BOFIT Weekly Review 11/2021

Russia expands price monitoring significantly; food prices under pressure to rise

A government regulation will extend price monitoring widely by including a monitoring list of goods and services that constitute about three-quarters of the goods and services contained in the official average consumption basket of goods and services used to measure changes in consumer prices. The monitoring list includes almost all foods, as well as alcohol, gasoline and diesel oil, textiles, clothing and footwear, furniture, household chemical products, household electronics, and construction materials. It also contains a broad range of services such as communications, passenger transport, housing sector, health care, education and cultural activities. The main responsibility of price monitoring rests with the economy ministry with essential support from Rosstat and the Federal Antimonopoly Service. Categories of goods and services subject to regulation are shared across nine ministries and two government agencies. Each responsible body needs to assess the causes of rapid price increases or an emerging risk of a rapid price rise. When such issues are detected, the officials are tasked with proposing regulatory measures “to balance the market”.

The law was amended this winter to lower regional price ceiling on products of social significance that could trigger government price restrictions. Agreements involving producers, sellers and ministries on limiting price increases of certain foodstuffs and agricultural products were signed last year. The move also included the introduction of a few export quotas and export tariffs that remain in force until 30 June (BOFIT Weekly 2020/51). These measures will be complemented on 1 June, when a moving export tariff on wheat is launched to offset the difference between the export price and the domestic price.

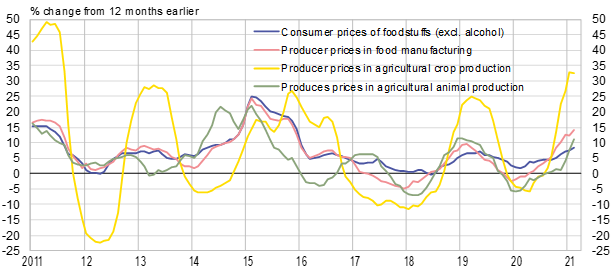

With price controls focused on certain food items (e.g. sugar and sunflower oil), the rise in those consumer prices came to a halt in recent months. The seasonally adjusted rise in consumer food prices overall has slowed slightly this year. The acceleration in the rise in the second half of 2020 was due mainly to increased world prices for farm crops, a drop in the ruble’s exchange rate and poor domestic harvests of certain crops. The rise in prices has been quite rapid. Food prices in February were up by 7.7 % y-o-y (8.4 % without alcohol). This includes an on-year increase in prices of fruits and vegetables of 16−17 % and a 6.5 % rise in prices of other food items. Foodstuffs represent a third of the products in the consumer price basket of goods (not including alcohol).

Pressures on consumer food prices appear. Food industry producer prices, which have risen at an accelerated pace since last autumn, were up over 14 % y-o-y in February. The rise in agricultural producer prices calmed in January, but after soaring last autumn they were up by nearly 20 % y-o-y in February. The on-year increase in the crop farming category in the first two months of this year was as high as 32−33 %.

According to a study by the central bank of Russia, price restrictions have created different measures for managing their business in firms operating in branches covered by the restrictions as well as related branches, i.e. agriculture, industry, wholesale and retail, and exports. Some companies have refrained from raising prices, while some wholesalers have passed along some of the price pressures on to retailers. Uncertainty has increased in estimates and planning. Some farmers plan to increase or decrease the area of land under cultivation for particular crops. Harvest assessments have risen or fallen, depending on perceived changes in incentives. Some industrial firms see a need to lower production. Some farmers are considering shifts to growing other crops, while some industrial firms are looking at increasing reliance on imported raw materials. Besides planned government support for firms from the federal budget, the situation is varied regarding support from regional and local budgets. The survey concludes that assessments of business conditions have weakened and producers refer to risks for reduced profitability and weaker incentives.

Food prices in Russia have increased

Sources: Rosstat and BOFIT.