BOFIT Weekly Review 05/2025

Russian economic output growth slowed and economic imbalances worsened in second half of 2024

Slowing in output growth became more apparent at year’s end

Preliminary estimates evaluate that Russian GDP grew by 3.5–4 % for all of last year. Output growth slowed sharply down in the second half of the year. Large increases in government spending largely supported last year’s growth. Fastest growth was seen in branches serving the war effort, but the impacts of higher expenditure also filtered through to the broader economy. Forward-looking indicators suggest output growth will slow further. Most recent forecasts expect Russian GDP to rise by about 1.5 % this year. Moreover, even if the government increases stimulus, economic output gains have become harder to achieve due to production capacity constraints.

The strong growth in government spending has gradually begun to be reflected in prices. Inflation accelerated further at the end of last year. The Central Bank of Russia reports that the seasonally adjusted annual rate (SAAR) reached 14 % in December, while the year-on-year change was 10 %. Inflation pressure was further increased by a sharp ruble depreciation episode in late November and early December. According to survey data companies expect prices to rise further this year. Defying inflationary pressures and market expectations, the CBR’s board decided to leave the key rate unchanged at their December meeting. The key rate currently stands at a historic high of 21 %, a level that has aroused considerable consternation in Russia.

Substantial federal budget deficits continue

Preliminary figures from Russia’s finance ministry show federal budget spending rose by 24 % last year. While the government no longer releases details on the structure of government spending, the 2024 budget framework anticipated that most spending growth would occur in the “Defence” spending category. Federal budget revenues increased by 26 %. Oil & gas revenues and revenue streams from other sources grew at roughly the same rate. About 30 % of federal budget revenues last year came from oil & gas.

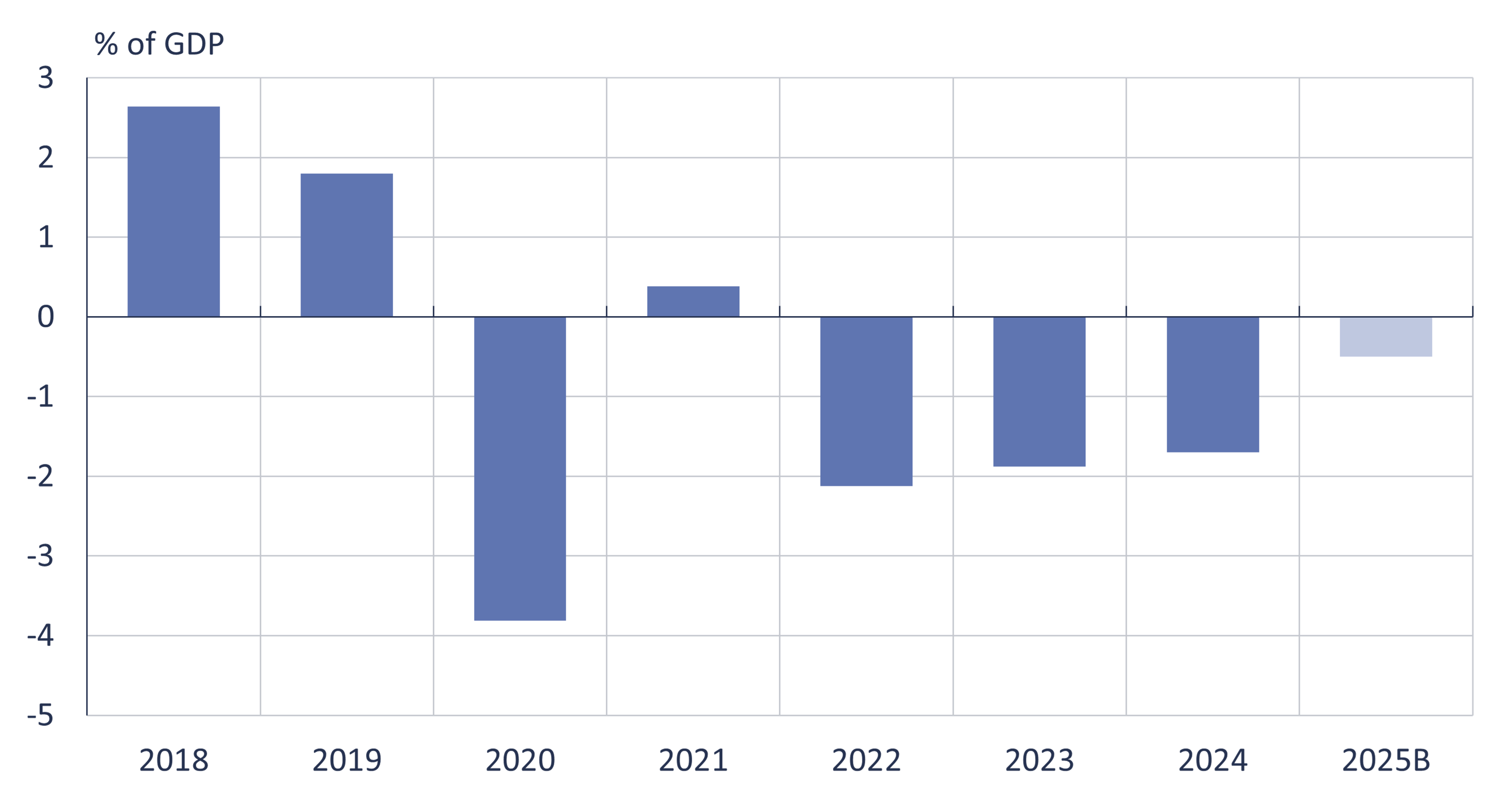

Preliminary figures show that the federal budget deficit was more than double the original deficit projected in the 2024 budget framework. Last year’s deficit amounted to roughly 3.5 trillion (1.7 % of GDP). The deficit was about the same size as the deficits of 2022 and 2023. The cumulative federal budget deficit for the past three years was about 10 trillion rubles.

The deficit has been funded with assets from the National Wealth Fund (NWF) and increased government borrowing. Russia has been heavily draining liquid assets from the National Wealth Fund since the invasion of Ukraine. In February 2022, the NWF held liquid assets of about 9.8 trillion rubles. By the end of last year, that amount had fallen to 3.8 trillion rubles. While the government has taken on new domestic debt, the level it is still quite modest by international standards. At the end of last year, government domestic debt corresponded to about 19 % of GDP.

This year’s budget framework anticipates a federal budget deficit of 1.2 trillion rubles (0.5 % of GDP). The budget framework is based in part on rather optimistic assumptions, suggesting that the actual deficit this year (as in previous years) could well exceed the budget projection. While Russia can handle a larger-than-planned deficit this year, it would further complicate the government’s financial situation.

Russia’s federal budget remained in deficit last year

Sources: CEIC, Russian Ministry of Finance, BOFIT.

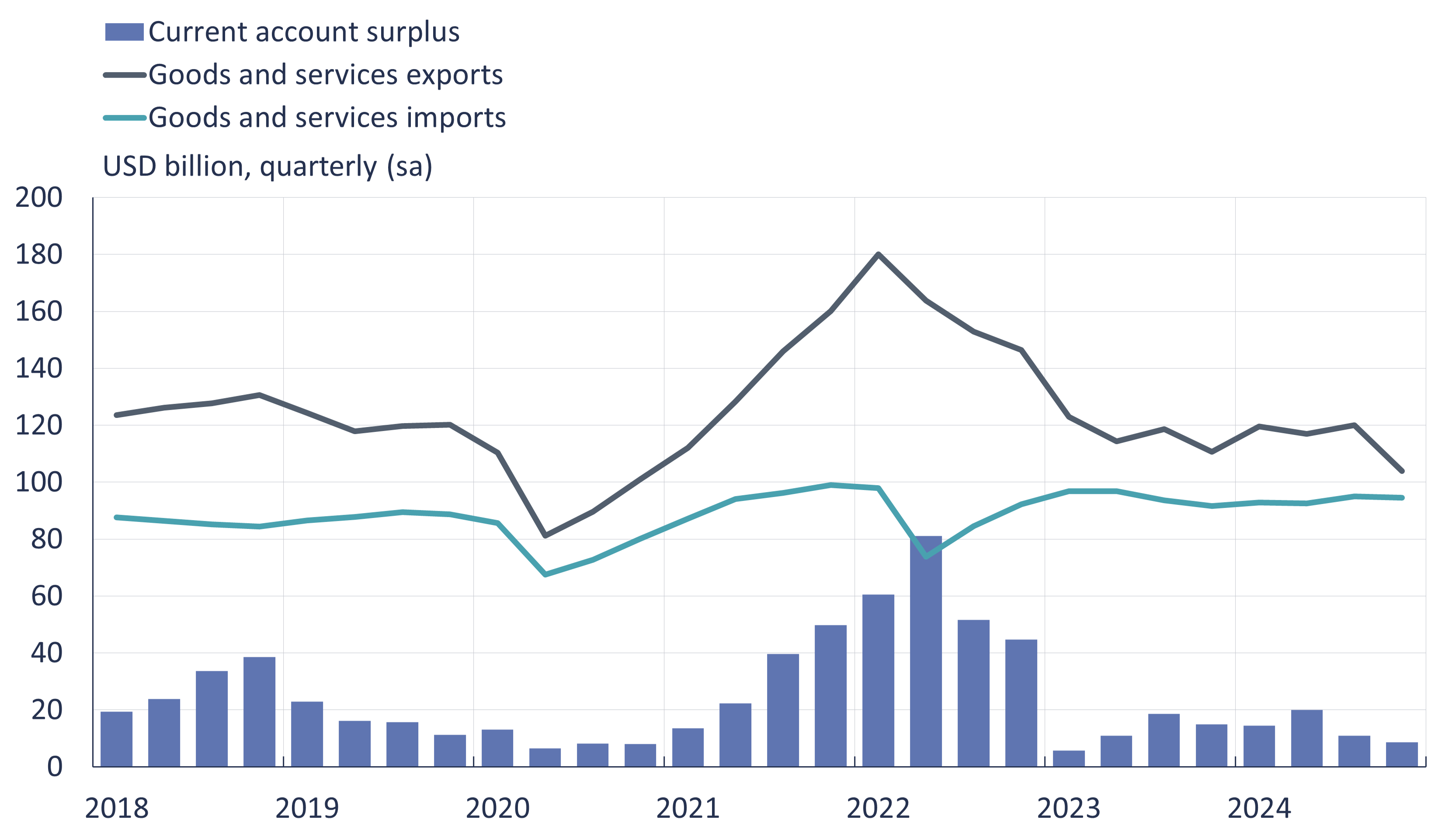

Foreign trade contracted slightly last year, current account still on surplus

Preliminary balance-of-payments figures released by the CBR show the value of Russian goods and services exports last year amounted to $460 billion, a decline of about 1 % from 2023. The value of goods exports contracted by 2 %, while the value of services exports rose by 3 %. The export trend worsened in the final months of last year, contracting by 6 % y-o-y in the fourth quarter.

Figures from Russian Customs show that over 60 % of goods exports last year consisted of mineral fuels. Russia no longer releases detailed export statistics. The International Energy Agency (IEA) estimates that Russia’s export earnings on crude oil and petroleum products amounted to $192 billion last year, an increase of about 2 % from 2023. The growth in export revenues reflected higher energy prices. The IEA said that the volume of Russian crude oil exports fell by 2 % last year, while the export volume of refined petroleum products declined by 7 %. The IEA estimates that the average export price of Russian crude oil was $69 a barrel last year, up from an average of $64 a barrel in 2023. Russian oil last year sold on average at an $11 per barrel discount relative to comparable grades.

The value of Russia’s goods and services imports contracted last year by about 1 % to $375 billion. The value of goods imports contracted by 3 %, while the value of services imports rose by 5 %. Growth in services imports largely reflected increased Russian tourism abroad. Imports generally picked up at the end of last year. The value of imports was up by 5 % y-o-y in the fourth quarter.

The current account surplus for all of 2024 amounted to $53 billion, a small increase from the previous year. The current account surplus contracted in the final months of last year. In December, the current account balance turned negative due to reduced exports.

Due to the scantiness of preliminary figures for the financial account, changes from earlier are difficult to analyse. The CBR says that the changes in the financial account largely reflect the impacts of sanctions. Russia’s foreign assets increased slightly. This is largely associated with delays in repatriation of export earnings complicated by sanctions. Russia’s foreign liabilities also increased slightly last year, but the CBR estimates that this, too, largely reflects difficulties in international payments traffic caused by sanctions.

The quarterly value of Russian exports declined at the end of 2024

Sources: CEIC, Central Bank of Russia, BOFIT.