BOFIT Weekly Review 43/2016

Mainland China stock markets await investment of pension savings and foreign investors

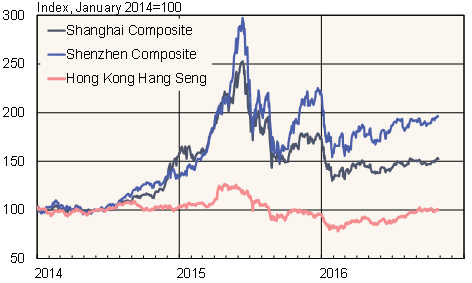

Prices on mainland China stock markets have remained relatively stable this year and trading has calmed considerably from last year’s boom. New possibilities to invest in the stock exchange are increasing. A change in the law approved last year now allows pension funds to invest in equities and debt securities. According to press reports, China’s local governments are beginning to invest pension assets in publicly traded stocks this year, which could bring 200–400 billion yuan to the market before the end of the year. The amount is less than 1 % of the market capitalisation of mainland China stock exchanges. Local pension funds will be transferred to China’s national social security fund, which will administer the invested assets.

The long-awaited Shenzhen-Hong Kong Stock Connect project has reached its technical phase, with trading expected to begin in late November. Investor interest in the Shanghai-Hong Kong Stock Connect project that launched in November 2014 has been relatively modest and inter-exchange trading under Stock Connect still accounts for less than 2 % of the Shanghai stock exchange’s daily turnover. The programme has also failed to close the price gap between Shanghai and Hong Kong, even if it has narrowed slightly in recent months. Prices of Chinese company shares in Shanghai on average are still 22 % higher than the same shares in Hong Kong.

Trends in Chinese stock markets

Sources: Macrobond and BOFIT.