BOFIT Weekly Review 13/2020

BOFIT forecasts economic contraction in 2020 for Russia

Our latest outlook for the Russian economy is far gloomier than our previous forecast from last October, due to the recent collapse in oil prices and the impacts of the coronavirus pandemic. When the new forecast was compiled, markets expected an average price of Urals-grade crude oil of around $39 a barrel this year, which is 40 % below the 2019 average. Most observers have also sharply lowered their forecasts for the global economy due to the coronavirus pandemic.

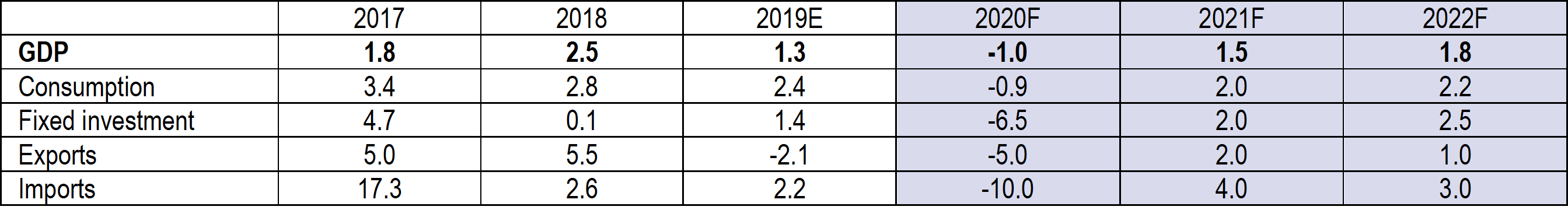

The newest Forecast for Russia 2020–2022 sees Russian GDP contracting by 1 % this year and returning to modest growth next year. Increased public sector spending supports the economy. In the current highly uncertain situation, risks related to the forecast are exceptionally high. Russia’s economic performance could be much worse if the coronavirus pandemic persists and oil prices drop further.

Government spending should rise 6–7 % a year in nominal terms during the 2020–2022 forecast period under Russia’s approved budget framework. Even with lower oil prices, the Russian government is expected to hold the line on budget spending. Under the current oil price assumption, Russia’s public economy will turn to deficit this year, but the deficit can be covered with oil & gas earnings retained in the National Welfare Fund.

Private consumption is expected to contract this year on weak economic activity and impacts related to the coronavirus. Recent ruble depreciation can accelerate inflation and thus reduce purchasing power. Consumption is expected to revive next year. Private fixed investment should contract sharply this year on low oil prices and a degraded economic outlook.

Exports also will decline this year on the weak global outlook, but improve gradually next year as demand returns. Imports are expected to contract substantially this year due to ruble depreciation and weaker demand. Russia will still show a slight current account surplus this year, even if it is significantly smaller than last year’s surplus.

BOFIT expects Russian GDP to contract this year, then return to growth. (”E” = Estimate; ”F” = Forecast)

Sources: Rosstat and BOFIT Forecast for Russia 2020–2022.