BOFIT Weekly Review 42/2022

United States tightens rules on semiconductor exports to China

On October 7, the United States issued new bans on exports to China of advanced semiconductors and devices for chip manufacture. Special government permission is required for companies seeking to avoid the export controls, which are based on national security. The purpose is to prevent China from getting its hands on technologies that can be used to in advance weapons systems.

The US first implemented technology export bans on China during the Trump administration (BOFIT Weekly 40/2020). The latest US Department of Commerce export controls apply to critical advanced chips that are difficult to acquire elsewhere. The controls even grant the US government power to forbid exports of chips manufactured outside the US that incorporate US technology. The comprehensive export ban applied to Huawei and its subsidiaries in August 2020 now extends to 28 other Chinese firms on the US entity list. In addition to chips and semiconductor manufacturing equipment, the ban applies to US citizens, US permanent residents and firms that support Chinese chip manufacturers without a special permit. Media reports note that the extension of bans to employees has caused confusion in many firms. The Dutch semiconductor equipment manufacturer ASML has ordered all its American employees to refrain from dealing with Chinese customers until the extent of the controls are determined.

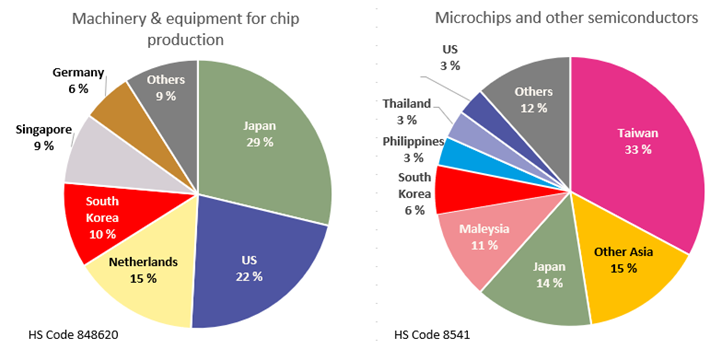

The ban is expected to cripple the operations of Chinese chipmakers, as well as cause hardships for China’s big tech firms, by reducing the availability of semiconductors. It looks increasingly unlikely that China will achieve its declared goal of self-sufficiency in advanced technologies, particularly semiconductor production. On the other hand, the ban will also hurt American firms as China traditionally has been an important export market. Over a third of net earnings of some large American chipmakers have come from China in recent years. The world’s largest chipmaker is Taiwanese TSMC, which controls over 50 % of the global market. Next comes the Korean Samsung (17 % market share), the Taiwanese UMC (7 %) and US-based GlobalFoundries (6 %). Chinese chipmaker SMIC ranks fifth in the world with a market share close to 6 %. Most of the equipment for chip manufacturing is produced in Japan, the US and Europe.

Japan, Taiwan and the US were the top providers of semiconductors and semiconductor production equipment to China in 2019

Sources: Comtrade, Macrobond and BOFIT.