget energy revenues

Russia’s current account surplus, which last year spiked to historical highs, has fallen sharply in recent months. Preliminary CBR estimates show that the current account surplus for the first four months of this year was around 23 billion dollars, a 77 % decline from the same period last year. The surplus was last this small in the first four months of 2017. The current account surplus has evaporated with the declining value of exports and increased imports.

The value of exports has fallen sharply as the price of crude oil has fallen. The IEA reports that the average export price for Russian crude oil (weighted average of Urals and ESPO blends) in April was around 60 dollars a barrel. Export revenues have also been cut by the major drop in natural gas exports. Russia has ceased to sell pipeline gas to most EU customers. Russia’s imports, in contrast, have revived significantly from last spring’s nadir. Figures from the Central Bank of Russia show that the value of goods imports in March was down by about 8 % from pre-invasion levels (in seasonally adjusted terms).

Russian current account surplus has contracted sharply in recent months

Sources: CEIC, Central Bank of Russia, BOFIT.

Sources: CEIC, Central Bank of Russia, BOFIT.

Russia’s federal budget revenues well reflect the drop in global crude oil prices. Preliminary figures show that the federal budget collected 2.9 trillion rubles (38 billion dollars) from taxes and fees on oil & gas production and exports during the first five months of this year, approximately half of the amount collected in the same period last year. Federal budget revenues from oil & gas, measured in rubles, were last this low in January-May 2020. While revenues fell, budget spending increased, creating a federal budget deficit in January-May of over 3.4 trillion rubles (about 2 % of GDP).

Contraction of Russian GDP expected to continue this year

Recent forecasts see Russian GDP still contracting slightly this year and returning to modest growth next year. On Wednesday (Jun. 7), the OECD released its latest Economic Outlook, which expects Russian GDP to contract by 1.5 % this year. The World Bank’s Global Economic Prospects, released Tuesday (Jun. 6), forecasts Russian GDP will fall this year by 0.2 %. The World Bank sees the Russian economy dragged down this year by shrinking exports, weak domestic demand, political uncertainty and sanctions. The OECD expects Russian GDP to contract still in 2024 by o.4 %, while the World Bank expects GDP to grow by 1.2 %. According to the May consensus forecast, GDP should contract by 0.3 % this year and grow by 1.3 % next year.